Campaign groups are calling on the Prime Minister to ensure a recent pledge to improve maths lessons in schools also embraces personal finance.

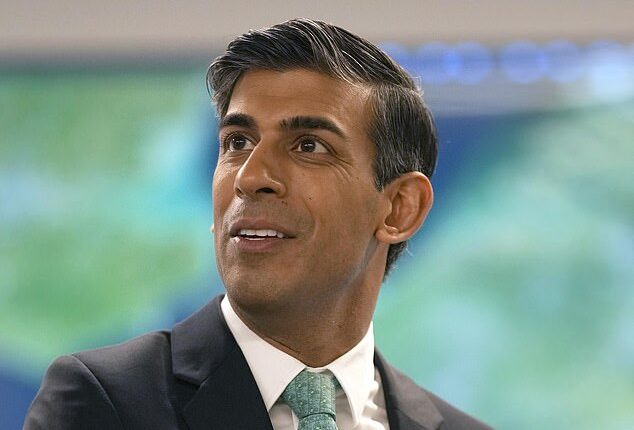

Rishi Sunak promised last week that he would ensure all pupils study maths until the age of 18 and ‘reimagine our approach to numeracy’. Guy Rigden, chief executive of financial education charity MyBnk, says that alongside topics such as algebra and statistics, pupils need to learn the practical skills to manage their money with confidence.

Pledge: Rishi Sunak promised that he would ensure all pupils study maths until the age of 18

‘This may indeed involve some maths, but also information on financial products and services, as well as a focus on forming positive money habits,’ he says.

Personal finance lessons are currently not compulsory in primary schools and often they are only briefly touched on in secondary school education as part of personal, social, health and economic (PSHE) lessons. The Centre for Financial Capability charity wants maths lessons to include practical support to help pupils better manage their finances once they leave school.

Carol Knight, a trustee for the charity and chief executive of the campaign group Investing and Savings Alliance, says: ‘The Prime Minister’s announcement does not solve the problem of helping people be more financially resilient in later life. Including financial literacy as part of the maths lessons is critical.’

Catherine Winter, managing director of the charity London Institute of Banking and Finance, adds: ‘Financial education must ensure pupils are better equipped to make the right decisions after school on how to budget. We have found four out of five young people are anxious about money and they need help as part of the lessons.’