It’s gonna be another busy week in the forex market, as the economic calendar is filled to the brim with top-tier events.

Not only do we have PMI readings from major economies, but we’ve also got the RBNZ statement, FOMC minutes, and U.S. core PCE price index. Phew!

Before all that, ICYMI, I’ve written a quick recap of the market themes that pushed currency pairs around last week. Check it!

And now for the closely-watched economic indicators on the economic calendar this week:

Global PMI readings

The market action is bound to pick up starting on Tuesday, May 23 7:15 am GMT when France gets the ball rolling with its flash manufacturing and services PMIs for the month of May.

Mixed results are expected, as the former is slated to improve from 45.6 to 46.1, indicating a slower pace of contraction, while the latter could dip from 54.6 to 54.0.

Germany is lined up next, with the May flash manufacturing PMI expected to tick higher from 44.5 to 44.9 and the flash services PMI to fall from 56.0 to 55.0, reflecting a slowdown in industry growth.

After that, the U.K. is scheduled to report its PMI readings by 8:30 am GMT. A small uptick from 47.8 to 47.9 is expected for the manufacturing sector while the services industry could show a dip from 55.9 to 55.5.

Lastly, the U.S. economy will release its PMI readings by 1:45 pm GMT, possibly printing a manufacturing PMI decline from 50.2 to 50.0 and a services PMI drop from 53.6 to 52.6.

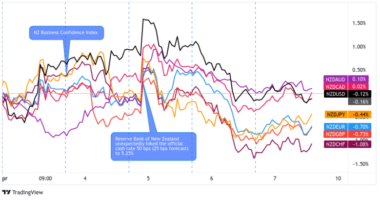

RBNZ monetary policy decision

One of the more highly anticipated top-tier events this week is the RBNZ interest rate statement on May 24, 2:00 am GMT, during which the central bank is likely to announce another 0.25% hike.

Now the RBNZ seems far from toning down their strongly hawkish rhetoric, so reiterating their optimistic outlook for the economy might lead more market watchers to price in higher tightening odds down the line.

After all, inflationary pressures have remained elevated in New Zealand while employment and consumer spending have also been robust.

However, should RBNZ officials suggest that they are approaching the end of their rate hike cycle, we might see a round of profit-taking from the Kiwi’s rallies. Be sure to keep your ears peeled for any clues during the RBNZ presser at 3:00 pm GMT.

FOMC May meeting minutes

Another central bank event worth keeping tabs on this week is the release of the minutes of the May 2023 FOMC meeting on May 24, 6:00 pm GMT, during which the Fed dashed hopes of seeing a tightening pause any time soon.

In their official statement, policymakers highlighted the strength of the labor market and stubborn inflationary pressures as reasons to hike interest rates again.

Fed head Powell also downplayed contagion risks from the banking sector, citing that tighter credit conditions don’t warrant a pause just yet.

Since then, Fed officials have been talking about the possibility of a June rate hike during their testimonies, underscoring the likelihood that the May meeting minutes would reflect these hawkish views.

U.S. core PCE price index

Last but certainly not least is the Fed’s preferred inflation measure or the U.S. core PCE price index, which is due on May 26, 12:30 pm GMT.

Yet another 0.3% month-over-month uptick in price levels is expected for April, marking its third in a row. A stronger than expected read, however, would point to another pickup in inflationary pressures.

Recall that the official U.S. CPI reports for the same month turned out mixed, with the headline reading coming in as expected at 0.4% and the core figure beating expectations.