A Celebrity clinic whose previous clients have included Kate Moss, Robbie Williams and Paul Gascoigne, is ‘burning cash’ and facing an ‘unaffordable’ rent bill, according to a US investment research firm.

Priory Group operates a network of hospitals and treatment centres across the UK specialising in treatments for mental health, addiction and eating disorders.

The clinic also provides services to the NHS including accommodation for patients who are sectioned under the Mental Health Act.

Overall, the firm provides around 10 per cent of NHS mental healthcare beds and reported that it made over 90 per cent of its revenue from public organisations last year.

But the health service’s reliance on Priory has come starkly into focus after a report published last month by analysts at US risk management group Hedgeye argued the business was ‘burning cash’ and was locked in onerous rent agreements with an American medical property group.

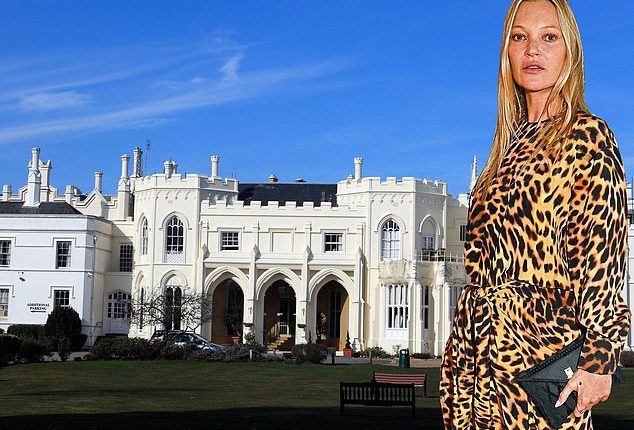

Rehab for the stars: The Priory Clinic in London and, right, Kate Moss

A source close to Priory Group, however, dismissed the claims.

The source said that the firm’s accounts confirmed it was solvent and were signed off by auditors without any concern about its ability to continue operating.

In accounts filed with Companies House this summer, Priory reported a loss of £28 million for 2022 following losses of £37 million the previous year.

According to Hedgeye, the accounts also suggested Priory Group is not generating enough cash to pay its rent.

The business faced lease payments of £61 million, but only generated £38 million in cash that year after shelling out on upkeep costs on buildings and equipment.

The firm’s reserves – funds set aside for a rainy day – have fallen from nearly £55 million at the start of 2021 to just £10.5 million at the end of last year. It is nursing debts of nearly £1.1 billion.

Hedgeye analyst Rob Simone said: ‘The financial picture for Priory is troubling to say the least. The company is paying nearly £61 million in rent every year but is only generating around £38 million in cash, meaning it needs to rely on external funding to prop up its balance sheet.’

‘This clearly isn’t sustainable and if Priory can’t obtain financing from other parties, it will be in serious trouble.

‘The rent is simply unaffordable.’

Concerns about Priory’s rental costs were initially raised in an article in the Financial Times in 2021 after it was acquired by Dutch private equity firm Waterland for nearly £1.1 billion.

The takeover was almost entirely financed by a sale and leaseback agreement of around 40 of Priory’s hospitals to US property fund Medical Properties Trust (MPT).

In July, Priory signed yet another sale and leaseback deal with MPT, this time for five sites raising nearly £44 million.

When contacted by The Mail on Sunday, Dr Andre Schmidt, head of German healthcare outfit Median Group, which owns Priory, said the firm was ‘very well financed and has comfortable levels of rent cover to meet its lease payments, having been in partnership with its property owners for over ten years’.

He added: ‘We are in a robust financial position, and remain focused on ensuring our services provide the highest quality of care.’