Shares in Babcock International were in demand for the sixth straight session as it hit highs not seen since late 2020.

Britain’s second-largest defence contractor’s stock slumped in late July as it put out results that spooked investors with large write-downs.

It has been on a winning streak since then, which was turbocharged by the sale of a consultancy business last week for £293million.

Britain’s second-largest defence contractor Babcock has been on a winning streak since stock slumped in late July after it put out results that spooked investors with large write-downs

But it might also have been pushed higher by talk on the City rumour mill that two private equity groups are ‘sniffing around’ the defence group, a source said.

‘Sniffing around’ can mean a lot of things – from junior staff doing basic research to detailed plans drawn up in talks with bankers.

Though for any eyeing up to make it into City chatter means it is unlikely to just be summer interns running some numbers.

It is unclear if any bids will be forthcoming, but an offer would be of little surprise after the recent swoops on Ultra Electronics and Meggitt.

JP Morgan bankers recently tagged Babcock as a potential takeover target alongside Senior, which has fended off multiple approaches from Lone Star, and Qinetiq.

Babcock boss David Lockwood was the chief executive who turned Cobham around before it was snapped up by Ultra’s suitor Advent International in a £4billion deal last year.

The initial reaction to Lockwood’s restructuring plan last month was negative. But the sale of a major business within a fortnight might have given potential buyers more faith in the company, which maintains the UK’s fleet of nuclear submarines.

Babcock closed up 3 per cent, or 10.3p, at 355.6p, and has gained around 10 per cent this week.

But it was a mixed day for the group’s FTSE 250 peers. Senior dipped 0.4 per cent, or 0.6p, to 172.3p, Meggitt rose 0.2 per cent, or 2p, to 838.8p, Ultra Electronics climbed 0.3 per cent, or 10p, to 3318p and Qinetiq slid 0.5 per cent, or 1.8p, to 334.4p.

The wider mid-cap index had a cheery end to the week, rising 0.61 per cent, or 144 points, to 23750.89.

It was buoyed by a double whammy of retail news as Marks and Spencer shot 14.1 per cent higher, up 20.1p, to 162.8p on the back of a rare results upgrade and a 4.2 per cent jump in Morrisons shares – up 11.8p, to 291p – after the board accepted a £7billion, 285p-per-share takeover offer.

The FTSE 100 rose by a more modest 0.41 per cent, or 29.04 points, to 7087.90. Over on AIM, car dealership Vertu Motors also issued an upgrade.

Its shares roared 8.1 per cent higher, up 3.8p, to 51p after it said that annual profits were likely to come in at £50million to £55million, compared with previous estimates of £40million to £45million.

It put this down to the ‘exceptional’ surge in used car sales though it has warned that used cars have been so popular that they could be tricky to get hold of in the coming months.

Vertu, which has 115 sites in the UK, will use the profit boost to reward investors with a £3million share buyback.

Clipper Logistics also made gains after it won a five-year deal to provide warehouse space and other services to Ireland’s largest sports retailer, Life Style Sports, which has 42 stores.

Clipper’s work is expected to start in January, and will include using fancy technology such as auto-bagging.

It rose 0.5 per cent, or 4p, to 816p.

Profits more than doubled at challenger lender Onesavings Bank in the first six months of the year, to a record £222million.

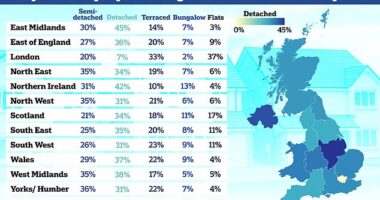

The frenzy in the housing market ahead of the stamp duty deadline was a boon as it capitalised on soaring demand for mortgages. Low lending rates also mean that many landlords are remortgaging, it said.

Shares finished 1.8 per cent higher, up 9p, to 506p.