Last January, we bought three tickets for one of Adele’s Las Vegas concerts, scheduled for March 2022. They cost $4,970 (£4,100).

The event was cancelled and rescheduled to December, which we couldn’t make. We bought the tickets via U.S. ticket agency StubHub, using my husband’s American Express card.

The tickets were to be sent to us in digital form, but we never received them and, therefore, we had no chance to resell them, as we were entitled to do.

We’ve tried twice to get reimbursement via a chargeback claim on our Amex card but failed. There’s been no proper communication and StubHub blocked us.

C. E., Bourne End, Bucks.

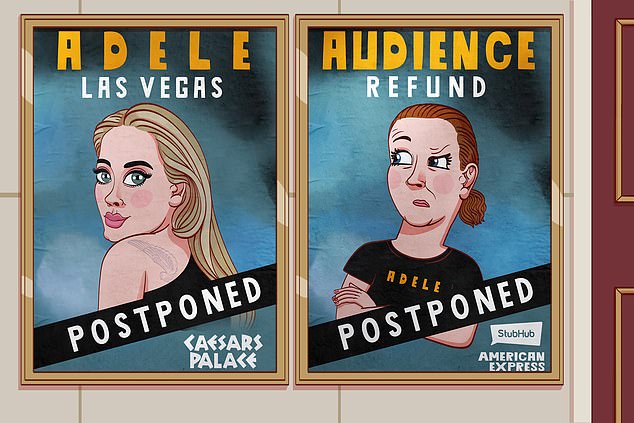

No show: An Adele fan was left £4,100 out of pocket after the singer cancelled her Las Vegas concerts

Sally Hamilton replies: It was one of the biggest dramas in the pop world last year when Adele cancelled her Las Vegas gigs just days before the first performance was scheduled.

She made a tearful video apologising and letting down thousands of fans, many of whom were from Britain and had spent a fortune on tickets, flights and hotels to see her perform live at the iconic Caesars Palace.

You and your husband, along with a friend, were among those who booked a trip to Las Vegas specifically to see the Someone Like You singer in concert.

In your case, this would be the first time seeing her live. Sadly, you told me the whole process of the cancelled event and trying to get your money back has coloured your view of the pop star and you don’t plan to try to see her in concert again.

It all started to go wrong, you said, when the original string of performances at Caesars Palace were postponed rather than cancelled. You were told you could not claim your money back for the tickets unless the shows were cancelled.

Despite this, you decided to go to Las Vegas anyway as you feared you would lose the money paid for flights and the hotel.

It turned out American singer Katy Perry was in concert there on the same dates you had originally booked for Adele, so you attended her show instead — with seats just two rows back from the stage and far cheaper than your Adele tickets.

You were delighted with Perry’s performance and glad you had stuck with your Las Vegas plans.

Meanwhile, you were left in limbo about what to do about your pricey Adele tickets. At the time, nobody knew what was going to happen with her concerts and whether she would reschedule them or eventually cancel.

You contacted StubHub but staff simply told you to read the terms and conditions of sale which said you were not entitled to a refund as the concert had not been cancelled.

It stated that if you were not able to make the rescheduled date, you could resell the tickets through StubHub.

As it turned out, in the autumn, Adele announced rescheduled performances, with December 23 as your new date.

Since you had no intention of attending, especially so close to Christmas, you tried to start the process of selling your tickets.

It was then you realised you had never actually received any.

You tried to contact StubHub but the emails you found for contacting the agency were ‘no reply’ addresses. You tried calling a U.S. number and got a voice message. You also tried its chatbot but got nowhere.

In October, you opened your first claim for a chargeback refund via Amex. This is a voluntary scheme offered by card providers where cardholders can dispute a transaction and request a refund for a purchase that’s gone wrong.

It is a two-sided process, with the customer and the business given the chance to provide evidence.

Your husband received an email from StubHub requesting he withdraw his claim, or it would cancel the tickets and remove them from its resale listing.

You were confused as you had never received the tickets — even though your account on the StubHub app had stated they would be sent out in August. As the email was from a no-reply address, your husband was unable to respond.

You told Amex several times about not receiving the tickets and how you had not been able to contact StubHub. You showed the provider a screenshot of your account on the app that simply said your tickets ‘would be available soon’.

You were hugely frustrated by the difficulties involved in contacting StubHub, something I identify with, having tried its press department in the U.S. three times before someone finally responded.

By the third attempt, I was feeling a little shrill and demanded StubHub show me evidence it had sent you the tickets — or pay up.

Finally, a (rather long) response from StubHub.

‘After reviewing, we confirmed the tickets he purchased were never delivered.

‘It’s rare that this happens, but it’s worth noting that StubHub’s records show that they never heard from this buyer about any issues so they were unable to help him find replacement tickets or immediately refund, as would have been our standard procedures in support of our FanProtect Guarantee, which guarantees that if there’s any error with the tickets, they’ll find tickets of equivalent or better value or offer a full refund.’

The spokesman added that since your husband had challenged the charge through Amex, this meant StubHub was unable to refund the credit until the chargeback case was closed.

Last week, StubHub told me that since the chargeback claim via Amex had concluded, with no reimbursement given, the agency could now issue a conventional refund to your husband’s card —which, to your great relief, it has now done.

Thankfully, in the words of Adele’s hit Bond theme song, Skyfall, ‘this is the end’.

Shock £4,700 Italian hospital bill

In July 2016, my partner and I went on holiday to Tuscany. We had travel insurance with Axa as well as a European Health Insurance Card (Ehic).

On the last day I was taken ill and went to a hospital 15 miles away, where I was diagnosed with sepsis. My partner was told I might die within 24 hours.

However, after I spent five days in intensive care and a further four days in the main hospital, I got better and was discharged.

We sorted everything out with Axa and a doctor was flown out to escort me home.

As far we were concerned, everything was in order with the claim. But, recently, I received a letter from the hospital saying I owed it €5,494 (£4,786). Since this happened six years ago, I have no paperwork.

P. H., Sunderland, Tyne and Wear.

Sally Hamilton replies: First, I’m delighted you recovered from your nasty brush with sepsis. But how horrible to receive a shock bill in the post after so many years.

I contacted Axa, which was as surprised as you to hear about the mystery invoice. It investigated straight away.

From its records, Axa could see the Italian hospital accepted your Ehic card at the time of the incident.

This card allows holders to receive healthcare services under the same arrangements in most European countries as locals.

The service is often free, or might involve a contribution that isn’t reimbursed. Since the UK left the European Union, the same arrangements are offered via a Global Health Insurance Card once an existing Ehic card expires.

Axa says your claim progressed normally, with your previous medical history reviewed, the bills covered and a medical escort provided. At no point did the hospital raise any financial concerns with Axa or with you.

After my intervention, Axa contacted the hospital via its local team in Italy. Meanwhile, it confirmed that whatever happened, you wouldn’t need to pay this bill.

Axa kept me informed during the to-ing and fro-ing between it and the hospital over the following weeks. I’m pleased to say the hospital eventually confirmed it accepted your Ehic cover and no expenses would be sought.

An Axa spokesman says: ‘The hospital will be sending a credit note to the customer to confirm that he is not liable for costs.’

- Write to Sally Hamilton at Sally Sorts It, Money Mail, Northcliffe House, 2 Derry Street, London W8 5TT or email [email protected] — include phone number, address and a note addressed to the offending organisation giving them permission to talk to Sally Hamilton. Please do not send original documents as we cannot take responsibility for them. No legal responsibility can be accepted by the Daily Mail for answers given.