MILLIONS of homeowners could face higher mortgage repayments as the Bank of England hikes interest rates again.

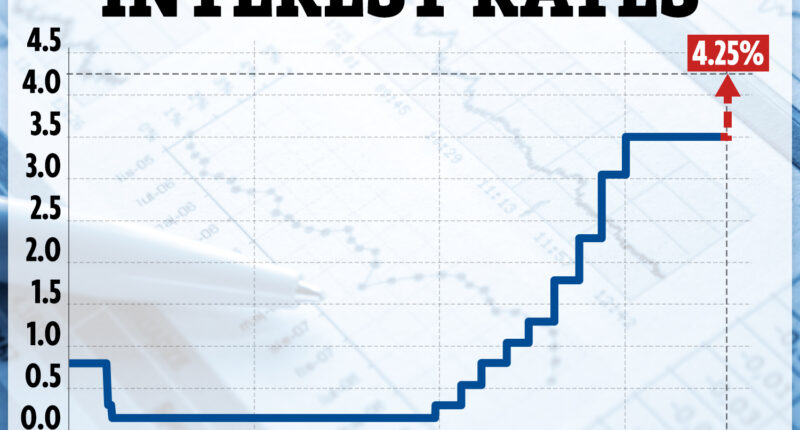

The rate has been hiked from 4% to 4.25% today in a bid to keep a lid on soaring inflation.

An unexpected rise in the UK’s inflation rate has led the Bank of England (BoE) to up interest rates for the 11th time in a row.

Seven members of the BoE’s Monetary Policy Committee (MPC) voted to increase the rate, with two voting to keep it at 4%.

The last time was in February, when it increased the rate from 3.5% to 4%.

The base rate is now the highest it has been since October 2008, when it stood at 4.5%.

Experts had been on the fence about whether the central bank would opt for another rise in its Monetary Policy Committee (MPC) meeting today.

But the surprise jump in inflation, from 10.1% in January to 10.4% in February, made it harder for the Bank to justify leaving rates at the same level.

But the Bank remained calm about the surprise jump, predicting that it will “fall significantly” later this year.

The Bank has hiked rates for eleven consecutive months since December 2021 when it was at a historic low of 0.1%.

Most read in Money

Economists said the Bank is walking a tightrope, with weeks of financial market rollercoasters and bank rescues have highlighting the risks and potential fallouts from higher interest rates.

The move will make the cost of borrowing, including loans, credit cards and mortgage repayments more expensive.

Alice Haine, personal finance analyst at BestInvest, said the hike might feel like a “hammer blow” to households finances.

She added: ” For now, higher interest rates will undoubtedly heap more pressure on household budgets, particularly for homeowners whose finances are already hurting thanks to costlier mortgage repayments along with the many other money challenges – from falling real incomes to significantly higher food costs and looming tax rises.

“The worst of the cost of living crisis- may be behind us, but households should still strive to contain expenditure where they can.”

But, in some good news, the BoE said it expects the UK economy to grow slightly between April and June.

It had previously forecast that gross domestic product (GDP) would drop by 0.4%.

“While subdued overall, activity was holding up better than contacts had previously expected, particularly in the consumer services sector,” the Bank said.

But what does an increase in the base rate mean for your finances? We explain all.

Why does the Bank of England increase its base rate?

One of the BoE’s main jobs is to keep inflation at 2%. Hiking its base rate is one way of doing this.

Hiking interest rates is meant to encourage households to save rather than spend, which forces inflation down.

The UK’s rate of inflation has risen to 10.4% in February – up from 10.1% in January.

Inflation is a measure of the price of everyday goods, so if it’s high it means everything from fuel to food is costing more.

Mortgage rates rising – how much could mine rise by?

Your mortgage rates could go up following today’s hike – but how much it will rise depends on the type of loan you have.

For the average UK property costing £270,708 on a variable rate and with a 75% LTV, monthly mortgage repayments would increase by £26 a month, according to data from TotallyMoney and Moneycomms.

When compared to December 2021, this means repayments could be a whopping £456 more.

Tracker mortgages are directly tied to the BoE base rate and around 715,000 households with this type of mortgage will see repayments rise straight away.

Around 191million households on standard variable rates (SVRs) are likely to see their monthly bill rise if their bank decides to pass on the increase.

Anyone with a fixed mortgage won’t see rates increase as they are locked in to a rate for a set period.

But when these homeowners come to remortgage, they will face a shock with higher repayments as they’ll be forced to take out fixed deals with much higher rates.

Exactly how much more depends on the size of the mortgage, the rate you fixed at, the new rate and the loan-to-value when you remortgage.

It is estimated that 5.2million mortgages may be exposed to changes in interest rates from June 2022 to the end of June 2024.

And around 360,000 of these mortgage borrowers could face payment difficulties as a result, according to the Financial Conduct Authority (FCA).

High-street banks use the Bank’s base rate to work out the interest rates it offers to customers.

This means the move is pushing up borrowing costs, including on mortgages, though savers may get better rates on their nest egg.

Andrew Hagger, personal finance expert at Moneycomms.co.uk, said: “It appears that UK interest rates may have finally peaked in this current cycle as the Government banks on inflation falling sharply throughout the remainder of 2023.

“But the current high rates are of little comfort to consumers struggling to make ends meet and particularly those facing an additional huge payment shock when they come to renew their fixed rate mortgage in the coming months.”

Martin Lewis previously warned that millions of homeowners face a “huge payment shock” in the Spring.

But fixed mortgage rates are currently at a six-month low, according to MoneyFacts.

Both the average two- and five-year fixed rates fell month-on-month for the fourth month running.

Two-year fixes were down to 5.32%, while five-year fixes were down 5%.

Mortgage rates shot up to record highs last autumn after the mini-Budget, but have since come down.

But they are still higher than before the BoE started hiking rates when many fixed at historic low rates.

Rachel Springall, finance expert at Moneyfacts, said that while it’s encourafing to see fixed rates falling, variable interest rates are “rising significantly”.

She added: “The average SVR has now breached 7% for the first time since October 2008, which means borrowers will be in for a shock if they are about to revert from a low fixed rate deal.”

Households usually end up on an SVR at the end of a fix and they are usually far higher, so getting a new fix can save you cash.

Credit card and loan rates could rise

The cost of borrowing through loans, credit cards and overdrafts could go up too, as banks are likely to pass on the increased rate.

After consecutive rate rises by the BoE, interest rates on credit cards and personal loans already hit a record high in December, according to Moneyfacts.

Many big banks – like Lloyds, MBNA, Halifax and Barclaycard – link their credit card rates directly to the Bank of England base rate.

That means their credit card rates will hike automatically in line with any changes to interest rates – but you’ll be given notice before this happens.

You can check the terms and conditions of your credit card to see if the rate can go up when the base rate does.

Certain loans you already have like a personal loan or car financing will usually stay the same, as you’ve already agreed on the rate.

But rates for any future loan could be higher, and lenders could increase the rate on credit cards and overdrafts – although they must let you know beforehand.

You can cancel a credit card if you want and will have 60 days to pay off any outstanding balance.

Savers might get better rates

The hike is likely to be good news for savers as banks battle it out to offer market-leading interest rates.

A rate rise is generally good news for savers, especially after a long stretch of getting very low rates on their money.

But, bear in mind high inflation can erode away the value of any savings you have.

So if you have £100 in the bank this year and inflation is 10.4%, the real spending power of that money is reduced to £89.60.

The base rate rise could see banks pass on higher rates to savers – though they are usually much slower to act than with passing on higher rates for borrowing.

This means savings rates are more likely to edge up slowly rather than change immediately.

Anyone currently getting a low rate on easy-access savings might want to look around for a better rate.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected]