In a mixed week of FX trade, the British pound took the top spot as U.K. employment and inflation data likely supported speculation that more rate hikes may be needed.

While on the other end of the spectrum, the Japanese yen was the biggest loser after the Bank of Japan disappointed traders who were betting on a rate hike this week.

Notable News & Economic Updates:

On Monday, the World Economic Forum (WEF) told business and government leaders at its annual gathering that two-thirds of private and public sector chief economists forecast a worldwide recession in 2023.

Chinese GDP rose by 2.9% q/y in Q4 2022 vs. 1.6% forecast

Fragmentation, according to the IMF on Monday, could cost the global economy up to 7% of GDP.

U.K. average earnings index up from 6.1% to 6.4% in three-month period ending in Nov.; Claimant counts at 19.7K in December vs. 30.5K in November

Canada CPI in December: +6.3% y/y vs. 6.8% y/y in November; the -0.6% m/m decline was the biggest monthly drop since April 2020

API crude oil inventory report showed 7.6M build vs. expected draw

The Bank of Japan left policy and yield curve targets unchanged on Thursday; cut its 2023 GDP forecast but leaves CPI forecast unchanged

U.S. producer prices dropped in December by -0.5% m/m vs. -0.1% m/m forecast; +6.2% y/y; Retail Sales for December was -1.1% m/m while November sales revised lower to -1.0% m/m

Australian economy lost 14.6K jobs in Dec vs. a projected 26.5K gain; jobless rate held steady at 3.5%

Genesis has filed for U.S. bankruptcy protection on Thursday, owing creditors at least $3.4B

On Thursday, European Central Bank President Christine Lagarde said that the inflation rate is still too high and that ECB policymakers will stay vigilant on bringing price growth back to target.

Swiss National Bank President Jordan said on Thursday from the World Economic Forum that further tightening is likely still ahead.

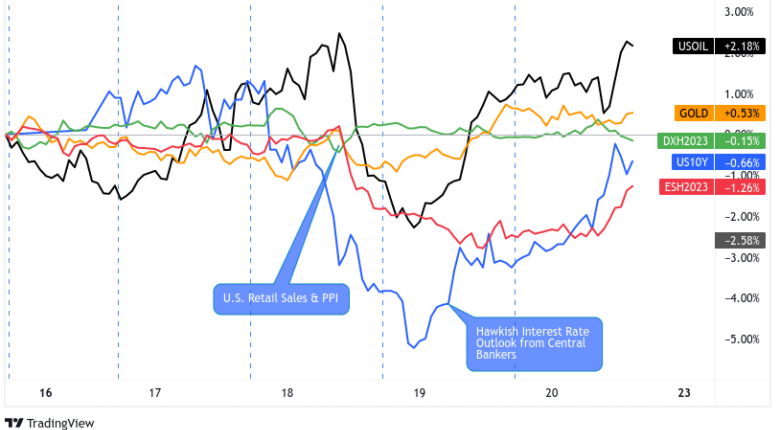

Intermarket Weekly Recap:

Dollar, Gold, S&P 500, Oil, U.S. 10-yr Yield Overlay 1-Hour from TradingView

It was a heavy week of economic updates and central bank speak, resulting in choppy price action across the financial markets. We did see a brief moment of uniform sentiment moves on Wednesday, but before we get there, let’s take a quick step back.

Price action in the front half of the week was mixed, likely due to traders balancing the perception of a global recession ahead and expectations that we’d see more evidence of peak inflation rates this week.

The recession narrative was fueled early by comments from the World Economic Forum and the International Monetary Fund that economic activity was likely to slow in 2023.

And it was further supported when we got the weaker-than-expected U.S. retail sales data report, an event that correlates with the big volatile move of the week as risk assets fell quickly during the Wednesday U.S. trading session.

This narrative is likely what drove bond prices higher, and a big uniform dip in risk assets (oil, equities & crypto) and bond yields into the Wednesday session close.

The negative vibes seemed to have bottomed during the Thursday Asia session, followed by an apparent switch in focus to inflation rates as we saw a u-turn in bond yields by the start of the U.S. trading session.

The spike higher in bond yields been a reaction to hawkish interest rate rhetoric from European Central Bank policy makers during the Thursday London session, with some calling for multiple 50 bps rate hikes ahead.

This shook up the other main narrative of “peak inflation/a shift in monetary policy regime ahead”, in that some traders were expecting central bankers to let their foot off the gas a bit on interest rate hikes.

This may be the case with the Fed as several Fed Governors hinted on 25 bps hikes ahead, versus an opposite, aggressive tone from ECB and SNB officials who spoke at the World Economic Forum this week.

On Friday, it looks like the markets were back to focusing on broad risk sentiment as most risk assets moved higher through the session. There doesn’t seem to have been a unifying theme, so it’s possible individual asset class stories may have been more of a factor.

We saw U.S. equities boosted higher on Friday by a bounce in the tech sector from an early week dip (lead by rallies in NFLX and GOOGL), bond traders sent yields higher (likely a continuation of pricing in a hawkish interest rate outlook), and oil caught some bids, likely due to forecasts from both OPEC and the IEA that demand will grow due to China lifting COVID-19 restrictions.

Top Moves in FX

Mixed week for the U.S. dollar as traders bounced between a busy U.S. economic calendar and lots of Fed speak this week. There didn’t appear to be a uniform directional bias either, likely due to strong headlines from the other countries forcing traders to be more focused on individual currency narratives.

USD Pairs

Overlay of USD Pairs: 1-Hour Forex Chart

The New York state factory index for January: -32.9 vs. -11.2 in December; the fifth worst reading in survey history and the worst since May 2020

The National Association of Home Builders optimism index in the month of January rose to 35 vs. 31 in December

Fed Beige Book: Overall economic activity was unchanged with some districts reporting a slight or modest increase and others noting no change or slight decline.

The U.S. Federal debt ceiling was reached on Thursday, prompting the U.S. Treasury Department to deploy exceptional measures to prevent a US payment default.

U.S. weekly initial jobless claims: 190K vs. 205K previous; continuing claims rose by 17K to 1.647M

President Collins of the Boston Federal Reserve said Thursday that the Fed would need to raise interest rates to “just above” 5% and hold them there for a period.

U.S. Existing Home Sales for December: -34% y/y to 4.02M units

Federal Reserve Bank of Philadelphia President Patrick Harker sees rate hikes at 25bps going forward.

GBP Pairs

Overlay of GBP Pairs: 1-Hour Forex Chart

Traders were bullish on Sterling this week with the beginning of the rally correlating with the release of U.K. employment data on Tuesday. The most notable data point was likely the average earnings data as the index rose by 6.4% in November, possibly giving more weight to the idea the Bank of England needs to keep interest rates high.

This was later given more fuel with the latest inflation data from the U.K., with the annualized CPI read for December coming in at 10.5% y/y. While a tick lower than the 10.7% y/y November read, it’s still far and away from the 2% inflation target.

So, it looks like traders priced in expectations of higher interest rates ahead, but that was capped Thursday and Friday, possibly in reaction to the Bank of England’s latest credit conditions survey (lenders look to tighten in Q1 2023) and a weaker-than-expected U.K. retail sales read at -1.0% m/m in December.

JPY Pairs

Overlay of Inverted JPY Pairs: 1-Hour Forex Chart

All was quiet for the Japanese yen on Monday and Tuesday as forex traders awaited the highly anticipated monetary policy statement from the Bank of Japan. And the event did not disappoint as the yen whipsawed back and forth after the BOJ decided to keep monetary policy as-is.

With inflation rates accelerating higher in Japan, there were some traders who were expecting the BOJ to tighten monetary policy further, but we saw the complete opposite as BOJ Governor Kuroda reiterated that the BOJ would not hesitate to ease policy if needed. So it’s no surprise that JPY quickly dipped on the news as traders took off some of their rate hike bets on the news.