My garage roof was torn off and my greenhouse smashed during a bad storm last November.

I made a claim on my home insurance with Direct Line, which sent out a surveyor who confirmed the garage roof was beyond repair and needed replacing.

I arranged quotes, which were all in excess of £5,000 just for the roof. Replacing the smashed greenhouse and broken garage door would cost hundreds more.

The insurer said its own contractors would do the repairs.

At first, I thought this was fantastic. I could do without the stress of dealing with the claim on my own, as I am a single mum and have several jobs.

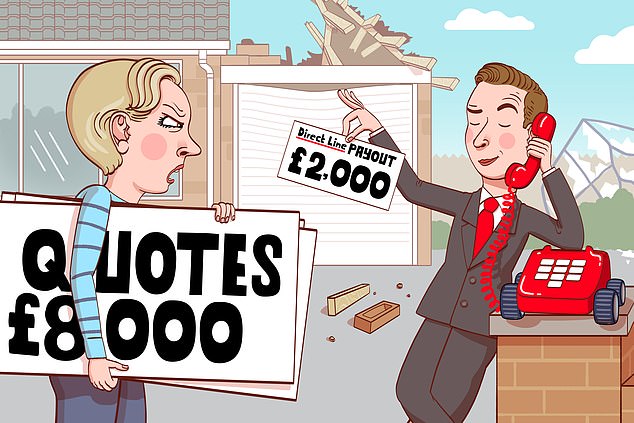

Insult: Direct Line tried to fob of a home insurance customer – whose garage roof was torn off in a storm – with a paltry £2,000 payout

But weeks passed and, after phoning Direct Line numerous times, I was eventually told the contractors couldn’t get the parts to replace the roof.

In the end, the insurer suggested a cash settlement of £2,000 — and left me to arrange the repairs myself.

But that’s nowhere near enough to cover the cost. I am so disappointed with the service I have received. Please help.

L. M., Dunbar.

Sally Hamilton replies: I receive many letters from upset readers who feel short-changed on the sums offered by their insurers to meet valid claims. But I felt the amounts proposed to you by Direct Line took the biscuit.

Home insurance premiums have been increasing sharply, as anyone who has renewed a policy recently will know.

One of the reasons for the soaring prices is that the costs of building materials and labour have been going through the roof. Insurers have to pay more to meet the repair bills on successful claims — and therefore, so that they can balance their books, they raise their premiums.

If materials and labour are costing more, then why did Direct Line think you could fix your damaged property for less than half the price of the quotes you received from various contractors?

I contacted Direct Line to ask it to look again at your claim and sort it once and for all with a more acceptable sum. That was back in late February.

After about eight weeks, it decided that it would meet the full cost of your claim after all.

It has now paid you £8,042, minus £250 for the excess, which is the sum you must pay as your share of the claim, as agreed in your policy.

The final payout is four times what it tried to fob you off with when it didn’t manage to organise the repair work for you.

You told me that although the process has been exhausting and ‘like getting blood out of a stone’, you are delighted with the result.

A spokesman for the insurer says: ‘We investigated L. M.’s concerns regarding a home insurance claim, following storm damage to her home, which we appreciate has taken longer than it normally would to resolve.

‘We have agreed that the total cost for the repairs should be covered by Direct Line, subject to the policy excess.

‘In addition, we have offered compensation for the inconvenience caused. We understand that this has been frustrating and apologise unreservedly.’

The lesson from your story is that homeowners should not just accept what an insurer offers initially following a claim, if the sums do not add up.

PayPal scammer hacked my account and stole £2,800

I was shocked to receive a demand from PayPal in January for the sum of £2,808.

It appears that someone had accessed my account and gone on a spending spree. I wrote to customer services to cancel my account and notified my bank.

Although I explained to PayPal that someone had hijacked my account, I received no response.

PayPal then sent me a notice of default on the payments.

I wrote to the collections manager and again I heard nothing from them. I also phoned to explain the situation. But then in March I received another default notice.

Please can you help?

C. C., Ashby-de-la-Zouch, Leics.

Sally Hamilton replies: PayPal is a widely used online payment system, which allows customers to purchase goods from retailers without having to enter their bank card details.

PayPal customers are able to store their bank details securely in its virtual ‘wallet’. Then, when they wish to make an online purchase, they can do it through PayPal just by entering their email address and password.

Shoppers can opt to pay either by PayPal debit or credit. With the credit system, customers are not charged immediately. Instead, they receive a monthly bill.

You told me that you rarely use PayPal credit, preferring to use the debit system as you typically spend relatively small amounts that you can pay upfront.

You were therefore shocked to see a £2,808 bill on your credit statement. The culprit who had hacked your account went on a three-week shopping spree, mainly buying luxury goods online from John Lewis.

Since you were having trouble getting PayPal to pay attention to your problem, I intervened on your behalf.

Its team investigated and, I am pleased to say, a few days later refunded the full amount and added £150 as a goodwill gesture.

PayPal also told you how to regain access to your account securely. It confirmed there would be no more attempts to collect money from you and that your credit record would not be affected, either.

Can our wedding gift dodge inheritance tax?

Are we allowed to give our granddaughter a wedding gift of money without incurring inheritance tax?

My husband and I are in our 80s.

J. E., Solihull.

Sally Hamilton replies: The short answer is, yes. In fact, you may be able to give away up to £17,000 using various inheritance tax allowances.

As grandparents, you can each hand over £2,500 to a grandchild using an exemption called ‘gifts in consideration of marriage’ and it will be immediately exempt from inheritance tax (IHT).

The gift must be made shortly before the marriage or civil partnership, not after, and would no longer be exempt if your granddaughter didn’t go ahead with the wedding.

You may also be able to hand over a further £3,000 each, as everyone can give away up to this amount each tax year without attracting IHT.

If you did not make any gifts last year, you could also use up last year’s allowance. That would amount to a further £6,000 between you and your husband.

You can only use up last year’s allowances — you cannot backdate claims further than that.

In theory, people can give away any sum of money beyond these exempt amounts. But they will count as part of your estate for IHT purposes if you die within seven years of making the gift. IHT is currently charged at 40 pc.

- Write to Sally Hamilton at Sally Sorts It, Money Mail, Northcliffe House, 2 Derry Street, London W8 5TT or email [email protected] — include phone number, address and a note addressed to the offending organisation giving them permission to talk to Sally Hamilton. Please do not send original documents as we cannot take responsibility for them. No legal responsibility can be accepted by the Daily Mail for answers given.