THE UK’s most expensive and cheapest areas to buy or rent a home have been revealed in a recent study.

Rightmove has assessed the cheapest cities for first-time buyers as well as the average monthly rent for all UK areas.

The data looked at the cost two two-bedroom properties taking into account that first-time buyers in Scotland and Wales have a 20% deposit, and first-time buyers in England have to find a 25% deposit.

The size of deposits was based on averages from UK Finance, and the research also revealed a lot of first-time buyers are choosing longer repayment terms to improve their affordability.

The data reflects repayment terms which average at 35 years.

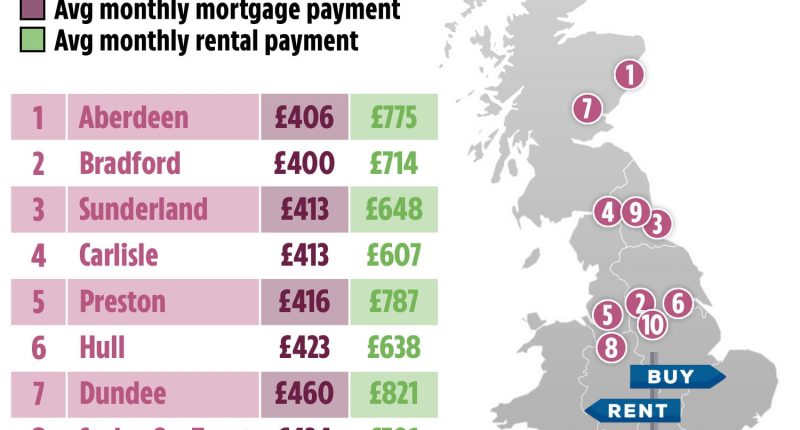

Aberdeen claimed the top spot as the UK’s cheapest city to buy a first home with prices averaging £102,601 for a two-bed property.

Read more on property

Average monthly rent sits at just £775 with average mortgage payments nearly half that at £406.

It will probably come as no surprise to our readers that London is by far the most expensive city to buy and rent a property.

First-time buyers in London are looking at an average of £501,934 for a standard two-bed property with mortgage payments at £1,862 per month.

Renters in London are facing the highest rents across the country with many having to put up an average of £2,264 a month.

Most read in Money

By comparison that’s £755 more expensive than the second-highest city to buy and rent a home St. Albans where average rent prices are £1,509.

Despite being not far from Aberdeen, Edinburgh made it onto the list of the most expensive places to buy a first home.

In Edinburgh average two beds cost £239,028 more than double the average cost in Aberdeen.

Monthly mortgage payments are £946 and average rental payments are £1,310.

The cheapest city for a tenant who is looking for a two-bed or smaller is Carlisle where such rents are £607 on average per month.

Rent prices have been rising at a shocking pace over the past few months.

The ONS said private rental prices in the UK rose by 6.2% in the 12 months to January 2024, unchanged for the second consecutive month.

The average UK house price fell by 0.2% month on month in March, although there are signs that activity is picking up, according to Nationwide’s latest index.

Figures from Nationwide showed they were 0.7% higher this February than the same month in 2023.

The average house price in the UK is now £282,000.

How to buy your first home

Getting on the property ladder can feel like a daunting task but there are schemes out there to help first-time buyers have their own home.

Lifetime ISA – This is a Government scheme that gives anyone aged 18 to 39 the chance to save tax-free and get a bonus of up to £32,000 towards their first home.

You can save up to £4,000 a year and the Government will add 25% on top.

Shared ownership – Co-owning with a housing association means you can buy a part of the property and pay rent on the remaining amount.

You can buy anything from 25% to 75% of the property but you’re restricted to specific ones.

Mortgage guarantee scheme – Available for first-time buyers and those who’ve owned a property before who have a minimum 5% deposit.

READ MORE SUN STORIES

It can be used to buy any type of home so long as you don’t pay more than £600,000 for it.

By providing a guarantee that the government will cover some of a lender’s losses if a borrower can’t afford to repay their mortgage and the home is repossessed – more lenders are prepared to lend up to 95%.

First-Time Buyer Tips

IF you’re looking to take your first step onto the property ladder, why not sign up to our new first-time buyer newsletter.

Buying your first home can be scary and confusing, but our five-part series will cover everything you need to know.

From ways to boost your chances of getting a top-rate mortgage to preparing for your move, The Sun’s new first-time buyer newsletter has got you covered.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories