Elon Musk is under pressure to produce a solid set of fourth quarter results at Tesla next week after an iffy start to the year.

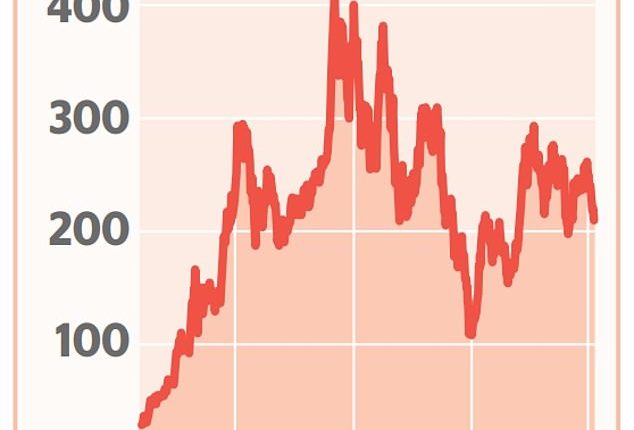

Shares in the electric car giant – one of the so-called Magnificent Seven alongside Apple, Microsoft, Google-owner Alphabet, Amazon, Nvidia and Facebook-parent Meta – doubled last year.

But they are down around 15 per cent this year and are worth just half what they were at their peak in late 2021.

In a further blow, Tesla is no longer the biggest maker of electric cars in the world, having been overtaken by Chinese rival BYD amid a vicious price war to boost sales.

So investors will be hoping Musk – whose eccentric behaviour continues to raise eyebrows amid allegations of drug abuse, which he denies – can deliver the goods on Wednesday night.

Failure to do so may spark fresh talk about the future of his sprawling business empire which also includes X, formerly known as Twitter, and Space X.

‘Tesla has been disappointing investors as questions are raised over profitability amid an EV [electric vehicle] price war,’ said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

But she added: ‘It’s important to stress that Tesla has an excellent product. If production can be ramped up at pace, the horizon looks promising.’

Analysts are expecting quarterly revenues of around £20billion, and there will be much interest on how this translates into profits given the price cuts.