U.S. Treasury Secretary Janet Yellen said she was wrong about how severe inflation would be.

In an interview with CNN, Yellen was shown previous remarks she’d made last year where she indicated there would only be a “small risk” of inflation, and that it would be “manageable.”

In response, Yellen said, “Well, look, I think I was wrong then about the path that inflation would take.”

She continued: “As I mentioned, there have been unanticipated and large shocks to the economy that have boosted energy and food prices, and supply bottlenecks that have affected our economy badly, that I didn’t at the time didn’t fully understand. But we recognize that now the federal reserve is taking the steps that it needs to take.”

Yellen was referring to war in Ukraine, an event that has impacted gas prices and global food supplies among other things. A Treasury representative said later that Yellen also had in mind ongoing lockdowns in China and new strains of COVID that have further affected supply chains, according to Reuters.

Inflation has climbed 8.3 percent year-over-year — near a 40-year high. The Federal Reserve has already raised its key interest rate twice this year, and has signaled it intends to do so again at its next meetings this month and in July.

The aggressive rate hikes planned has raised the specter of recession, though many economists remain satisfied that an inevitable economic slowdown will not prove so severe that it sends the economy into reverse.

“Households, particularly in the US, have very high excess savings,” Bank of America economists wrote in a recent note. “Corporations have taken advantage of low interest rates to borrow in advance and build up cash balances as well.”

They added: “We wouldn‘t completely rule out a major recession. For example, the commodity shock or COVID could come back with a vengeance just as monetary tightening is starting to really hurt. However, our base case remains an extended period of weak growth and we think any recession is likely to be mild.”

Still, inflation continues to bite Americans’ wallets even as they enjoy record low unemployment and significant wage gains.

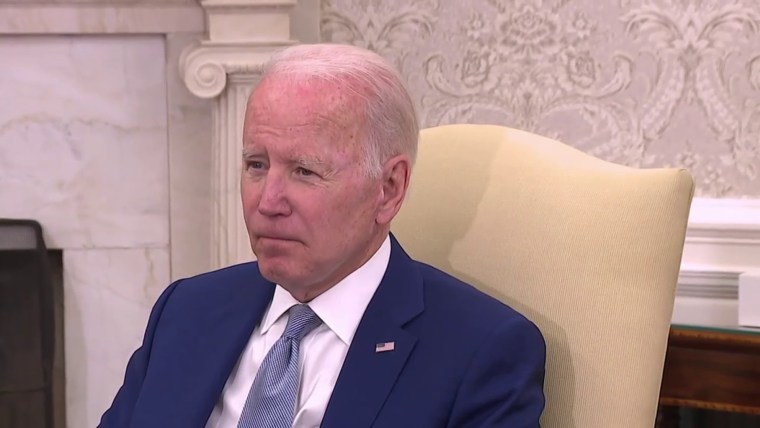

Yellen’s latest remarks came on the same day President Joe Biden met with Federal Reserve officials to discuss inflation. Biden emerged from that meeting saying he respects the Fed’s independence and would give the agency “space” to do its job.

Source: | This article originally belongs to Nbcnews.com