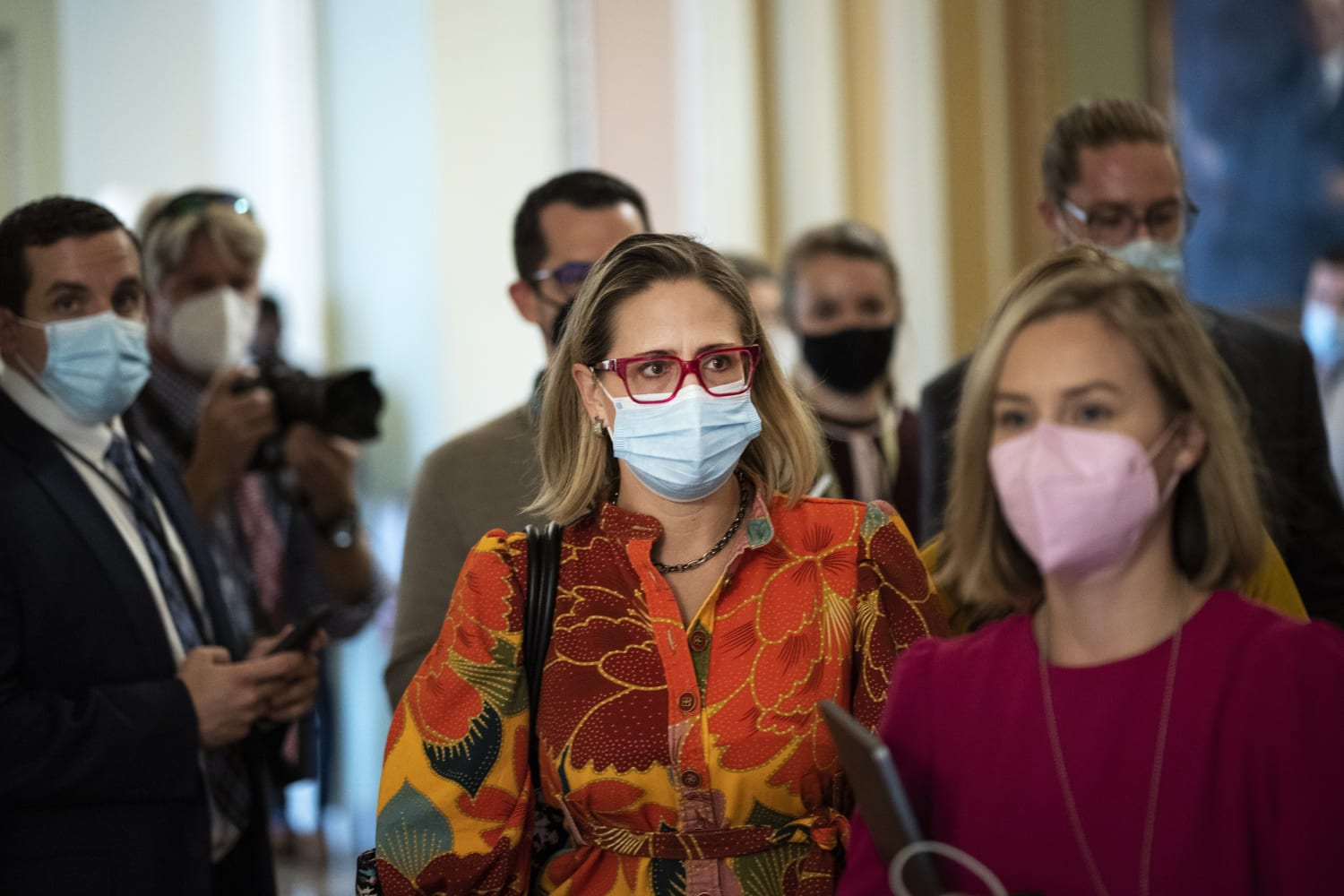

WASHINGTON — Democrats are again grappling with how to pay for their multitrillion-dollar social safety net bill as Sen. Kyrsten Sinema remains opposed to raising taxes on the wealthy and corporations, three Democratic aides familiar with her position told NBC News.

Those tax hikes have been central to Democrats’ plan to pay for the legislation at the heart of President Joe Biden’s Build Back Better agenda, currently the subject of intense negotiation.

But on a Wednesday conference call that included White House aides, House Speaker Nancy Pelosi and Democratic Leader Chuck Schumer, Biden administration officials said those plans would possibly need to shift, according a source familiar with the matter.

Details of the meeting were first reported by The Wall Street Journal and the Washington Post.

On that conference call, administration officials and Democratic leaders continued to discuss how to pay for the multi-trillion-dollar legislation, including alternatives to increasing the highest income tax bracket and the corporate tax rate, according to two people familiar with the call.

In additional to Schumer and Pelosi, Senate Finance Committee Chairman Ron Wyden, D-Ore., House Ways and Means Committee Chairman Richard Neal, D-Mass., participated.

Sinema has long expressed opposition to those tax increases and the changes are to accommodate her opposition, according to a person familiar with her thinking.

“There’s been no change in her position for a while,” one person privy to the negotiations said, adding that she does not support an increase in carried interest, in the individual tax rate or corporate tax rate. “It’s getting down to the wire and we need to think about how to move forward without” those tax increases.

Nothing has been decided, a source cautions

Sen. Joe Manchin, D-W.Va., who has forced Democrats to lower their price tag of the overall bill, wrote in a memo to Schumer, D- N.Y., that he supports increasing the individual tax rate to 39.6 percent and the corporate rate to 25 percent. President Joe Biden wanted to lift the corporate rate to 28 percent.

Biden held separate meetings with House progressives and moderates on Tuesday where he began to refocus the policy provisions that would be included and what would be left on the chopping block, including tuition-free community college.

The plan under consideration to accommodate the lost revenue from meeting Sinema’s demands includes a range of other ideas such as a tax on billionaires’ assets and a new minimum tax on corporations, a person familiar with the details said. A second person said the discussions also include broader IRS enforcement to help to raise revenue.

A spokesperson for Sinema, when asked for comment regarding her stance on tax policy included in the package, said: “We aren’t confirming any of this but as always will let you know if that changes.”

She has been in constant conversation with the White House about the legislation. But she might not be on an island. One senior aide for a moderate House Democrat said some are “grateful that Sinema is stepping up to roll back some of these politically unpopular revenue raisers.”

Source: | This article originally belongs to Nbcnews.com