I have £150,000 left on my mortgage and a fixed rate that runs until 2027. My lender lets me overpay by 10 per cent without penalty, but what does that mean?

Can I only make an annual lump sum payment of £15,000 or extra payments on my mortgage of £15,000 divided by 12?

Or, can I make a lump sum payment and also overpay monthly? Via email.

Slashing our debts: Roughly three in five homeowners who have remortgaged are making overpayments compared to two in five of those who have not yet remortgaged

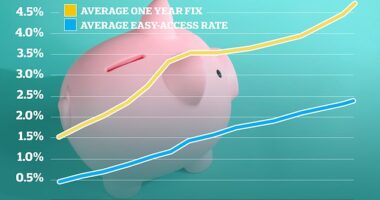

Ed Magnus of This is Money replies: The mortgage market has transformed. In what seemed like a matter of months, the decade of rock bottom interest rates came to an end.

After 14 consecutive hikes since December 2021, The Bank of England has moved base rate from 0.1 per cent to 5.25 per cent.

Mortgage rates have responded in kind. It was possible to get a five-year fix at less than 1 per cent, two years ago. Now the cheapest five-year fix is 5.25 per cent.

Fortunately, most mortgage borrowers are on fixed rate deals, meaning they are protected from rate rises until their current deal finishes.

However, as these two-year and five-year fixed deals come to end, increasing number of homeowners are seeing their monthly repayments balloon.

This new world for mortgage borrowers will likely have many asking similar questions to our reader. Should they overpay before their monthly payments start rising?

This question is just as likely on the minds of those who have remortgaged on to a much higher rate in the last 12 months.

The inflation war: The Bank of England (pictured) has been increasing its base rate since December 2021 – and fixed mortgage rates have gone up too

A study of 9,274 homeowners in the UK by the mortgage repayment app Sprive found that those who are now on higher rates prioritise overpayment to fight higher costs.

Its findings showed that 61 per cent of homeowners who have remortgaged are making overpayments, compared to 39 per cent of those who have not yet remortgaged.

How much can you overpay your mortgage?

Ed Magnus of This is Money replies: Most fixed rate mortgage deals allow borrowers to make overpayments amounting to 10 per cent of the total outstanding amount each year without incurring early repayment charges. Some are more flexible and others may be more restrictive.

If you want to pay more than that without incurring a charge you’ll have to wait until your existing mortgage is up for renewal.

Careful: Most fixed mortgages have limits, on how much you can overpay. If you go over this allowance, you may have to pay an Early Repayment Charge

In the meantime, avoid breaching whatever overpayment limit your lender restricts you to.

This is because early repayment charges typically range between 1 and 5 per cent of the total mortgage amount.

To provide expert advice on the matter, we spoke to Chris Sykes, technical director and senior mortgage broker at Private Finance.

How would you advise our reader?

Chris Sykes replies: You can overpay monthly, weekly, or do big lump sums as long as it doesn’t go over that 10 per cent as a total.

Your reader should speak to their mortgage lender more about the exact amount they can overpay this year.

They should also clarify what date exactly their 10 per cent overpayment allowance for the year starts and finishes.

Also, there can be two types of overpayment, which you can often choose between them.

The first one affects the payment. So for example this month you might pay £1,000 and next month you might pay £975 due to you overpaying.

The second type of overpayment affects the term of your mortgage.

The term of the mortgage is essentially the lifespan of the mortgage. For example, 25 years.

If you have this type of overpayment model, your monthly payments stay the same, but, each payment essentially chips away more of the balance of the mortgage moving forward.

What’s the best way to overpay?

Chris Sykes replies: Essentially it will depend on your circumstances.

The type that keeps your monthly payment the same is the best way to overpay if you’re looking to repay your mortgage as quickly as possible.

Chris Sykes, a senior mortgage broker, says you can overpay monthly, weekly, or do big lump sums as long as it doesn’t go over the lender’s maximum annual allowance.

For example, rather than allowing your overpayment to go from £1000 to £975 in a given month, if you instead opt to keep it at £1,000 you are in essence paying that extra £25 into the balance each month.

How do you overpay your mortgage?

Chris Sykes replies: To overpay, you call the lender and they’ll give you instructions. Then, once you have those instructions you can use the account number and sort code you bank transfer to over and over again.

If you have online banking with your lender it can usually easily be done through there.

If wanting to overpay, the sooner you do it, the more that money it is saving you in interest costs. So if you are debating saving for a year and paying a lump sum versus paying monthly, you are better to pay monthly.

Do some lenders allow larger overpayments?

Chris Sykes: They do. NatWest has recently made the move to allow 20 per cent overpayments rather than 10 per cent, and I believe they have backdated that to existing mortgages as well as new customers too.

Metro Bank also has 20 per cent overpayments and Suffolk Building Society lets you do 50 per cent of the original loan amount in the loan term, for example.

The standard is 10 per cent, and some lenders don’t let you overpay at all, but that is more typically only for very specialist mortgages or investment mortgages.

What if you exceed the overpayment limit?

Chris Sykes replies: You can overpay more than the overpayment allowance, but then you get charged an early redemption charge.

For example, say you made a 15 per cent overpayment on a mortgage that only allows 10 per cent, you’d pay early redemption charges on that 5 per cent.

If you’re taking out a new mortgage deal and you know you’ll be able to overpay by more than the 10 per cent per year, then ask your mortgage broker to recommend a lender with a higher allowance or an offset facility.

When does the annual overpayment allowance start and end?

Chris Sykes replies: This varies from lender to lender. Some do 10 per cent of the original balance when taking that product per year. Some do 10 per cent of the balance as at the start of that year.

The start of that year can be the product year – ie when the deal starts – or the calendar year depending on the lender.