A delay in lifting lockdown restrictions would ‘materially’ hamper the country’s economic recovery this year, the boss of the British Chambers of Commerce claims.

If the remaining restrictions in England are lifted on 21 June, Britain’s economy looks set to grow by nearly 7 per cent this year, which would be the fastest pace since records began in 1949, according to the BCC.

The growth would largely be driven by an upturn in consumer spending, which is, at present, expected to rise by 5.5 per cent this year, equivalent to the highest level seen since 1988.

But, bumper growth forecasts would need to be revised if the Government decides to delay the reopening of the entire economy later this month, the BCC added.

Money matters: Chancellor Rishi Sunak at the G7 summit this week

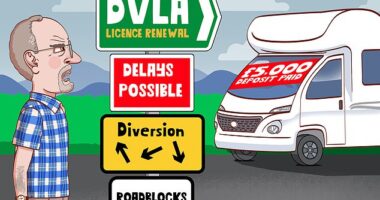

On 14 June, the Government is expected to announce whether or not all restrictions will be lifted in England as of 21 June, as planned in the current lockdown roadmap.

Some experts and ministers are urging caution as the number of people contracting the Delta, or Indian, variant, of coronavirus continues to rise.

Britain’s GDP dropped by 10 per cent last year, with output falling 9.1 per cent, marking the biggest annual drop on record.

As the economy floundered, the Bank of England cut interest rates to 0.1 per cent. The BCC now thinks interest rates will only start creeping up to 0.25 per cent from the second quarter of 2023.

Suren Thiru, head of economics at the BCC, said: ‘Our latest outlook points to a historically robust short-term outlook for the UK economy.

‘The UK economy is in a temporary sweet spot with the boost from the release of pent-up demand, if restrictions ease as planned, and ongoing government support expected to drive a substantial summer revival in economic activity, underpinned by the rapid vaccine rollout.

Impact: The pandemic took a major toll on Britain’s economic performance last year

‘Beyond the strong short-term outlook, notable economic scarring from the pandemic is projected to weigh on economic activity once government support winds down and drive an uneven recovery across different sectors and groups of people.’

Mr Thiru thinks the economy will become ‘increasingly unbalanced’ over the next year or so, with experts pinning their hopes on consumer spending driving up growth, while trade levels flounder.

He added: ‘Such economic imbalances leave the UK more exposed to future economic shocks.

‘The risks to the outlook are on the downside. A more significant surge in inflation would weigh on a consumer led revival by eroding their spending power.

‘The squeeze on activity and the damage to confidence from a marked delay to the full lifting of restrictions or further restrictions to combat Covid-19 variants would materially slow the recovery.’

The number goods exported from Britain to the European Union is forecast to drop by 12 per cent this year, by 1.4 per cent next year and by 2.5 per cent in 2023.

The BCC said: ‘Trade is projected to make a negative contribution over the forecast period.

‘This largely reflects an anticipated decline in exports to the EU with post-Brexit disruption and the weak near-term outlook for the euro area expected to weigh on EU demand for UK goods and services.’

Amid current lockdown easing plans, the BCC has predicted that quarterly growth will reach its strongest over the second and third quarters of this year, with the overall economy picture returning to pre-pandemic levels at the start of next year.

Slashed: The Bank of England dropped interest rates to 0.1% last year

Forecast: The BCC thinks the BoE will only hike interest rates from 2023

According to the data, the economy looks set to grow by 5.1 per cent in 2022.

UK unemployment is projected to remain at a ‘much lower level’ than in recent recessions, the BCC said. It is expected to peak at 6 per cent, with youth unemployment at 15.6 per cent, by the end of the year after the furlough scheme comes to an end.

Fresh figures from the Office for National Statistics have revealed that there are still around 1.7million people on furlough up and down the country.

The BCC thinks business investment levels will rebound strongly this year and in 2022, bolstered by the anticipated boost from the reopening of the economy and the introduction of the super-deduction incentive.

But, business investment is projected to slow sharply in 2023 as the super-deduction incentive ends and corporation tax rise.