My employer is offering an option to make my pension contribution via a salary sacrifice, or salary exchange, scheme.

They say that this means I can contribute more to my pension, but still take home the same pay each month.

How does this work, is it worth signing up to, and are there any downsides?

What is the best option to grow my pension? L.V

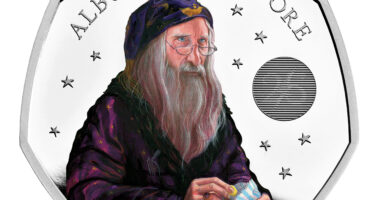

Tax-efficient: Salary sacrifice schemes mean that you will pay less in National Insurance

Harvey Dorset of this is Money replies: Making the most of your employer’s pension scheme is more important than ever in order to fund a comfortable retirement.

Many will already be paying in to a defined contribution plan every month thanks to auto-enrolment.

However, there may be a more effective way to grow your pension and a salary sacrifice scheme is one way savers can potentially do that.

Offered by some employers, often larger companies, salary sacrifice pension schemes see employees give up part of their salary, which is then paid by the employer directly into the employee’s pension.

Whilst this reduces your salary, both the employer and employee will make lower National Insurance contributions, meaning that the pay packet you take home each month will be unchanged. It may even rise slightly, as the lower salary means you could pay less tax.

It might sound like a win-win – but the downside is that those who sign up could lose out on benefits that are linked to their salary.

This is Money spoke to a pensions expert on whether a salary sacrifice scheme could be the right move for you.

Not for everyone: Mark Futcher recommends checking with your employer whether the scheme is best for you

Mark Futcher, partner and head of defined contribution pensions at consultancy Barnett Waddingham replies: Salary exchange, also known as salary sacrifice, can be a great thing for employers to offer their staff – but it can be confusing to work out if it’s the best option for you.

In a nutshell, salary sacrifice means you can make payments to your workplace pension arrangement in a more tax-efficient way, by offering National Insurance (NI) savings for both the employee and employer.

It’s important to know that it is a formal agreement between you and your employer, affecting your terms and conditions of employment with regards to pay and benefits.

With a ‘normal’ workplace defined contribution pension, you have an agreed contractual salary, but before it lands in your bank account you pay a percentage to your workplace pension. Your employer also pays a percentage, and the Government tops it up.

With salary sacrifice, your contractual salary is reduced in exchange for employer contributions, rather than you making payments directly as an employee payment. As pay is reduced, neither you nor your employer pay NI on the amount of the salary exchanged.

Salary sacrifice can’t take your salary below the National Living or National Minimum Wage, so you will be excluded if this is the case. There may also be a maximum limit which you pay in, so as not to inadvertently bring you below certain NI limits, which could impact your eligibility for some state benefits.

The main advantage of paying via salary exchange is the reduced National Insurance, and therefore higher take-home pay. There’s usually no impact on income tax.

If you’re a higher rate taxpayer then paying via salary exchange will mean there is no higher rate tax relief to claim on your payments, as you’re not taxed on the salary exchanged or sacrificed.

As an example, for an employee who earns £35,000 a year, contributing 5 per cent into their pension and receiving 5 per cent from their employer, their total pension contributions will be £3,500 regardless. Under the salary exchange method however, take home pay would increase by £140 over the year. This example is based on the 2024/25 tax year – please remember that the tax treatment depends on your individual circumstances and may be subject to change in the future.

Salary sacrifice isn’t suitable for everyone. If you’re unsure on how this may impact you it is worth checking with your employer and they should be able to support further.

As mentioned before, there can be some drawbacks which impact those on lower incomes or levels of state benefits, such as statutory maternity leave or disability benefits.

The recent Spring Budget announced that NI is reducing from 10 per cent to 8 per cent from 6 April 2024. This reduction will decrease the level of NI savings via salary exchange, for those that are eligible.

Is it the best option for me?

Once you’ve checked you’re eligible and that you won’t lose out on other pay-related benefits, there are three main reasons salary sacrifice might be worth it for you.

Employer contributions: Some employers may pass on some of their NI savings from salary exchange by paying more into your workplace pension, further boosting pension savings. It’s worth asking your employer how this will impact their level of contributions.

Compound growth: Higher contributions now will generate compound growth over time, like a snowball, because of dividends and interest rates. This means contributing more early should leave you with a larger retirement pot.

Child Benefit/Universal Credit: As salary sacrifice reduces pay, this could increase the level of Universal Credit or increase the main entitlement to Child Benefit if you’re eligible for those state benefits.

If you’re worried or in doubt, it’s worth chatting through your specific financial situation with a financial adviser, or looking on the Government’s ‘Money Helper’ website for more information.