LOW earners are set to pay £401 more in tax next year despite the government’s cut to National Insurance (NI) rates, figures show.

The government’s NI cut, intended to save households cash, will be wiped out by a “stealth tax” known as fiscal drag, calculations by financial firm Interactive Investor have found.

Fiscal drag is where workers end up paying more tax because their wages increase in line with inflation while tax thresholds stay the same (full explanation below).

The government announced a cut to the main rate of National Insurance (NI) from 12% to 10% in its Autumn Statement last year.

Touted as “the largest ever cut” for workers, the cut came into effect yesterday January 6.

But Interactive Investor calculated that fiscal drag means most workers will still be worse off this year even after the NI cut, with lower earners paying the most extra tax of all.

MORE ON MONEY

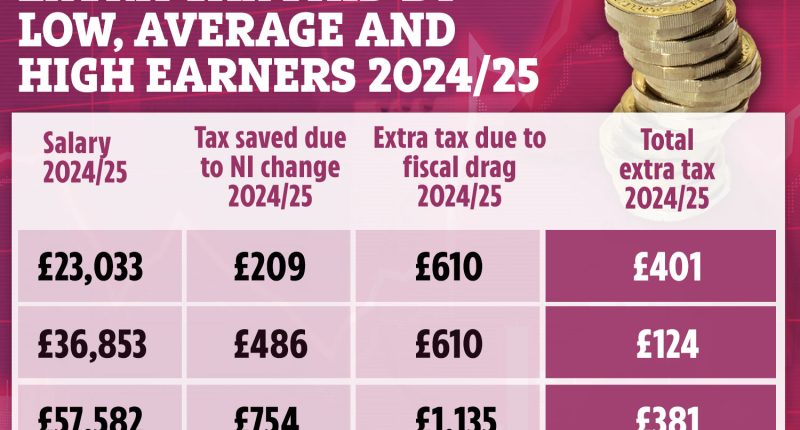

A low earner on £23,033 a year (based on a £20,000 salary last year which has risen with inflation) will pay £401 more in tax in 2024/25, the firm found.

The NI cut would save them £209, but they would pay an extra £610 in tax through fiscal drag, leaving them £401 worse off overall.

Meanwhile, an average earner on £36,853 a year will pay £124 more in 2024/25 while a higher earner on £57,582 will pay an extra £381 (see table above).

What is fiscal drag and how does it work?

The cost of living typically increases every year. This is called inflation.

Most read in Money

Workers usually get some sort of annual pay rise that is linked to inflation so rising prices don’t leave them poorer over time.

This is different to a “real terms” pay rise, where workers end up with more disposable cash, as it just means their pay is keeping up with the cost of living.

Tax thresholds normally increase over time too.

We all pay income tax on earnings at different levels. We don’t pay any tax on earnings up to £12,570. Then, 20% tax is paid on earnings between £12,571 and £50,270 and earnings over that are taxed at a higher 40% rate or an additional 45% rate.

These tax thresholds usually rise as wages rise so that people don’t end up paying more tax because of inflation.

For example, the personal allowance – the cash workers get to keep before they start paying any tax – has risen from £11,000 in 2016/17 to £12,570 in 2021.

But the government decided to freeze all tax thresholds in April 2021 in a bid to raise extra cash, and they are expected to stay frozen until 2028.

At the same time, inflation has risen dramatically – peaking at over 11% in November 2022 compared to the country’s target of 2% – meaning wages have had to increase more than usual.

As a result, many workers have been dragged into higher tax brackets as their pay has increased with inflation, meaning they are paying more tax even though they aren’t any better off. This is known as “fiscal drag”.

A freedom of information request by financial firm Quilter found more than 1.1million people will be dragged into a higher tax bracket by 2027/28.

Alice Guy, head of pensions and savings at Interactive Investor said:

“Fiscal drag is a ruthless and silently effective tax policy and leads to us all feeling a lot poorer over time.

“High and middle earners will benefit slightly more from the NI cut than low earners, but everyone will still pay a lot more tax overall.”

How can I avoid fiscal drag?

While everyone wants a pay rise, your pay boost could land you with a bigger tax bill until tax thresholds are unfrozen.

But there are ways to keep more of your cash for yourself.

Putting more money in your pension is one way to reduce your tax burden if you can afford it.

Ms Guy explained: “Some employers will allow you to pay into a workplace pension through salary sacrifice, which allows employers to reduce employees’ salary and pay the equivalent amount as pension contributions.

“Basic-rate taxpayers get 20% pension tax relief, which turns an £80 contribution into £100.”

According to Interactive Investor, someone earning £30,000 a year could save £150 in NI each year by using salary sacrifice to pay into their pension.

Read more on The Sun

“Look for other ways to stretch your budget, like shopping around for a better cash savings rate,” Ms Guy added.

Some banks offer a cash bonus just for moving your current account to them. First Direct is currently offering £175 to switch.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected] and [email protected].

Join our Sun Money Facebook group to share stories and tips and engage with the consumer team and other group members.