Ouch! There is more pain to come. And there is no doubt about which way interest rates are going after US Federal Reserve chairman Jay Powell’s long-awaited speech at Jackson Hole yesterday.

He used the annual economic symposium to declare war on inflation, pledging that the central bank will use its tools ‘forcefully’ to attack rising prices.

Analysts were surprised, as many had been hoping he would steer a more delicate line on further rate rises for fear of tipping an already fragile economy into recession.

Not for turning: Federal Reserve chairman Jay Powell has declared war on inflation

Their view – and it’s an understandable one – is that there have been signs that US inflation may have peaked and is falling.

They also wanted to see whether the recent rate hikes have had an impact on the wider economy before jacking them up again. But Powell was not for turning.

He was on the most offensive form seen for months, arguing that higher interest rates will persist and that he would not be swayed by a couple of months of data. ‘The historical record cautions strongly against prematurely loosening policy,’ he said.

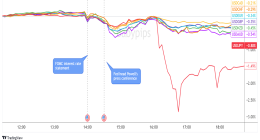

Although the financial markets had expected Powell would hint at higher rates, investors were surprised by the harder tone. Stock markets were surprised too and were sold off within minutes of his speech being published. The S&P 500, the Dow Jones and Nasdaq indices all slid while future rates climbed as markets bet on more hikes to come.

Traders have also revised their forecasts for future rates. Before the speech, traders had priced in a 50 basis-point increase but these have now shot up to a 55 per cent chance of a 75 basis point.

Although the Fed has already made four big hikes over the last few months adding 2.25 percentage points, Powell was emphatic that this was ‘no place to stop or pause’.

Yet he also accepts that higher rates will bring pain to households and businesses, leading to lower growth: ‘These are the unfortunate costs of reducing inflation.’

But a failure to restore price stability, he added, would mean far greater pain in the long term.

It’s impossible to know whether Powell is right. Was he being hawkish, as some analysts claim, or merely typically cautious?

Central bankers are there to be cautious. Hopefully, with the massive quantitative easing sales being unwound, it won’t be long before money supply figures fall again.

What we can bank on though is that the Bank of England and the European Central Bank are likely to be more aggressive with their rises after this decision not to pivot.

Boris is back

Some good news at last: we do have a Prime Minister after all, and a Government of sorts.

Boris Johnson finally re-emerged from his holidays to promise extra cash to support households facing crippling energy bills.

About time too, as the Government has been acting more like it’s in opposition due to the leadership campaign.

No doubt stung into action by criticism that there were no ministers available to comment on the staggering increase in Ofgem’s price cap to £3,549 a year, Johnson took to the airwaves to pledge that there will be financial help coming next month as well over the winter.

Although Johnson is Prime Minister in name only, he should follow up with a televised address explaining why energy bills are so high, the options being looked at to help, and suggest ways that consumers can cut down on consumption and insulate their homes.

If he were brave, he should also set out why Labour’s calls for another windfall tax or nationalising the energy suppliers are sticking plaster, and will not solve the fundamental issue: that we have little control over global gas prices.

If he were really brave, he would add that we are at the mercy of imports because successive Labour and Tory governments have messed up our energy security. If, as seems likely, Liz Truss becomes the next occupant of No 10, she should give a similar address on September 6 ahead of the emergency budget, which is due to follow her coronation.

She might look to her friend, President Emmanuel Macron, who bit the bullet this week when he warned his citizens that the time of energy abundance is over.

It was a clever call, putting him ahead of events rather than behind the curve. Time for Truss to do the same, and treat householders with respect.

This post first appeared on Dailymail.co.uk