Prologis Inc. PLD -2.58% said it has offered to buy Duke Realty Corp. DRE 6.77% in a $23.7 billion deal, as one of the country’s largest warehouse owners seeks to add more space serving the e-commerce market.

Prologis operates warehouses around the world for customers at the crux of online shopping, including Amazon.com Inc., Walmart Inc. and FedEx Corp. An acquisition of Duke would mark Prologis’s largest acquisition to date, according to FactSet, amid high demand for warehouse space needed to store and fulfill orders.

Duke has thus far turned a cold shoulder to Prologis, which said it first made an offer to Duke in a letter sent on Nov. 29. Since then, Prologis said Duke Realty didn’t substantively engage with the offer. Prologis said it raised its offer on May 3, but Duke Realty rejected the offer the same day.

Prologis Chief Executive Hamid Moghadam said in a letter to Duke that the company was making its offer public after a standstill in private negotiations. “While we would prefer to continue working privately with you, as we have with others, to reach agreement for the benefit of your shareholders and ours, this approach is clearly not working,” he said.

He added that the acquisition of Duke Realty, which owns about 160 million square feet of industrial real estate in 19 major U.S. logistics markets, would create a long-term strategic benefit, despite “the current market volatility.”

A Duke Realty spokesman declined to comment.

Prologis said its offer is valued at $61.68 per Duke Realty share, based on Prologis’s closing price on Monday, and represents a premium of 29%. Prologis’s all-stock offer for Duke Realty would give Duke Realty shareholders 0.466 share of Prologis stock for each share of Duke Realty that they own.

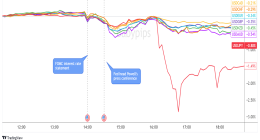

Shares of Duke Realty recently traded 9.5% higher at $52.24 a share, paring gains of about 20% from before the market opened. The gap between where the stock is trading and the offer price suggests investors are skeptical that Duke Realty will accept the bid.

Prologis stock was down 5.1% at $125.62 a share in late morning trading.

Write to Will Feuer at [email protected]

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8