MPs have written to the UK’s financial watchdog to demand answers around its handling of sexual harassment allegations against hedge fund manager Crispin Odey.

Conservative MP Harriett Baldwin, chairman of the House of Commons Treasury Select Committee, has asked the head of the Financial Conduct Authority Nikhil Rathi to clarify what the regulator was aware of and whether it had taken any action against Odey or his asset management firm following allegations of misconduct.

The letter requested more detail on systems put in place by the regulator to handle accusations of what it called ‘non-financial misconduct’ and whether it monitored the ‘cultural impact’ owners could have on their firms even if they do not hold a formal management position.

It followed a report in the Financial Times last week which alleged Odey sexually harassed 13 women over a 25-year period. He denies the claims.

‘Financial services culture, and the experiences of women, are ongoing concerns of the committee.

In the firing line: Hedge fund boss Crispin Odey (pictured) is alleged to have sexually harassed 13 women over a 25-year period

Journalists at the Financial Times have shone a light on deeply troubling allegations of conduct regarding the actions of a powerful individual.

We look forward to receiving a response from the financial regulator on these issues,’ Baldwin said.

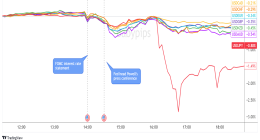

The scandal caused Odey Asset Management to throw out its 64-year-old founder over the weekend, block withdrawals from two funds and shut another as it struggled to contain the fallout.

The firm said Odey will ‘no longer have any economic or personal involvement’ and that it will rename the business.

But as investors rushed to withdraw money, the company gated the Brook Developed Markets fund and the LF Brook Afternoon fund. The Swan fund has been suspended with its portfolio set to be liquidated.

Other firms have moved to distance themselves from the fallen fund manager.

US bank JP Morgan has terminated its relationship, meaning all big banks – including Morgan Stanley, Goldman Sachs and Exane – have cut ties with Odey Asset Management since the scandal broke.

Discussions are ongoing as to whether the three banks – the firm’s prime brokers – can be lured back. There is hope internally that management changes announced by the business will help restore its reputation.

The fund has £3.5billion in assets under management – £1billion held in funds previously run by Odey, who still has £600million of his own money in the funds, which have now been taken over by other investment managers.

Odey has said he was the victim of an ‘aggressive campaign’, and had massaged a colleague’s back but said this was ‘not a criminal offence’.

He compared himself to Tesco chairman John Allan, who had to resign after four women made allegations about his conduct.