Sanderson Farms Inc. is nearing a deal to sell itself for around $4.5 billion, according to people familiar with the matter, as the poultry giant rides a wave of demand for chicken products.

Sanderson is in advanced talks with Cargill Inc. and agricultural-investment firm Continental Grain Co., which owns a smaller chicken processor, the people said. The deal could be finalized by Monday, they said.

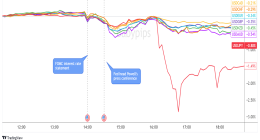

It would value Sanderson at $203 a share, about 30% above the price before The Wall Street Journal reported in June that the company had attracted interest from suitors including Continental.

Mississippi-based Sanderson is the country’s third-biggest chicken producer. It runs 13 poultry plants from North Carolina to Texas, processing about 13.6 million chickens a week. The company supplies grocery chains including Walmart Inc. and Albertsons Cos. as well as restaurant distributors like Sysco Corp. and US Foods Holding Corp.

Combining Sanderson with Georgia-based Wayne Farms LLC, a poultry company owned by Continental, would form a new competitor representing about 15% of U.S. chicken production, according to data from Watt Poultry USA. Tyson Foods Inc. leads the industry with about one-fifth of the market, while Pilgrim’s Pride Corp. represents about 16% of the national total.