WASHINGTON — It is unusual for a U.S. senator to publicly warn Americans not to apply for a job and threaten to eliminate it.

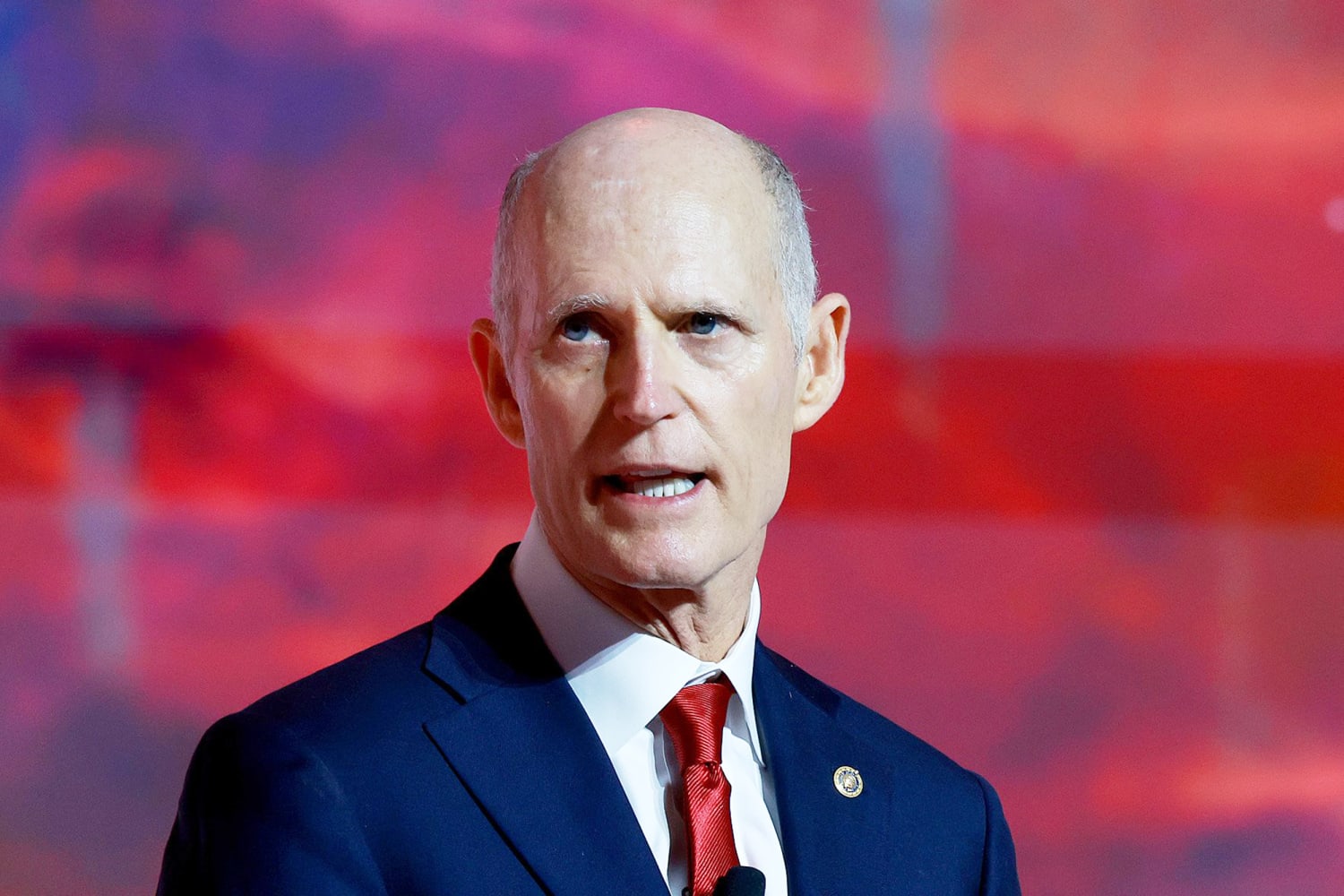

But that’s what Senate Republican campaign chair Rick Scott, R-Fla., did this week, publishing an open letter encouraging job seekers not to pursue new IRS positions, vowing that Republicans, who hope to take control of Congress next year, will quickly “defund” those jobs.

Scott claimed the Biden administration will use the Democrats’ newly enacted Inflation Reduction Act to create “an IRS super-police force” to “audit and investigate” ordinary Americans. “The IRS is making it very clear that you not only need to be ready to audit and investigate your fellow hardworking Americans, your neighbors and friends, you need to be ready and, to use the IRS’s words, willing, to kill them,” he wrote, referencing a job posting for the agency’s Criminal Investigation division, which has been mischaracterized.

Scott’s depiction of a new force of IRS agents targeting average Americans lacks basis in the text of the new law and has been dismissed by Democrats as a fabrication. It was debunked — indirectly — by formal guidance Wednesday by Treasury Secretary Janet Yellen to the IRS.

In a memo to IRS Commissioner Charles Rettig, obtained by NBC News, Yellen told the agency to use the law’s $80 billion cash infusion to “enforce the tax laws against high net-worth individuals, large corporations, and complex partnerships who today pay far less than they owe.”

“As I wrote last week, these investments will not result in households earning $400,000 per year or less or small businesses seeing an increase in the chances that they are audited relative to historical levels,” Yellen wrote, emphasizing that the funds would help “improve taxpayer service, modernize technology, and increase equity in our system of tax administration by pursuing tax evasion by those at the top who today do not pay their tax bill.”

Scott’s threat to eliminate the new IRS jobs is, for the time being at least, an empty one. It’s unclear if Republicans will win full control of Congress — and if they did, President Joe Biden would still have veto power to prevent them from undoing his signature legislation.

But the missive represents a dramatic escalation in Republican attacks on a provision of the Inflation Reduction Act bolstering the IRS — part of a strategy to stir up anti-government voters with deep misgivings about the agency ahead of the 2022 midterm elections.

‘A ridiculous caricature’

The Inflation Reduction Act, which passed with unanimous Democratic support and no Republican votes, is a collection of policies that are mostly popular with voters — from allowing Medicare to negotiate drug prices to a 15% minimum tax on corporations. And Democrats are eager to campaign on the legislation in a tough election for the party in power.

Despite its size, the bill hasn’t generated the backlash that the Affordable Care Act did in 2010, which has led Republicans to zero in on the IRS funding to try and motivate voter opposition. GOP leaders, candidates for office and strategists have begun claiming the IRS plans to hire tens of thousands of new employees to audit middle-class Americans, citing a Treasury analysis from May 2021.

Treasury estimated that the IRS could hire 86,852 people over a decade — and not all in auditing or tax enforcement. Some would replace retiring employees. It’s unclear how many will actually be hired, nor is there evidence of the administration considering greater scrutiny of middle-income Americans.

“It’s a ridiculous caricature,” said Kimberly Clausing, a former deputy assistant secretary for tax analysis at the Biden Treasury Department. “It’s deliberate fear-mongering that paints a picture that compliant taxpayers should be scared.”

She said much of the new staffing would go toward returning phone calls and processing tax refunds, with additional funds designed to modernize outdated technology so the agency can “target more sophisticated tax evaders” as opposed to lower-income taxpayers.

“The story for ordinary Americans who are compliant with their taxes is that this is great for them. They’re more likely to have their returns processed quickly, they’re more likely to have their phone calls returned,” Clausing said. “It’s less likely they’ll be audited because the IRS will have the skill and technology to target the audits to those who really should be targeted.”

Scott’s allusions to agents’ alleged license to kill, meanwhile, can be traced back to a job posting for a special agent at the IRS’s Criminal Investigation division, which has been falsely depicted as a listing for other positions in the agency. The distortions have proliferated among conservatives on social media and have been incorporated into Republican campaign messages ahead of the Nov. 8 midterm election.

Arizona Senate Republican nominee Blake Masters tweeted that the law means “87,000 new IRS agents to intimidate and drive [small] businesses into the ground.” House Minority Leader Kevin McCarthy said Democrats “plan to hire an army of 87,000 IRS agents so they can audit more Americans like you.” And Senate Minority Leader Mitch McConnell, R-Ky., said that “Senate Democrats treated themselves to 87,000 new IRS agents” after passing the bill.

A Democratic aide familiar with the process noted the original version of the Inflation Reduction Act included explicit language providing for “no tax increases” on taxpayers earning under $400,000 — but Republicans challenged the provision under the rules of the Senate budget process and successfully forced its removal.

The White House dismissed the Republican rhetoric and called attention to Scott’s proposal to automatically phase out laws like Social Security after five years unless Congress reauthorizes them.

“Nothing shows the extremity of congressional Republicans’ agenda or their prioritization of wealthy special interests over the American people like wanting to repeal Medicare’s new ability to lower drug prices and wanting to raise energy costs because rich tax cheats will have to stop breaking the law,” White House spokesman Andrew Bates said in a statement. “President Biden and congressional Democrats are lowering costs for middle class families, while Rick Scott tells debunked lies and keeps pushing to put Medicare and Social Security on the chopping block.”

Source: | This article originally belongs to Nbcnews.com