The Federal Reserve gave the broad markets the most to work with as we saw multiple instances of aggressive tightening rhetoric, sparking another move higher in bond yields this week.

This of course had a massive effect on financial assets, including a push in the U.S. dollar to the top spot among the major currencies.

Notable News & Economic Updates:

Fed Brainard says Fed to shrink balance sheet rapidly as soon as May

U.S. stopped Russian bond payments on Tuesday, raising risk of default

Lightning Labs raise $70M to bring stablecoins to Bitcoin

U.S. announces sanctions on Russia’s crypto exchange Garantex

API crude oil inventories rose by 1.08 million barrels

Chinese Caixin services PMI tumbled from 50.2 to 42.0 vs. 49.6 forecast

ISM Services PMI at 58.3 in March vs. 56.5 in February; New Orders index hit 60.1 vs. 56.1 previous; Prices Index rose to 83.8 vs. 83.1 previous

J.P. Morgan Global Composite Output Index: 52.7 in March vs. 53.5 in February; Employment Index 53.4 vs. 52.6 prev.; Input prices Index at 70.5 vs. 67.6 prev.

Fed Minutes outline plan to reduce balance sheet by about $95B per month

Swiss have frozen $8 billion in assets under Russia sanctions

The European Union and Japan placed new sanctions on Russia on Friday, most notably banning coal imports

Russian central bank cut their key interest rate to 17% on Friday

Tesla, Block and Blockstream team up to mine bitcoin off solar power in Texas

Intermarket Weekly Recap

Monetary policy seems to have been the main focus for traders this week, evidenced by another surge in bond yields and falling risk-on asset prices, correlating with commentary from central bank events and speeches.

The most notable move came on Tuesday after Federal Reserve Governor Lael Brainard shared expectations that the balance sheet will likely shrink more rapidly than in previous recoveries. This event correlates with the surge higher in bond yields with the U.S. 10-yr jumping over 2.50% during the U.S. session.

This was the first of many aggressive quantitative tightening comments from Fed officials this week, including the latest meeting minutes signaling a potential reduction of the balance sheet by $95B per month and comments from FOMC member Bullard say we may see rates at 3.5% by year end.

With this rise in higher interest rate expectations also comes higher expectations of a global economic slowdown ahead, an idea expressed by analysts across the board. Aside from higher inflation and interest rates, the World Bank says that the war in Ukraine will drag on Asian economies. And we also saw this week that Asian Development Bank cut its 2022 GDP forecast for China to 5.0% (vs. 6.9% growth in 2021) due to China’s battle COVID, and Deutsche Bank became the first big bank to forecast a U.S. recession, possibly starting in Q4 2023.

Rising recession speculation and expectations of higher interest rates were likely why we saw bond yields rally all the way through Friday, the U.S. Dollar Index break above the 100.00 level, and why risk assets like equities, oil (with the help of rising inventories) and crypto take a dive since Brainard’s comments on Tuesday.

In the FX space, we saw some short-term action outside of the Greenback, mainly a spike higher in the Aussie & Kiwi after the latest monetary policy statement from the Reserve Bank of Australia. While they did hold the cash rate at 0.10%, they dropped their pledge to stay “patient” on policy as inflation rages on in Australia.

We also saw a spike lower in the Japanese yen on Tuesday, likely on commentary that the Bank of Japan would buy an unlimited amount of 10-yr JGBS if long-term rates rise rapidly.

USD Pairs

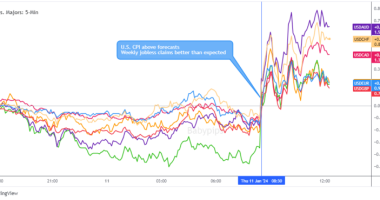

Overlay of USD Pairs: 1-Hour Forex Chart

Fed’s Williams: Pace of rate increases depends on how economy responds; balance sheet reduction could start in May

Fed’s Daly sees growing chance of 50 bps rise in May

Biden cites progress in creating more trucking jobs to help strengthen U.S. supply chains

U.S. Factory orders fell -0.5% m/m in February. January revised higher to +1.5% from 1.4%

S&P Global US Services PMI: 58.0 in March vs. 56.5 in February

Fed’s Patrick Harker is ‘acutely concerned’ about inflation, sees ‘deliberate’ rate hikes

Surging interest rates push mortgage demand down more than 40% from a year ago

Weekly U.S. jobless claims fall 5K to 166k, Continuing claims increase 17K to 1.523M

By one measure, rates may still need to rise 300 basis points, Fed’s Bullard says

GBP Pairs

Bank of England’s Cunliffe sees risk of U.K. inflation undershoot on Ukraine War

UK services PMI firms from 60.5 to 62.6 in March, cost pressures balloon

U.K. Construction PMI: headline unchanged at 59.1 in March vs. Feb.

U.K. House prices grew +1.4% m/m in March – Halifax

EUR Pairs

Overlay of EUR Pairs: 1-Hour Forex Chart

Eurozone Investor Confidence Lowest Since July 2020: Sentix

ECB’s Vasle says negative rates may end by turn of the year

Eurozone economy got March boost from reopening but prices soared – PMI

S&P Global Germany Services PMI: 56.1 in March vs. 55.8 in February

Quick ECB action to rein in inflation could crash economy -Panetta

Germany Factory orders fall -2.2% in February vs. -0.3% forecast

Germany’s industrial output slows from 1.2% to 0.2% in February

Eurozone retail sales rose +0.3% m/m in February

CHF Pairs

Swiss unemployment rate comes inline with expectations at 2.2%

CAD Pairs

Bank of Canada Business Outlook Survey—First Quarter of 2022

Canada total value of building permits rose 21% to $12.4B in Feb.

Canada’s exports hit record high in February, rising 2.8% to C$58.75B, boosted by energy products

Canada Ivey PMI rose to 74.2 in February, highest reading on record

Canada unemployment rate reaches a record low in March at 5.3% as it added 72.5K jobs

NZD Pairs

Overlay of NZD Pairs: 1-Hour Forex Chart

New Zealand GDT auction revealed 1.0% slump in dairy prices

New Zealand ANZ commodity prices up by another 3.9%

AUD Pairs

Overlay of AUD Pairs: 1-Hour Forex Chart

Australia’s MI inflation gauge rose from 0.5% to 0.8%

Australian job advertisements slowed from 10.9% gain to 0.4% uptick

Australia’s central bank, no longer ‘patient’, opens door to tightening

Australia AiG construction index up from 53.4 to 56.5 in March

S&P Global Australia Services PMI: 55.6 in March vs. 57.4 in February

Australia’s trade surplus tightens from 11.79B AUD to 7.46B AUD, the smallest since March 2021, as imports hit record highs in February

In the Reserve Bank of Australia’s latest Financial Stability Review, the RBA wans that borrowers should prepare for rate increases

JPY Pairs

BOJ’s Kuroda looks to slow yen moves with verbal intervention

Japan household spending is up 1.1% y/y in Feb vs. 2.7% forecast; -2.8% m/m vs. -1.5% m/m forecast

Japan total cash earnings: +1.2% in February

Japan Services PMI: 49.4 in March vs. 44.2 in February

BOJ Noguchi says the benefits of a weak yen outweigh the cost of allowing inflation to surge

Japan Consumer Confidence Index fell to 32.8 in March vs. 35.2 in February

Japan Economy Watchers Survey rose 10.1 points to 47.8 in March

This post first appeared on babypips.com