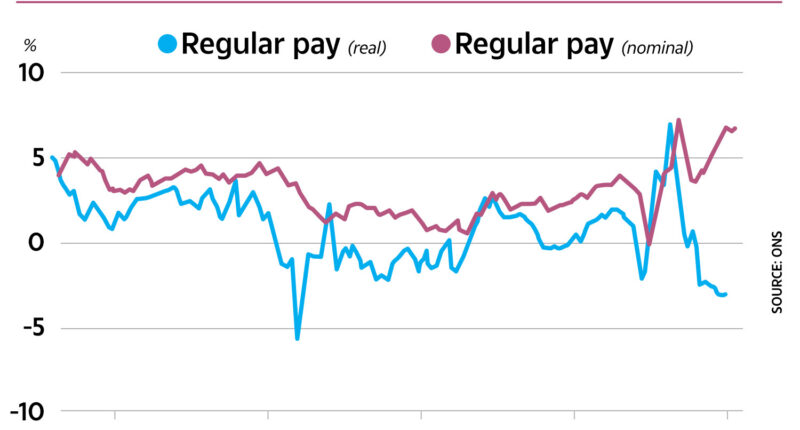

MILLIONS of workers are facing a pay cut after real term wages fell by 3%.

The latest figures from the Office for National Statistics (ONS) reveal household incomes are still being hammered by high inflation.

Pay went up by 5.8%, including bonuses, while pay excluding bonuses increased by 6.7% between January and March.

The average worker’s pay packet in March 2023 was £642 for total pay and £598 for regular pay.

But inflation hit 10.1% in March, after falling slightly from 10.4% the month before.

That means people’s pay packets have fallen in real terms, when factoring in other living costs such as food and energy.

Average wage increases for the private sector were 7% in January to March 2023 and 5.6% for the public sector.

The finance and business services sector saw the largest wage boost of 8.8%, followed by the manufacturing sector at 6.3% and construction sector at 6.2%.

Alice Haines, personal finance analyst at Bestinvest, said: “The hit to wage growth magnifies the financial struggle for workers who are not only having their disposable incomes eroded by increased food, energy and household bills but also rising borrowing costs and higher taxes.

“Interest rates at a 15-year high of 4.5%, with fears they could go up again if sticky inflation does not ease as fast as hoped, means employers are under pressure to increase wages at a time when economic growth is slowing.

Most read in Money

“However, rapidly rising pay packets make it harder for the Bank of England to tame inflation, potentially resulting in a dreaded wage-price spiral that could keep interest rates higher for longer.”

The ONS also said the rate of unemployment rose to 3.9% in the three months to March 2023, up from 3.8% between October and December 2022.

Meanwhile, figures show the first fall in workers on payrolls since February 2021, down 136,000 to 29.8million.

Darren Morgan, the ONS’ director of economic statistics, said: “Employment and unemployment both rose again the first three months of 2023, driven in particular by men.

“This means the number of those neither working nor looking for work continues to fall, although the number of people not working due to long-term sickness rose again, to a new record.

“However, the number of people on employers’ payrolls fell in April for the first time in over two years, though this is an early estimate that could be revised later.

“Despite continued growth in pay, people’s average earnings are still being outstripped by rising prices.”

Jeremy Hunt, the chancellor, added: “It’s encouraging that the unemployment rate remains historically low but difficulty in finding staff and rising prices are a worry for many families and businesses.

“That’s why we must stick to our plan to halve inflation and help families with the cost of living, while delivering our childcare reforms and supporting older people and disabled people who want to work.”

What does it mean for my money?

The main concern when workers see a “real terms” fall in their salary is that it is not keeping pace with the cost of living.

Wage growth is still behind inflation as prices of everything from groceries to energy bills increase at a faster rate.

The average household is forking out £2,500 a year on its energy bills, for example, although they are predicted to fall from July.

Meanwhile, food prices have soared by 19%, meaning everyday grocers are costing much more.

It means you will be feeling the pinch as your income doesn’t go as far and may end up struggling to pay your bills.

What help is available?

If you are struggling there’s support on offer.

The Government is handing out three cost of living payments to millions, worth £900, £150-£300 and £150.

To be eligible for the £900 payment, households will need to be claiming at least one of the following:

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

- Income Support

- Pension Credit

- Tax Credits (Child Tax Credit and Working Tax Credit)

- Housing Benefit

- Council Tax Support

- Social Fund (Sure Start Maternity Grant, Funeral Payment, Cold Weather Payment)

- Universal Credit

The payment has been split into three instalments worth £301, £300 and £299.

The first instalment should be paid to all eligible people by May 17 while the second and third instalments are expected in autumn this year and spring 2024.

Elderly Brits will receive another one-off £150-£300 top up to their Winter Fuel payment later this year too.

And millions of people with disabilities will get a £150 payment this summer.

You might also be able to get help via the Household Support Fund.

The help is being distributed by councils in England and what you are entitled to varies depending on where you live.

But, in most cases, you will be in line for support if you are on a low income or benefits.

Beyond this, a number of energy suppliers offer grants to customers who are struggling with their bills.

This includes British Gas, EDF, Octopus Energy and Scottish Power.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected]