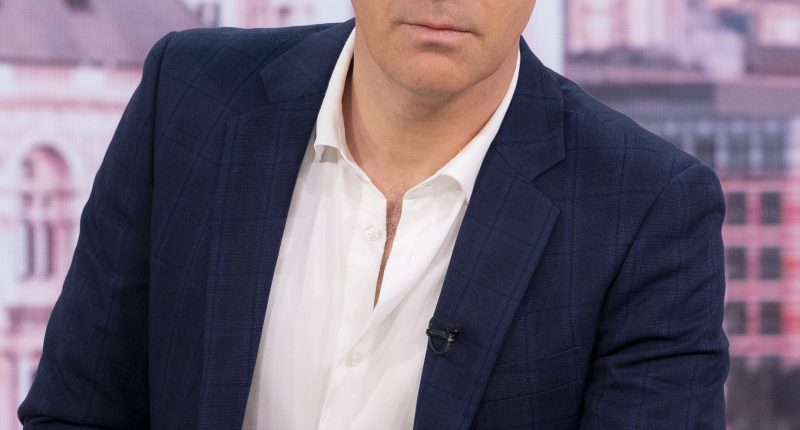

MARTIN Lewis has shared a no-brainer method to check if you’re energy direct debit is too high – and some could claim back £1,000s.

The founder of MoneySavingExpert.com discussed the issue of energy firms sitting on billions of pounds of customer cash.

Martin said: “Energy firms have over £8billion of our direct debit cash – check and get excess credit back.

“My rule of thumb is, right now, over two month’s worth of direct debit in credit is too much at this point in the payment cycle.”

For example, if your usual energy direct debit is set at £150 and you’re more than £300 in credit, now is the time to request a refund.

The MoneySavingExpert continued: “If that’s you, first ensure you’ve done an up-to-date meter reading (unless you have a working smart meter), then use the MoneySavingExpert.com direct debit calculator to check it’s currently set right.

Read more from Martin Lewis

“If so, politely ask for any excess credit back.

“Plus if your direct debit is set over 10% too high (factoring in the January price rise and wiggle room), ask them to lower it too.

After previously following this advice, one MoneySavingExpert fan called Debbie said: “Thanks so much for your direct debit calculator.

“After giving EDF meter readings yesterday, it was confirmed this morning I’m £3,831.91 in credit! Which is being repaid to me.”

Most read in Money

Martin also talked about this issue in last night’s episode of ITV’s Martin Lewis Money Show Live.

He said: “If you’ve got three months, four months or five months, or much more in credit now you’ll want some of it back.

“You have a legal right to ask for it back.”

We’ve explained how to calculate, check and challenge your energy direct debit below.

How do I calculate my bill?

To calculate how much you should be roughly paying, you will need to find out both your unit rate for gas and electricity and the standing charge for each fuel type.

The unit rate will usually be shown on your bill in p/kWh.

The standing charge is a daily fee that is paid 365 days of the year – irrespective of whether or not you use any gas or electricity.

You will then need to note down your own annual energy usage from a previous bill.

Once you have these details you can work out your gas and electricity costs separately.

Multiply your usage in kWh by the unit rate cost in p/kWh for the corresponding fuel type – this will give you your usage costs.

You’ll then need to multiply each standing charge by 365 and add this figure to the totals for your usage – this will then give you your annual costs.

Divide this figure by 12 and you’ll be able to work out how much you should expect to pay each month.

How do I challenge my energy bill?

If you pay your energy bill by direct debit, then it is assumed that this monthly amount should be “fair and reasonable”.

If you don’t think it is, you should complain directly to your supplier in the first instance.

If you’re not happy with the outcome you can take it to the independent Energy Ombudsman to dispute, but there are a few steps before you get to that stage.

Your supplier must clearly explain why it’s chosen that amount for your direct debit.

If you’ve got credit on your account, you have every right to get it back – although some experts recommend keeping it there through the summer, so your bills don’t go up in the winter when you use more energy.

Your supplier must refund you or explain exactly why not otherwise and the regulator, Ofgem, can fine suppliers if they don’t.

To ask for a refund call your supplier or contact them online.

If you are disputing a bill, taking a meter reading is a must.

If it’s lower than your estimate, you can ask your provider to lower your monthly direct debit to a more suitable amount.

Read More on The Sun

But beware so you don’t end up in debt later on with a bigger catch-up bill at the end of the year from underpayments racking up.

If you don’t have success in negotiating a lower payment then you can put in a complaint to the Energy Ombudsman.