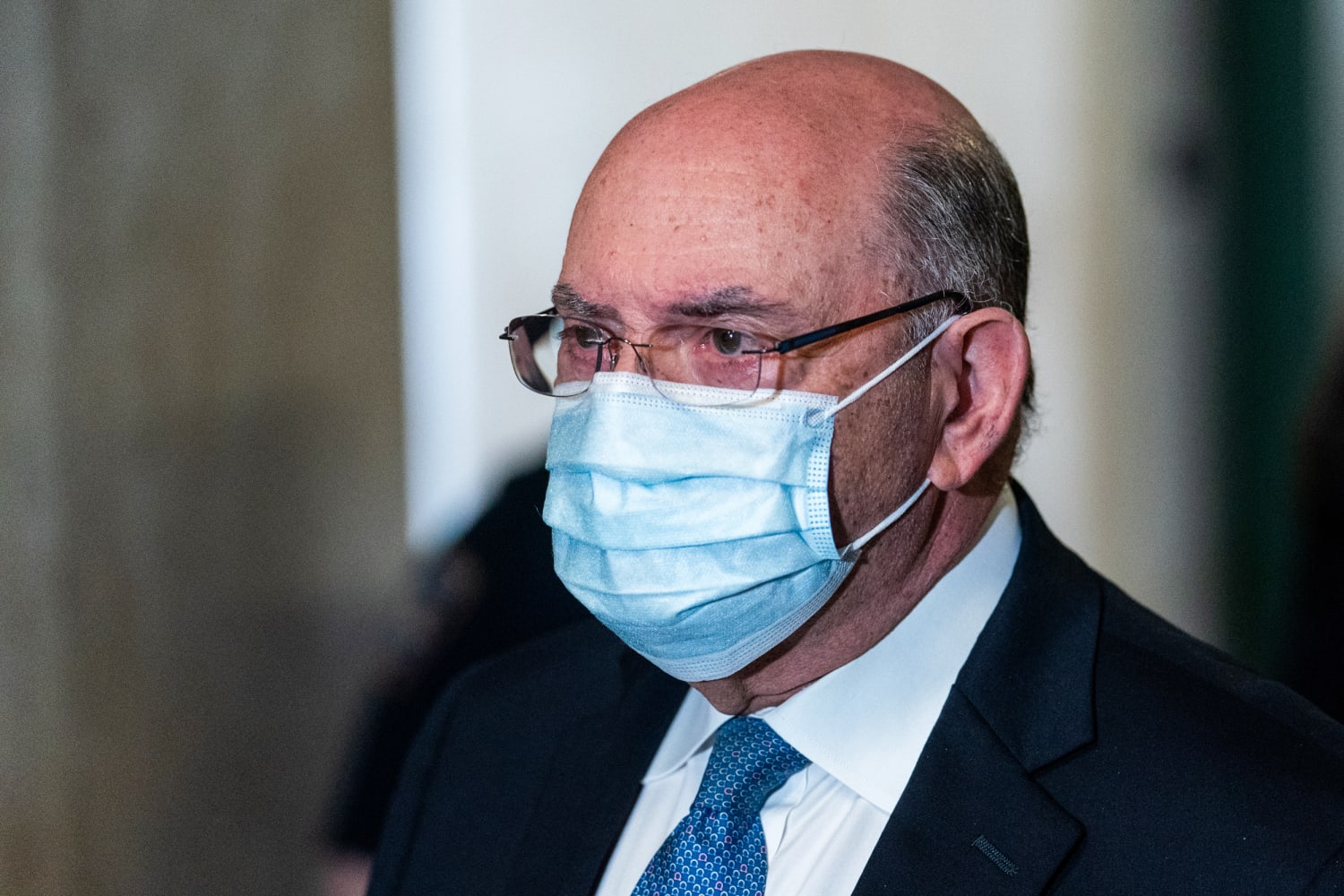

The former chief financial officer of Donald Trump’s family business will receive a five-month sentence after he pleaded guilty to tax fraud charges stemming from a case involving the company’s business dealings.

Allen Weisselberg was accused of failing to report and pay taxes on numerous fringe benefits he’d received while he was employed by the Trump Organization. Some of those benefits included cash to be used for trips, a rent-free apartment, expensive cars, private school tuition for his grandchildren and new furniture.

It’s the kind of case that illustrates how expensive gifts received by an employee can lead to trouble when those perks aren’t properly reported to the IRS. And the case against Weisselberg, who admitted to participating in the alleged tax scheme with the Trump Organization for 15 years, is an extraordinary example, featuring a longtime high-ranking employee of a former U.S. president.

Weisselberg’s blatant failure to report perks he received while he worked for Trump’s family business made the government’s case clear-cut, said Daniel Hemel, a tax law professor at the New York University School of Law.

“These items are described as fringe benefits,” Hemel said. “There’s not a fuzzy line when it comes to reporting them. This was just clearly tax fraud.”

The IRS has an entire publication devoted to reporting fringe benefits that includes how to itemize special job perks like the tuition payments, use of automobiles and real estate and other compensation Weisselberg is accused of having omitted or concealed while he was a Trump employee.

The IRS is clear that tax avoidance, like improperly claiming deductions, credits and adjustments to income, is illegal.

Meanwhile, federal tax evasion, which the IRS defines as failing to report income to, or hiding it from, the government, is a felony. According to the IRS’ tax crimes handbook, each count of tax fraud a person is accused of carries a fine of as much as $250,000 or up to five years in prison or both. For corporations, tax evasion carries a $500,000 penalty.

In pleading guilty, Weisselberg avoided a longer sentence of up to 15 years. His plea deal, which includes a fine of nearly $2 million, doesn’t require him to cooperate with prosecutors in their pursuit of a larger criminal case against Trump, although Weisselberg may still be called to testify at a trial against the Trump Organization in October.

Hemel said Weisselberg’s case was so egregious that it is unlikely to serve as a precedent for future tax liability cases — although in prosecuting him, the government will hope to deter future tax cheats.

The Inflation Reduction Act, which President Joe Biden signed into law this week, sets aside $80 billion for the IRS to use in part to hire more employees, some of whom will help the agency pursue wealthy people and companies that skirt tax payments.

Most workers need not worry about reporting fringe benefits, because it’s up to their employers to include them on annual W-2 tax forms, Hemel said.

“Most Americans don’t have to worry about their employer giving them thousands of dollars of cash and not reporting it on W-2s,” Hemel said. “For most of us, what we get on a W-2 reflects what we have to report to IRS.”

Source: | This article originally belongs to Nbcnews.com