The Reserve Bank of New Zealand (RBNZ) is up this week!

What are markets expecting from the central bank and how could the Kiwi react?

I’ve got the deets that you need to see!

RBNZ’s policy decision (Nov 11, 1:00 am GMT)

- RBNZ kept its policies unchanged in September but hinted at further easing

- The dovishness and a risk-averse trading environment dragged NZD lower throughout the day

- Analysts expect the central bank members to keep their rates steady at 0.25%

- Governor Orr is expected to unveil a Funding for Lending program that would allow RBNZ to offer lower retail lending rates

- Thanks to last week’s weaker-than-expected labor market numbers, some are expecting an interest rate cut from the central bank

- Orr will conduct a presser at 2:00 am GMT

Market risk sentiment

- U.S. election news will continue to impact NZD/USD and overall demand for high-yielding currencies like the Kiwi

- Stricter lockdown measures in the Eurozone is also a BFD for global growth trends and demand for risk assets

- Major economic releases, such as the U.K.’s GDP and the U.S. and China’s inflation data can also influence overall risk sentiment

Technical snapshot

- Stochastic considers the Kiwi as “oversold” against the Aussie

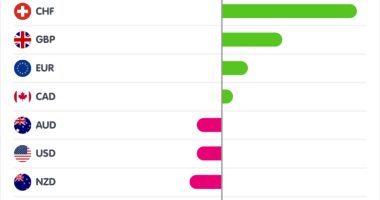

- NZD is in “overbought” territory against the rest of its major counterparts

- SMAs show the Kiwi’s short and long-term bullish trends on the daily time frame

- Watch out for potential retracement or reversal opportunities on AUD/NZD

- NZD saw the most volatility against the safe havens and the euro in the last seven days

Missed last week’s price action? Read NZD’s price recap for Nov. 2 – 6!