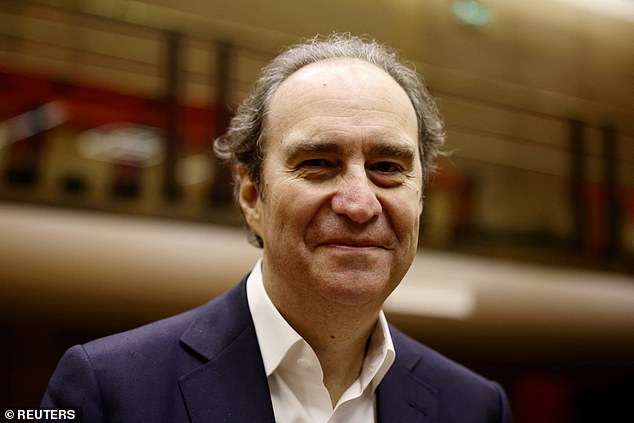

An investment vehicle backed by billionaire Xavier Niel will become the largest shareholder in GAM after receiving approval from Irish authorities.

NewGAMe had already gained permission from financial regulators in the UK, Italy, Switzerland, and Luxembourg to increase its stake in the Swiss fund manager from 17.5 per cent to ‘no less than’ 27.1 per cent.

The rebel investor group has now gained the green light from the Central Bank of Ireland and expects to finalise the purchase on 12 January.

Tycoon: NewGAMe is an investment vehicle backed by French billionaire Xavier Niel (pictured)

It marks a turbulent year for GAM, which looked set to be acquired by London-listed Liontrust Asset Management just a few months ago.

Liontrust conditionally agreed to buy the firm under a £96million deal that would have created an enlarged business with £53billion of assets under management.

However, the proposal fell through after only a third of GAM shareholders supported the offer, with many claiming Liontrust was undervaluing the company and would not bring stability due to its weak share price performance.

GAM then started discussions with NewGAMe, which comprises NJJ, the holding company of French telecoms tycoon Xavier Niel, and financial adviser Bruellan.

They proposed a partial counter-offer to buy 28 million GAM shares for £13.7million and released a 100-day turnaround plan, which included appointing a new board and a 25 million Swiss francs capital injection.

GAM agreed to promote its chief technology officer, Elmar Zumbuehl, to the chief executive role and accept £92million of bridge financing from NewGAMe so it could sustain its day-to-day operations.

Last week, the Zurich-based firm unveiled a ‘four pillar’ strategy aimed at boosting growth and profitability.

It includes proposals to reduce costs by simplifying business structures, building its wealth management division, focusing on clients in core markets and diversifying into new product areas.

The group announced the strategy as it warned that underlying pre-tax losses for this year were expected to total between CHF45million and CHF50million, compared to CHF42.8million in 2022.

In addition, the company anticipates that its average management fee margin in 2024 will decline to around 45 basis points.

‘GAM would like to thank all shareholders for their continued support and looks forward to creating long-term value and success for all our clients, shareholders and employees in 2024 and beyond,’ it said on Thursday.