Cloud-communications company Twilio Inc. TWLO 4.05% agreed to invest as much as $750 million in Syniverse Technologies LLC in a precursor to a public listing for the private-equity-owned messaging company.

The investment, announced Monday, could be followed in the coming months by a merger between Syniverse and a special-purpose acquisition company, people familiar with the matter said Sunday, when The Wall Street Journal first reported the news. Such a deal could value Syniverse, owned by private-equity firm Carlyle Group Inc., at around $2 billion to $3 billion including debt, they said. There is no guarantee that Syniverse will pull off a listing, either through a SPAC deal or a traditional IPO.

Should it go public through a SPAC, it would be the latest in a recent string of such deals as more companies seek an alternative to a traditional IPO. SPACs go public without a business and then look for one to merge with, and the resulting transaction provides the target with a listing.

Crucially for Syniverse, the Twilio deal involves a commercial arrangement that would send a significant amount of business its way. Syniverse may also use proceeds from a SPAC deal to make acquisitions.

Syniverse provides roaming, messaging and other telecommunications services for mobile operators and other businesses. Since 2011 it has been owned by Carlyle.

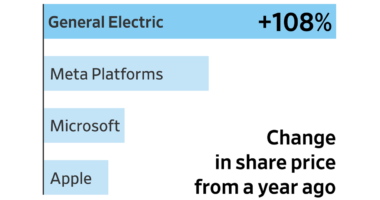

Twilio went public in 2016 and offers a product suite aimed at software developers who use its tools to create various services such as alerts for flight delays, secure communications for people meeting through dating websites and platforms for communicating with Uber drivers. Its market value has soared to more than $67 billion from around $15 billion a year ago as the coronavirus pandemic boosted the already growing demand for cloud-based services.

Twilio last year took advantage of its soaring stock by buying customer-data firm Segment for around $3 billion. Segment offers products that allow companies to glean data about shoppers from websites, mobile apps and email.

Salesforce.com Inc. last year struck a roughly $27.7 billion deal to buy Slack Technologies Inc., a messaging platform that has sought to replace office email. In the wake of that transaction, analysts have anticipated more deals in cloud-computing as companies race to add features to accommodate all manner of business done from a distance and to compete with business software giants including Microsoft Corp.

Carlyle agreed to take Syniverse private in 2010 in a deal valued at more than $2 billion. In the years since, it has completed add-on acquisitions, buying rivals Mach and Aicent Inc. in 2013 and 2014, respectively. Syniverse hasn’t been seen as a great success for Carlyle, but the transaction with Twilio and an ensuing listing could revive the deal’s fortunes.

Moelis & Company LLC was financial advisor to Syniverse and Carlyle and Debevoise & Plimpton LLP were legal counsel. Centerview Partners LLC served as financial advisor to Twilio and Kirkland & Ellis LLP and DLA Piper LLP were legal advisors.

—Miriam Gottfried contributed to this article.

Write to Cara Lombardo at [email protected] and Dana Cimilluca at [email protected]

Copyright ©2020 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Appeared in the March 1, 2021, print edition as ‘Twilio Looks To Help Take Messaging Firm Public.’