HOUSEHOLDS are being warned about an easy insurance mistake which could add £100s to their bills.

Motorists are being throttled by huge 40% interest charges when paying for their insurance monthly, according to new research by Which?.

Home insurers also charge a whopping 35% APR on monthly payments, the consumer ground found.

The rates are similar to the amount charged by credit cards, piling extra pressure onto households as insurance costs soar.

Customers can avoid the charge by paying annually – but many households cannot afford to do this.

Car insurance premiums have jumped by 56.4% in the last year, according to Consumer Intelligence.

Read more in money

Home insurance premiums have risen by 40% too.

Andrew Hagger, personal finance expert and founder of Moneycomms, says: “It’s hard enough for consumers to cope with soaring insurance costs, forcing many to look to spread the cost – only to find they will be hammered again for the privilege.

“It’s grossly unfair and hitting those who can least afford it the hardest.”

Many insurers charge additional fees for monthly payment plans.

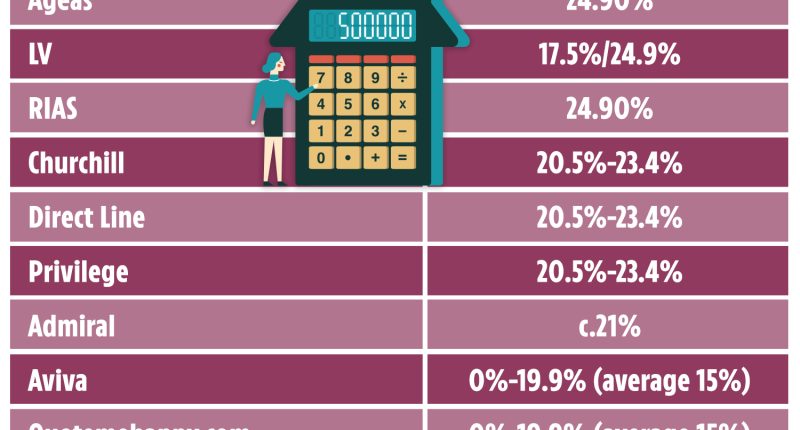

Which? asked 39 car insurers and 34 home insurers what APRs were being applied to monthly payments.

Most read in Money

Many insurers did not disclose their APR.

Among those that did, Which? found that 1st Central charges between five per cent and 39.11%.

It gives customers a personal interest rate after a credit risk assessment, Which? said.

The average rate across 27 providers that charge interest and disclosed their rate was 23.37%.

A spokesperson for 1st Central said: “We offer a range of APRs from 5% to enable us to provide credit to as many customers wishing to pay monthly as possible, including those with low or poor credit scores.

“Over the past quarter less than two per cent of customers paid our highest APR.”

For home insurance, the highest rate in the Which? study was from Co-op Insurance.

Which? found that customers pay between 31.31% to 34.75% APR on monthly payments.

A spokesperson for Co-op Insurance said: “Our insurance partner, Markerstudy Distribution, performs regular benchmarking on the rates of credit they offer to our customers.

“This benchmarking has led us to review these rates and we are looking to reduce them.”

However, it’s important to note that some insurers don’t charge interest on monthly payments.

Which insurers don’t charge interest?

SEVERAL major car and home insurance providers do not charge interest when

Only two car insurers – NFU Mutual and Hiscox – told Which? they do not charge interest on monthly repayments.

Fifteen home insurance providers surveyed said they do not charge interest:

- Bank of Scotland

- Halifax

- Hiscox

- HSBC

- Lloyds Bank

- MBNA

- M&S Bank

- Nationwide Building Society

- NFU Mutual

- SAGIC

- Sainsbury’s Bank

- Santander

- TSB

- Urban Jungle

- Yorkshire Building Society

Rocio Concha, Which? director of policy and advocacy said the FCA should “step up and get tough with firms”.

A spokesperson for the Association of British Insurers (ABI) said: “Paying premiums by monthly instalments is an option [insurers] offer to help customers manage their budgets.

“The cost of premium finance is one of a number of topics we continue to discuss with our members and the Financial Conduct Authority.”

How can I cut my car insurance costs?

Tweaking your excess is an easy way to lower your car insurance premium.

The excess is what you agree to pay each time you make a claim on your policy.

You can usually choose your own excess when setting up a policy, and it can be as low as £100 and as high as £500 or more.

The higher your excess, the lower your premium and vice versa.

This means you could lower the cost of your insurance by agreeing to pay more if you need to make a claim.

But before you hike your excess, make sure you would be able to pay in the event that you do need to make a claim.

Certain jobs are seen as more risky than others for insurance purposes.

Making small but accurate changes to your job title can save you money.

For example, swapping your role from “chef” to “caterer” can save you £20, comparison site GoCompare found.

And changing your role from “fast food delivery driver” to “delivery driver” could save you £40.

But lying about your job could invalidate your policy so make sure any changes are legitimate and accurate.

It’s also vital to shop around when you’re looking for a renewal quote.

Not all comparison sites have the same range of insurers, so to get the best price, it’s a good idea to check two or three from Go Compare, Comparethemarket, MoneySupermarket and Confused.com.

Insurer Direct Line is also not on comparison sites, so check its prices directly.

You can also get a free cash bonus by going via a cashback site such as Topcashback or Quidco.

How can I cut my home insurance costs?

You should never settle for your current provider’s quote when you come up for renewal.

The first step to finding the cheapest cover is by checking the comparison websites like MoneySupermarket or Confused.com.

According to Consumer Intelligence, the average combined home and contents insurance policy, based on the five cheapest quoted premiums, is now £244 on the open market.

This compares to £174 in 2023.

But renewal quotes with your current insurer can be substantially more.

In fact, price comparison website Money.co.uk says you can save up to £201 on your home insurance by ditching your auto-renewal.

Don’t forget to check big insurance firms like Direct Line, which do not appear on comparison sites.

But before switching it’s vital to assess what cover you actually need.

If you don’t have home insurance, then you’re leaving your home and your possessions at risk.

It covers everything from fire and weather damage to theft and falling trees.

Two main types of cover are available, and these determine the amount you pay and what is protected.

Everyone should get their contents covered irrespective of whether they own or rent.

This helps protect your possessions if anything happens to them.

It covers your clothes, gadgets, furniture, and, in some policies, jewellery.

It’s wise for those who own a freehold home to also take out building insurance too.

This protects your actual bricks and mortar, walls, windows and roof and covers the rebuild costs if a fire destroys your home.

Many insurance companies offer these two aspects of cover combined, so if you’re only after contents insurance, ensure you don’t pay more for what you don’t need.

Your insurer will want to know about the security you have at home when calculating your quote.

Functional burglar alarms, security lighting and lockable windows make your home less susceptible to burglaries and having to make a claim for stolen or damaged belongings.

These security items will work in your favour and get you cheaper prices, so make sure you’re burglar-proofed.

Insurers will also ask about the types of door locks you possess, so make sure you declare the correct type or risk invalidating your cover.

Renewing your home insurance sooner rather than later could save you some cash.

New cover becomes more expensive the closer you get to the renewal date.

Set a reminder in your diary for 90 days before your policy renewal date to find the cheapest quote, as you can lock in a deal from then onwards.

READ MORE SUN STORIES

However, analysis by MoneySavingExpert.com, shows that the cheapest time to get new quotes is 21 days ahead of renewal.

Do this, and you’ll save over 20 per cent compared to leaving it until the last minute.