The British pound was a major focus this week as volatility remained high after last week’s surprise tax cut plan from the U.K. government. Fortunately for Sterling bulls, the Bank of England came in to save the day, bringing stability not only to the pound, but broad risk sentiment as well.

Notable News & Economic Updates:

Two Russian gas pipeline leaks churned up the Baltic Sea on Tuesday, raising suspicions from Moscow to Copenhagen of sabotage.

Instead of the 5.0% prediction back in April, the World Bank predicted that East Asia and the Pacific will grow by 3.2% this year. In 2023, the growth rate is anticipated to increase to 4.6%

In an effort to combat inflation that is at its highest level in decades, Morocco hiked its benchmark interest rate by 50 bps to 2.00%, the first hike since 2008.

The American Petroleum Institute (API) crude oil inventory: +4.15M bbl vs. +333K forecast

The Bank of England intervened in the bond market (pledge to buy 65B pounds ($69.4 billion) of long-dated gilts) to restore stability; also postponed selling of bonds held under the QE program to October 31

Christine Lagarde, president of the European Central Bank, re-iterated on Wednesday that the ECB will continue to keep raising rates over the next several meetings.

A fourth leak found on the Nord Stream pipelines on Thursday according to Swedish coastguard

China’s manufacturing PMI expanded (50.1) in Sept vs. a contractionary 49.4 reading in Aug; non-manufacturing PMI inched lower from 52.6 to 50.6 in Sept.

Russian President Putin announced Russia’s annexation of a portion of eastern Ukraine, and vowed that Russia would win its “special military operation” despite some of his troops faced likely defeat.

The US announced sweeping sanctions on Russia Friday over its annexation of a region of Ukraine, targeting hundreds of people and companies, including Russia’s military-industrial complex and politicians.

Intermarket Weekly Recap

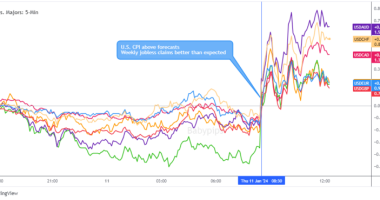

This week started out as a continuation of last week’s themes and price action, where bond yields and USD pushed higher, while most other assets fell as traders looked to USD for safety from growing recessionary conditions and inflation fears. Geopolitical fears also likely contributed to early risk-off vibes as Nord Stream pipeline leaks and the Ukraine referendum stories dominated headlines this week.

An especially big mover to start the week (and likely the main focus of the week for forex traders) was the British pound and U.K. bond prices, which took a nose dive right at the week open. This was a continuation of last week’s weakness sparked by the U.K. government announcement of bigger-than-expected potential tax cuts, which traders took as a potential contributor to high inflationary and recessionary conditions ahead).

But traders quickly found a bottom on Monday, likely in reaction to the Bank of England who announced that it would not hesitate to hike interest rates. This was followed by another bullish catalyst for the pound on Wednesday after the Bank of England stepped into the bond market, pledging to buy £65B worth of long-dated gilts to restore market stability.

This move by the BOE appears to have been a big macro catalyst as we not only saw a rally in the British pound, but broad risk sentiment behavior in general as it turned somewhat positive on the session. We can see in the chart above that the BOE’s announcement correlated with a swift turn higher in equities, commodities and crypto, while bond yields and the U.S. dollar fell through the end of the Wednesday session.

The euro wasn’t too far behind the pound in terms of performance, beating all majors (minus Sterling). This move higher was likely a reaction to a steady round of hawkish rhetoric from several members of the European Central Bank this week. Many were calling for an aggressive 75 – 100 bps at the October meeting, so it’s likely traders started to price in that aggressiveness once again.

USD Pairs

Raphael Bostic of the Federal Reserve Bank of Atlanta expects job losses but maintains that reaching 2% inflation without crashing the economy is possible.

U.S. durable goods orders for August: -0.2% m/m vs. -0.1% m/m previous; Core durable goods rose by +0.2% m/m & +1.3% y/y

According to FHFA, the U.S. House prices index fell -0.6% m/m in July, but still up +13.9% y/y; U.S. new home sales surged +28.8% m/m in August to 685K vs. 532K previous, a turn around from the -8.6% m/m dip in July – Commerce Department

Fed’s Evans sees interest rates peaking at 4.50-4.75%; Fed’s Kashkari: Fed ‘united,’ moving at ‘appropriately aggressive’ pace; St. Louis Fed’s Bullard sees more rate hikes ahead as inflation is ‘serious problem’

U.S. Q2 Final GDP read: -0.6% q/q, unchanged from previous estimates

U.S. weekly initial jobless claims dipped to 193K vs. 209K the previous week, a five-month low

U.S. Core PCE index for August: +4.9% y/y and 0.6% m/m; July was revised lower to 0.0% m/m

The University of Michigan revised its September consumer sentiment index reading to 58.6 from 59.5. Economists expected no revisions. The current economic conditions index rose to 59.7 in September vs. 58.6 in August

GBP Pairs

Overlay of GBP Pairs: 1-Hour Forex Chart

British government bond prices plunged on Monday, sending yields to their highest in over a decade. Sterling hit a record low against the U.S. dollar overnight, prompting concern the Bank of England may need to take extraordinary action; the Bank of England said it won’t hesitate to hike rates even after the pound fell to a historic low

Two-year gilt rates soared as high as 4.533%, their highest since September 2008

Chief Economist Huw Pill said the UK’s fiscal announcement and the market’s reaction necessitated a strong monetary policy response, but the optimum time to examine their impact is during the institution’s quarterly meetings.

BRC: The U.K. Shop Price Index hits +5.7% y/y in September, the highest read since 2005

UK house prices stagnate for the first time since mid-2021, but are still higher by 9.5% from September 2021.

U.K. mortgage approvals rose to 74.3K in August from 63.7K in July and 62K forecast, the highest reading since the beginning of 2022.

U.K. Q2 Final GDP at +0.2% q/q vs. -0.1% q/q previous

EUR Pairs

Overlay of EUR Pairs: 1-Hour Forex Chart

Germany Ifo business sentiment slumped from 88.4 to 84.3, the lowest level since May 2020

According to European Central Bank Vice President Luis de Guindos, as the EU suffers with the effects of Russia’s war in Ukraine, inflation in the euro zone is widening and growth is deteriorating.

Even if economic growth is to “slow appreciably,” the European Central Bank will keep raising borrowing prices, according to ECB President Christine Lagarde.

The growth rate of broad monetary aggregate M3 increased to 6.1% y/y in August 2022 from 5.7% y/y in July (revised from 5.5%)

Robert Holzmann, an ECB Governing Council member, said he prefers a three-quarter-point rate hike next month over a 100-basis-point hike

Slovak central bank chief Peter Kazimir said that the ECB may need to hike by another 75 bps in October

Germany GfK consumer sentiment fell to – 42.5 from -36.8 as high prices showed no signs of slowing

Eurostat reported September inflation in the Eurozone of 10% y/y, up from 9.1% y/y in August. The rate beat the 9.7% prediction; Core inflation rose to 4.8% in September from 4.3% in August. Core inflation was expected to reach 4.7%.

Seasonally adjusted unemployment in the euro area was 6.6% in August 2022, unchanged from July 2022 and down from 7.5% in August 2021. The EU unemployment rate was 6.0% in August 2022, down from 6.8% in August 2021.

CHF Pairs

Overlay of CHF Pairs: 1-Hour Forex Chart

Andrea Maechler, a member of the Swiss National Bank’s governing board, stated on Monday that the institution will do “everything” to combat inflation, adding that the purpose of last week’s rate increase was to convey the institution’s commitment to combating price hikes in Switzerland.

Swiss National Bank Quarterly Bulletin for Q3 2022 was released on Wednesday:

- The SNB anticipates a GDP growth rate of around

2% for 2022. This is roughly half a percentage point lower than at

the last monetary policy assessment - They see the biggest risks as a global economic downturn, a worsening

of the gas shortage in Europe and a power shortage in

Switzerland. Furthermore, they see a resurgence of the coronavirus

pandemic as a scenario that cannot be ruled out.

The Swiss Economic Institute’s KOF economic barometer ticked slightly higher in September to 93.8 from 93.5 in August (86.2 forecast)

CAD Pairs

Overlay of CAD Pairs: 1-Hour Forex Chart

As it faces one of the most severe tests of its credibility, the Bank of Canada will start publishing a minutes-like description of official deliberations after each policy decision in an effort to increase transparency.

Canada GDP in July: +0.1% m/m vs. +0.1% in June. Manufacturing and oil and gas extraction fell, offsetting increases in retail and wholesale commerce, agriculture, forestry, fishing, and hunting.

NZD Pairs

Overlay of NZD Pairs: 1-Hour Forex Chart

New Zealand ANZ business confidence index improved from -47.8 to -36.7

The seasonally adjusted number of New Zealand building permits issued in August was was down -1.6% to 4,547, Statistics New Zealand announced Friday. That followed July’s downwardly revised 4.9% gain (originally 5.0 percent).

AUD Pairs

Overlay of AUD Pairs: 1-Hour Forex Chart

Australia Retail Sales Sales rose +0.6% m/m from July, above economists’ expectations of a +0.4% m/m gain.

Australian CPI dipped from 7.0% y/y in July to 6.8% y/y in August

Australia will lift the required five-day home quarantine for COVID-infected people on Oct. 14, Prime Minister Anthony Albanese said Friday.

Australia private sector credit rose +0.8%m/m in August vs. +0.8% m/m in July

JPY Pairs

Jibun Bank Japan manufacturing down from 51.5 to 51.0, services PMI up to a three-month high of 51.9 in Sept

Haruhiko Kuroda, the governor of the BOJ, stated on Monday that the central bank was likely to continue its extremely loose monetary policy for the time being, but added that its promise to keep interest rates at “current or lower levels” may not necessarily remain constant for years.

Japanese Finance Minister Shunichi Suzuki: we are “deeply concerned about recent rapid and one-sided market moves

According to the latest meeting minutes, the Bank of Japan board agreed to be vigilant on sharp yen moves, and that easy policy needs to stay

Japan’s Aug. unemployment rate falls to 2.5% as expected, job availability rises

Japan’s annual retail sales up from 2.4% to 4.1% in Aug

Japan’s consumer confidence weakened from 32.5 to 30.8 in Sept.