It was another week of mixed priced action between the different asset classes as traders awaited top tier economic data and various central bank events.

Currencies were giving risk aversion vibes all week as safe havens outperformed the comdolls, possibly on signs that high inflation and supply chain issues may continue to limit global growth.

Notable News & Economic Updates:

China’s economy faces new downward pressures, Premier Li Keqiang says on Monday; tax cuts needed to help small businesses; input costs remain high and export orders declined further

The Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) rose to 50.6 in October vs. 50.0 in Sept.; input costs remain high and export orders declined further

ASEAN manufacturing PMI rose from 50.0 in September to 53.6 in October; new orders and factory production grew rapidly as COVID-19 measures eased – Markit

J.P. Morgan Global Manufacturing PMI: 54.3 in October vs. 54.1 September; “Growth of global manufacturing output slows amid record supplier delays, rising costs and stalling export trade”

China’s latest Delta outbreak is most widespread since Wuhan; Beijing tightens travel restrictions as city records 93 new coronavirus cases on Wednesday

Oil falls to near 4-week low on Wednesday after big build of +3.3M barrels in U.S. inventories; OPEC+ rebuffs U.S. calls for speedier oil output increases

Bank of England surprised the market on Thursday as they kept rates on hold at 0.10%; two members voted for an immediate raise to 0.15%

U.S. job growth outpaces forecast in October: +531K, Unemployment rate dips to 4.6%

Pfizer says antiviral pill cuts risk of severe COVID-19 by 89%

Intermarket Weekly Recap

Price action across the different financial assets was relatively tight this week, especially at the start as traders were likely on the sidelines ahead of various central bank events, including the highly anticipated monetary policy statement from the Federal Reserve.

Overall, no changes to policy were seen this week, which was a bit of a surprise given the level of high inflation concerns at the moment. The biggest surprise came from the Bank of England, who many expected would likely raise rates this week but decided to hold.

We also saw a fresh round of business sentiment updates from around the globe which on net, arguably brought on some risk-off vibes to some markets as they showed cracks in the global recovery with high inflation and supply chain concerns. Currency traders seemed to favor safe havens, gold was mostly green this week as well and bond yields dipped, especially after central banks kept a door open for keeping loose monetary policies around down the road.

Oil was a net loser this week, starting its decline on Wednesday in reaction to the rise in U.S. oil supply and OPEC’s dismissal of calls from the U.S. to pick up production. And crypto assets were relatively tame as headlines from the space were few and far between. Bitcoin chopped around the $62,000 handle, but we did see bullish vibes from the largest market cap alts like Solana, Binance Coin, and Terra, likely pulled higher as Ether made new all-time highs after breaking the $4,600 handle.

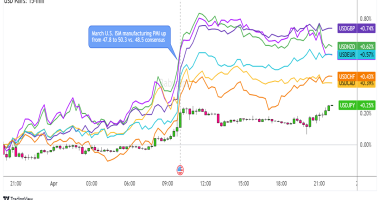

As for currencies, the big move of the week in FX was the drop in GBP as markets were surprised by the BOE holding off on policy changes, as previously mentioned above. Sterling dropped right after the news and could find a way to recover before the weekend. The big winner was the Japanese yen, again the usual beneficiary in risk-off environments which was likely the lean this week due to the previously mentioned inflation and supply chain concerns.

USD Pairs

ISM Manufacturing PMI in October: 60.8 vs. 61.1 in Sept.

U.S. Treasury plans to borrow $1.015T in the fourth quarter, more than the August estimate of $703B

FOMC statement: Fed will reduce bond purchasing program (by $10B Treasury; $5B in mortgage-backed securities); inflation to last “well into next year”

Markit US Services PMI: 58.7 in October vs. 54.9 in September

ADP National Employment Report: Private Sector Employment Increased by 571,000 Jobs in October

Biden says U.S. economy is recovering faster than expected

GBP Pairs

U.K. Manufacturing PMI in Oct: 57.8 vs. 57.1 in Sept.

UK Services PMI: 59.1 in October vs. 55.4 in September

Bank of England defies markets, keeps rates on hold at 0.10%; two members voted for an immediate raise to 0.15%

UK house prices rose for a fourth month running in October, climbing above an average of £270K – Halifax

Bank of England should be cautious about raising rates -Tenreyro

BOE Governor Bailey says jobs market will provide missing clues to rate hike timing

EUR Pairs

German Retail turnover for Sept. 2021: -2.5% m/m (real terms)

Euro zone Oct factory growth hurt by supply woes, price pressures -PMI

France Manufacturing PMI fell to 53.6 in October, down from 55.0 in September – IHS Markit

Germany Manufacturing PMI fell to 57.8 in October, down from 58.4 in September

Lagarde says ECB is ‘very unlikely’ to hike rates next year

ECB’s Vasle sees growing risk that inflation will stay elevated

German factory orders up 1.3% vs. 1.7% forecast, -8.8% previous

German industrial production unexpectedly drops by 1.1% in September

Euro area retail sales down by -0.3%; -0.2% in the EU

CHF Pairs

procure.ch Purchasing Managers’ Index (PMI): 65.4 in Oct. vs. 68.1 in Sept.

Swiss Retail trade turnover in September 2021: +2.5%

Swiss CPI rose to 0.3% m/m in Oct; +1.2% y/y

CAD Pairs

Canada manufacturing PMI in Oct: 57.7 vs. 57.0 in Sept – Markit

Canadian building permits rose 4.3% to $10.1B in September

Canada employment in Oct.: +31,200 vs. 50,000 forecast; unemployment rate ticked lower to 6.7% from 6.8%

Canada Ivey Index dipped to 59.3 in October vs. 70.4

NZD Pairs

Global Dairy Prices: +4.3% vs. +2.2% rise Oct. 19th

RBNZ considering debt servicing restrictions and interest rate floors to fight housing-related financial stability risks

NZ jobless rate drops to record low of 3.4%, participation and hourly wages up in Q3 2021

New Zealand ANZ commodity prices up by 2.1% after previous 1.5% gain

AUD Pairs

ANZ job advertisement series rose 6.2% in October, recovering the losses of the previous three months during the COVID-19 restrictions.

Australia AIG manufacturing PMI for October: 50.4 vs. 51.8 previous

The RBA held its cash rate at 0.10% as expected. Drops projection for no rate rise until 2024, but remains patient with expectations for hike in 2023

Australia Markit Services PMI for October: 51.8 vs. 45.5 in September

Australia AIG construction index up from 53.3 to five-month high of 57.6 in October

Australian retail sales rose 1.3% as expected

Australian trade surplus narrowed from 14.74B AUD to 12.24B AUD

Australia’s AiG services PMI improves from 45.7 to 47.6

JPY Pairs

au Jibun Bank Japan Manufacturing PMI in October: +53.2 vs. 51.5 in Sept.

Bank of Japan, Japanese finance and economy ministers meet and reaffirm the commitment to 2% inflation target.

BOJ Gov. Kuroda: No rush to exit stimulus even if Fed tapers

This post first appeared on babypips.com