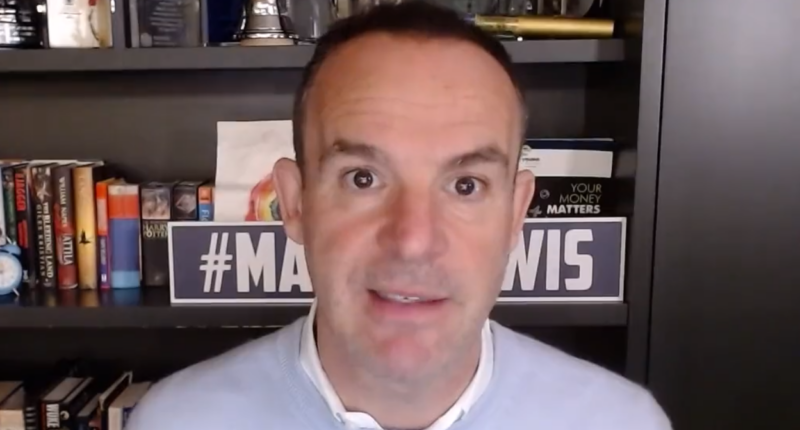

MARTIN Lewis has warned up to a million Brits they are in line for unclaimed cash worth on average £2,100.

The MoneySavingExpert.com website founder offered the advice in a video posted on Twitter yesterday, January 23.

Mr Lewis said the money comes via lost Child Trust Funds (CTF), which are savings accounts for children born between September 1, 2002 and January 2, 2011.

All children who had accounts set up automatically received a £250 voucher at birth, and lower income families would have got £500.

Children born between 2002 and 2010 would have received an additional £250 when they turned seven.

You can add extra money to a fund and parents can also decide whether to invest the cash in stocks and shares or save it until the account can be opened.

The money can then be claimed when the child turns 18.

The first batch of teenagers with CTF accounts turned 18 and were able to access their accounts from September 2, 2020.

But many who have come of age don’t even know they have an account – and they could be missing out on thousands of pounds.

Plus, there’s up to a million so-called “lost” accounts that people have forgotten about.

Most read in Money

Mr Lewis explained in the video: “Of the 6.3 million Child Trust Funds that were active, it’s thought up to a million of them are lost, meaning people have lost track of them, or are unaware that you have them, and that could be you.

“And just to put this in context, gov.uk estimates that the average Child Trust Fund has £2,100 in.”

Mr Lewis went on to explain a CTF could be worth more or less than the £2,100 figure though.

He said: “If it was inactive and nobody put money in, you’ve probably got less in that that.

“But it’s still likely to be three, four, £500, £1,000, or possibly more.”

How do I find a lost Child Trust Fund account?

A CTF can be claimed when the account-holder turns 18.

The money will stay in the account until you withdraw or transfer it.

You can find an old CTF by contacting the Child Trust Fund provider directly.

If you don’t know who your provider is, you can ask HMRC to locate it for you on the government’s website, but you’ll need some details on hand.

This includes your government gateway login and National Insurance number.

What can you do once you’ve claimed the money?

You don’t have to spend the CTF once you’ve claimed it and you have some options.

Cash it in

You can ask your CTF provider to hand over the money and get it paid into a bank account.

Transfer it into an ISA

You can transfer it into an Individual Savings Account (ISA).

You don’t pay tax on the interest you earn with an ISA.

You can transfer the money into a cash ISA – although the interest rates on these are typically lower than a standard savings account.

Or, you can transfer it into a stocks and shares ISA, which lets you invest the money.

A good option for young people saving to buy their first home is the Lifetime ISA.

You can put £4,000 a year into these accounts.

The government will give you a 25% bonus on your savings as long as you use it to buy your first property, or if you wait until retirement age to access the cash.

Do nothing

If you do nothing with your CTF, your provider will either transfer it to an ISA or to a “protected account”.

It won’t incur income or capital gains tax and will sit until the account holder does something with it.

This isn’t a great option though as your money won’t be earning interest, which means its value in real terms is being eroded by inflation every year.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected]