THE Bank of England today raised interest rates for the 11th time in a row to a near 15-year high.

But bosses now expect the economy to grow, rather than shrink, in the first half of this year.

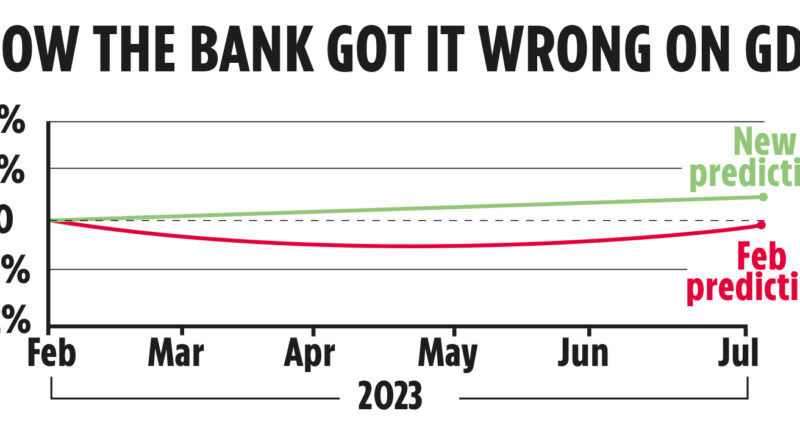

The Bank had to admit it had been too gloomy about predictions as it hiked the base rate by 0.25 percentage points to 4.25 per cent.

The rise was widely forecast after official figures a day earlier showed a surprise increase in consumer price inflation in February.

Raising interest rates is the biggest weapon the Bank has in tackling inflation as it encourages consumers and businesses to save rather than spend.

However, rises also pile on extra costs for mortgage holders and borrowers at a time of record high prices for basic essentials such as food, fuel and rent.

Bank of England governor Andrew Bailey said: “Low and stable inflation is the foundation of a healthy economy.

“Raising rates is the best tool to bring inflation down.

“We have raised rates a lot already. We believe inflation will begin to fall quite rapidly before the summer.

“But as yesterday’s release for February showed, we need to see that actually happen.”

Most read in Money

Traders have taken the Bank’s signal that inflation will fall sharply later this year as a signal it will not have to keep raising rates.

AJ Bell head of investment analysis Laith Khalaf said: “In other words, the end of the rate-hiking cycle is nigh. It’s been a hell of a journey, and there have been casualties along the way.

“Bond funds, LDI pension funds, mortgage holders, and more recently the banking sector, have all suffered as a result of higher interest rates.”

The Bank now estimates GDP will “increase slightly” in the second quarter of the year, compared with the dip it predicted last month.

This means the UK will have avoided a technical recession in the first half of the year.

This post first appeared on thesun.co.uk