A LITTLE-known bank charge that’s still applied by five major providers could be pushing you into more debt.

The financial regulator banned banks from charging rip-off overdraft fees back in April 2020.

However, the new Financial Conduct Authority (FCA) rules fell short of eradicating one little-known overdraft fee.

This meant that banks can still get away with charging for bounced payments, also known as refused payments or unpaid transaction fees.

These apply when a bank refuses or returns a payment because you’re in an unarranged overdraft, which is borrowing that’s not been agreed upon in advance by your lender.

Sarah Coles, head of personal finance at Hargreaves Lansdown said: “Unpaid transaction fees don’t tend to be vast sums, and there’s usually a cap on the number of times you can be charged each month.

“However, it still means pushing people deeper into debt, and it seems inordinately unfair to pile another charge on someone who is already struggling.”

Several major providers including Barclays, HSBC, First Direct, Lloyds Bank, Halifax and Nationwide have all scrapped these charges.

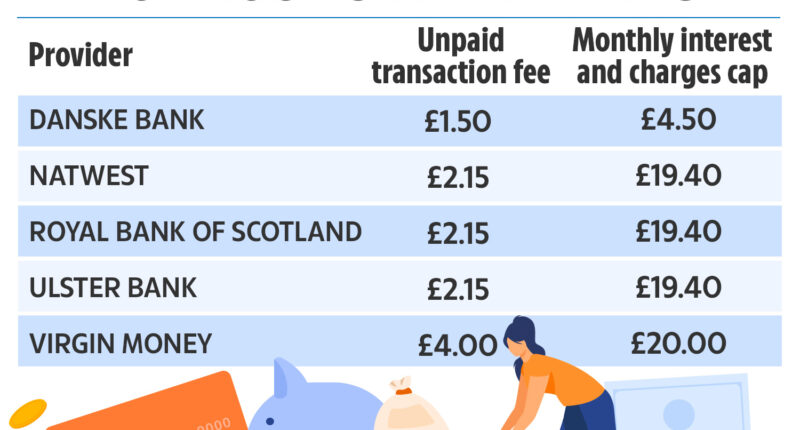

But five large banks still charge customers unpaid transaction fees.

NatWest, Royal Bank of Scotland (RBS) and Ulster Bank charge a £2.15 bounced transaction fee.

Most read in Money

While there’s no limit on the number of unpaid transaction fees that can be applied to a customer’s account – there is a monthly cap on unarranged overdraft charges worth £19.40.

Danske Bank, which operates out of Northern Ireland, charges customers that fall into an unarranged overdraft £1.50 for each unpaid transaction.

This affects all customers that hold a Choice, Reward, Choice Plus, Prestige, Freedom and Standard current account.

Danske Bank’s monthly interest and charges cap for an unarranged overdraft is £4.50.

Virgin Money M Plus and Club M account holders face a single £4 lack of funds fee if a payment bounces.

These customers could then pay up to £20 a month in interest and such charges on an unarranged overdraft.

How did the FCA shake up overdraft rules?

Before the FCA changed the rules, banks could charge a range of overdraft fees including daily and monthly charges, as well as interest.

The complex charges made it hard for people to understand how much they were paying and compare if there were cheaper borrowing options.

But since the rules came into force in April 2020, banks can only charge a single annual interest rate for overdrafts.

Banks can also no longer charge more for an unarranged overdraft (when you haven’t agreed on the borrowing with the bank) compared to an arranged one.

However, as discussed above the rules fell short of eradicating charges like unpaid transaction fees.

How can I avoid falling into more debt?

Overdrafts are a very expensive form of borrowing, with most banks charging around 40% interest on most accounts.

But in an emergency, you may find yourself with no other option.

The single best way to ensure that you won’t fall into more debt caused by unpaid transactions is to ensure you have enough cash in your bank account in the first place.

You shouldn’t face higher interest charges if you do fall into your unarranged overdraft.

But by doing so, you’ll limit your borrowing options, as it will leave a red mark on your credit score.

Only the best credit scores get access to the lowest interest rate credit cards and mortgages, so if your score is poor you could end up being forced to take on more expensive debt in the future.

If you’ve already been hit by excessive overdraft charges and fees and been pushed further into debt as a result, you may be able to get a refund from your bank.

And if you are struggling to pay your debts month after month it’s important you get advice as soon as possible, before they build up even further

Sara Williams, founder of Debt Camel said: “You should talk to your bank about how they could help, but if you have other problem debts as well or you are behind with important bills, talk to your local Citizens Advice.”

Groups like Citizens Advice can help you prioritise and negotiate with your creditors to offer you more affordable repayment plans.

This post first appeared on thesun.co.uk