New Zealand just printed its Q1 2024 CPI figures, with the headline reading coming in line with expectations of a 0.6% quarterly uptick.

Not only was the actual result stronger than the previous period’s 0.5% increase in price levels, but underlying components also reflected sticky domestic inflation.

- Headline CPI: +0.6% q/q (0.6% expected, 0.5% previous)

- Annual Headline CPI: +4.0% y/y (3.7% expected, 4.7% previous)

- Annual Core CPI: +4.1% y/y (unchanged from December quarter)

Link to New Zealand’s Q1 2024 CPI report

Although the figures reflected easing price pressures, annual inflation remained well above RBNZ expectations, dashing hopes of seeing monetary policy easing anytime soon.

The top contributors to higher consumer inflation were housing and household utilities, which chalked up a 4.5% gain for the quarter due to rising rent, construction costs, and property rates.

“Rent prices are increasing at the highest rate since the series was introduced in September 1999,” Statistics New Zealand noted.

Market Reactions

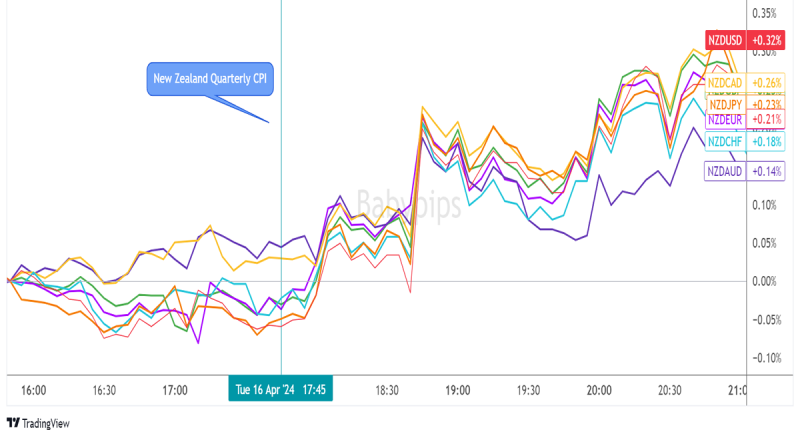

New Zealand Dollar vs. Major Currencies: 5-min

Kiwi pairs were in consolidation prior to the release of the CPI figures, as these were expected to shape RBNZ policy bets in the next few months

Soon after the figures were printed, number crunchers repriced lower odds of a rate cut in August while some predicted that the central bank would likely sit on its hands until September.

With that, NZD popped higher across the board and extended its climb, as markets continued to account for sustained inflationary pressures down the line. Although the Kiwi returned most of its winnings to the Aussie, it stayed in the green overall.

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!