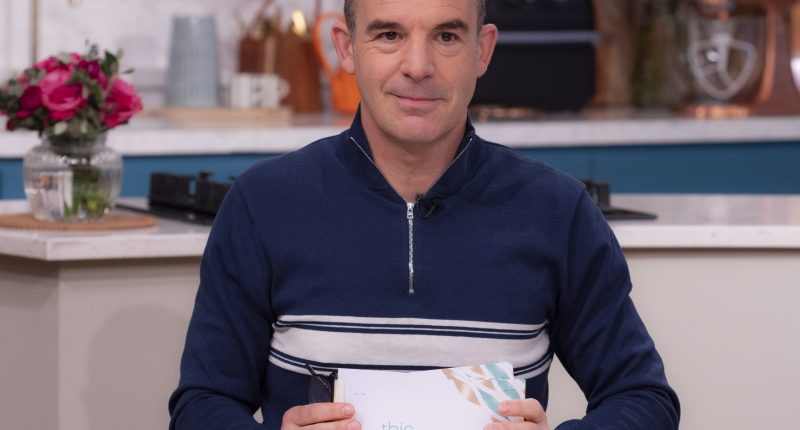

MARTIN Lewis has urgently warned millions to check their tax codes now.

He said that millions of workers could be owed cash and should check their payslips – as one person got £2,000 cashback.

If your tax code is wrong, you may be paying thousands more than you need to, and you’ll likely be owed money back.

During this week’s Martin Lewis BBC Radio 5 Live Podcast, the founder of MoneySavingExpert.com said: “You need to know your tax code and what it means, it’s your legal responsibility.

“Millions are wrong. Millions are overpaying. Millions are underpaying.

“It all causes a nightmare, so make sure you know what your tax code is and check that it’s right.”

read more on martin lewis

Writing in to Lewis, one viewer of the show – who gave her name as Julie – was over the moon at the benefit she got from listening to the financial expert.

Julie wrote: “Thank you to Martin and the team.

“Thanks to your show I have received £1,983.60 back after being on the wrong tax code.”

The code is usually a mixture of letters and numbers – with the most common tax code being 1257L.

Most read in Money

But these numbers and letters determine exactly how much income tax you pay on your earnings – so it’s important you’re on the right one.

And if you notice that you’re on the wrong tax code, you can claim back any overpaid tax for the last four tax years.

But it’s your responsibility to check and let HMRC know if it’s wrong.

Here’s exactly what each tax code means.

Plus, we’ve explained how to check and challenge your own tax code.

Why could I be on the wrong tax code?

Tax codes on your payslip will tell you how much you should pay to HMRC every month.

You can be on the wrong tax code for several reasons, including if you change your job or your salary goes up or down.

Sometimes, HMRC might not have received this information, and so will assume your circumstances haven’t changed.

It’s always worth checking your tax code to make sure you’re paying the right amount of tax if you have moved jobs or had a change in salary.

How do I check my tax code?

You can check your tax code on your personal tax account online, on any payslips or on the HMRC app.

If you’ve got one, you can check it on a “Tax Code Notice” letter from HMRC too.

Bear in mind, you might need your Government Gateway ID and password to hand to log in.

But if you don’t have this you can use your National Insurance number or postcode and two of the following:

- A valid UK passport

- A UK photocard driving licence issued by the DVLA (or DVA in Northern Ireland)

- A payslip from the last three months or a P60 from your employer for the last tax year

- Details of a tax credit claim if you have made one

- Details from a self assessment tax return (in the last two years) if you made one

- Information held on your credit record if you have one (such as loans, credit cards or mortgages)

What do I do if it’s wrong?

If, after checking, you think you’re on the wrong tax code, you can contact HMRC to tell them via phone on 0300 200 3300.

This is usually the quickest way to get a response.

Or, you can send a letter to the following address: Pay as You Earn and Self Assessment, HM Revenue and Customs, BX9 1AS, United Kingdom.

If you are on the wrong tax code and have been paying too much, HMRC will change it so you pay the correct amount moving forwards.

They should also reimburse any tax you’ve already overpaid on.

It’s always worth noting, you might contact HMRC about an incorrect tax code and you might have underpaid them.

In this case, you will usually have to pay the money back over 12 months.

But, only if you are earning enough income over the Personal Allowance, which is currently £12,570, and owe less than £3,000 back.

HMRC might get in touch with you to tell you you’re owed a tax rebate too – they’ll do this via a P800 letter or a simple assessment letter in the post.

But again, a P800 might tell you if you’ve not paid enough tax and have to pay it back.

A P800 letter will tell you if you can claim online through the government’s website.

If you can claim online, you’ll need your Government Gateway ID and password.

READ MORE SUN STORIES

If you claim online the money will be sent to your bank account within five days.

You can also claim your refund through the HMRC app.

What does my tax code mean?

TAX codes tell you how much you should be paying to HMRC every month.

Here’s our guide to what each of the letters mean:

- L – You’re entitled to the standard tax-free Personal Allowance

- M – Marriage Allowance: you’ve received a transfer of 10% of your partner’s personal allowance (£1,260)

- N – Marriage Allowance: you’ve transferred 10% of your personal allowance to your partner

- S – Your income or pension is taxed using the rates in Scotland

- T – Your tax code includes other calculations to work out your personal allowance, for example, it’s been reduced because your estimated annual income is more than £100,000

- 0T – Your personal allowance (which is currently £12,570) has been used up, or you’ve started a new job and your employer doesn’t have the details they need to give you a tax code

- BR – All your income from this job or pension is taxed at the basic rate (usually used if you’ve got more than one job or pension)

- D0 – All your income from this job or pension is taxed at the higher rate (usually used if you’ve got more than one job or pension)

- D1 – All your income from this job or pension is taxed at the additional rate (usually used if you’ve got more than one job or pension)

- NT – You’re not paying any tax on this income

- Tax codes starting with K mean you have income that isn’t being taxed another way and it’s worth more than your tax-free allowance

How eBay’s fees work according to the Money Saving Experts

- When your item sells you pay fees and eBay then charges a final value fee of 12.8% (13.22% from 8 April), including postage, plus 30p per order.

- You’ll get paid directly into your bank account which usually takes four working days. This means in most cases you dispatch items and pay for postage before you have the cash in your account.

- eBay deducts fees automatically from your sales. The rest is paid out to your bank account. This usually means no “surprise” invoice at the end of the month, which some sellers prefer.

- You’ll still be charged fees for cash-in-hand items. Ebay still charges fees even if you accept cash, by debiting the fee from the “preferred” account you’ve listed on its records.