In January 2021 we ordered two large sofas from Marks & Spencer costing £1,598. When they arrived three months later, we immediately noticed a squeaky noise when we sat on one of them and so reported it to M&S.

Technicians inspected the sofa, stripped it and advised us that the frame was broken in a few places as if it had been dropped from a great height.

We were told it was not safe to use, but they suggested it could be repaired.

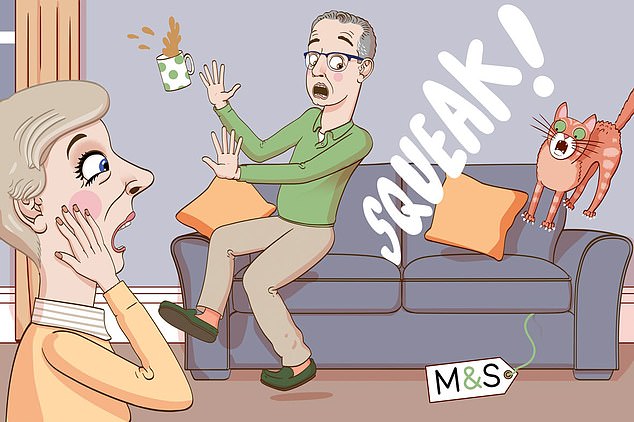

Sofa so bad: A reader has had no end of trouble with their Marks & Spencer sofas, but the company has done little to help

M&S said if we wanted a replacement sofa instead there would be a ten-week wait. Since we’d disposed of our old sofas, we agreed to the repairs.

How we regret that decision now, as after it was repaired both sofas started to give us problems. The seat pads developed severe bobbling, making them very unsightly.

M&S said it could do no more and referred me to the Furniture & Home Improvement Ombudsman. It ruled that there wasn’t a manufacturing defect but requested M&S replace the seat covers.

But the same problem occurred soon afterwards. I asked for replacement sofas in a different fabric that didn’t bobble but was refused — and the ombudsman agreed with M&S when we asked it to rule again. Please can you help.

V. C., Hitchin, Herts.

Sally Hamilton replies: Acquiring a sofa, whether or not it’s from M&S, is not just an expense, it’s a big expense. It’s not something people do regularly, so I can understand your dissatisfaction over the fabric bobbling relatively soon after you bought your furniture.

You said you understood that this might not be considered a manufacturing problem as such, but felt M&S should have stated in its description at the point of sale that the material used would be prone to bobbling and piling.

As you said to me, ‘no one wants their sofas to look like an old jumper’. If it had couched its description more helpfully, you could have made an informed choice not to buy sofas in this fabric. You felt M&S had mis-sold you the sofas and that they weren’t fit for purpose.

Under the Consumer Rights Act 2015, shoppers have a right to a remedy if their purchase does not meet a certain standard of quality and durability.

Consumer expert Martyn James says: ‘After the first 30 days you have an additional six months from purchase during which you must give the firm one shot at a repair or replacement, after which you can get a refund.

‘Even after six months, if the item is not doing what it’s supposed to do, then you can ask for a repair, replacement or refund if the goods aren’t lasting a reasonable length of time.’

Reasonable is hard to quantify, and with an aesthetic issue such as bobbling, the complaint falls into a grey area, he says.

‘The sofa hasn’t broken but it’s not quite as it should be. Though the onus from this point is on the consumer to prove the item has not functioned as promised, the firm should still try to reach some sort of compromise.’

M&S did replace the covers on the seats of your couches, although only after you’d taken your case to the ombudsman.

However, the bobbles soon came back. I felt that the persistent bobbling issue was enough to merit my intervention. I suggested to M&S that even though the sofas weren’t technically broken, it might be time to show some goodwill and cushion your disappointment either by offering replacement items in a different fabric or refunding you at least some of the original cost.

Within a couple of days, a member of M&S’s executive office got in touch with you directly offering to take back the sofas and reimburse you the full £1,598.

You were delighted with this result and have used the money to order new sofas from another retailer with (fingers crossed) non-bobbling upholstery.

Six weeks to clear a cheque at Barclays

I paid in a €10,000 (£8,766) cheque I had received as an inheritance from an aunt in Ireland to my Barclays bank current account.

Two weeks later it still had not been credited. I went in to my ‘local’ branch eight miles away to chase it up, but was told it could take up to six weeks to clear. In this age of technology, this is ridiculous.

My brother deposited a cheque he received for the same amount at around the same time with his bank Lloyds, and it cleared in four days.

Six weeks after depositing mine, I returned to the branch and was given a number to ring. A message said to leave my number and that somebody would return my call, but this didn’t happen. Can you please apply some pressure?

Anon.

Sally Hamilton replies: Cheques are dwindling in popularity due to the rise of internet banking, and now account for less than 0.5 per cent of payments made each year.

But with fewer cheques to process you would think banks would be able to deal with them more speedily. Don’t bank on it.

When I asked Barclays to justify the delay you experienced compared with your brother, it explained that banks have two methods of crediting foreign currency cheques to accounts, each with different clearing periods.

The options are ‘negotiation’ or ‘collection’. A negotiation is effectively when a bank gives a loan of funds to the customer until the funds have finally ‘cleared’.

A collection is where the customer only receives the money once the funds have been cleared by their own bank.

As it’s essentially a loan of the value of the cheque until it clears, the choice of which method used depends on factors such as the cheque amount and the level of activity of money going in and out of an account.

As your cheque was for quite a large sum, the decision was taken to use the collection option. It seems likely your brother’s bank chose negotiation, which explains the speed at which he received his money. Perhaps he is also a more active user of his account.

The collection process can take up to eight weeks. Barclays, however, admits that in your case there were delays in requesting the funds from Allied Irish Bank, the issuer of your €10,000 cheque, with the request not made until nearly seven weeks after you had paid it in.

After I stepped in, the bank finally got its act into gear and credited your account — nine weeks after you delivered the cheque to your branch.

Barclays paid you £200 as an apology for such poor service. Annoying as the delays were, a movement in exchange rates between when you deposited the cheque and when the funds were eventually credited to your account worked in your favour, meaning you were better off by a further £230.

A Barclays spokesman says: ‘Unfortunately, on this occasion we failed to provide the high level of service that our customers can rightly expect to receive, for which we sincerely apologise.’

- Write to Sally Hamilton at Sally Sorts It, Money Mail, Northcliffe House, 2 Derry Street, London W8 5TT or email [email protected] — include phone number, address and a note addressed to the offending organisation giving them permission to talk to Sally Hamilton. Please do not send original documents as we cannot take responsibility for them. No legal responsibility can be accepted by the Daily Mail for answers given.