Japan is printing a bunch of lower-tier reports, but investors are likely to trade the yen as a safe haven this week.

Which catalysts should you watch out for?

I’ve got a short list!

Lower tier economic releases

- Reuters Tankan: Japan manufacturers’ less pessimistic in November

- Economy Watchers Survey (Nov 10, 5:00 am GMT) to see improvements in outlook and current conditions

- Preliminary machine tool orders (Nov 11, 6:00 am GMT) could worsen from -15.0% to -2.0% in October

- Core machinery orders (Nov 11, 11:50 pm GMT) seen dropping by 1.0% after 0.2% gain in August

- PPI (Nov 11, 11:50 pm GMT) to dip by 2.0% (from -0.8%) in September

Broad risk sentiment

- Coronavirus updates (rising cases, lockdown plans, stimulus and vaccine prospects, recession concerns) will continue to affect the demand for safe havens like the yen

- Clear U.S. election results will mean clarity on U.S. policies to expect, which could weigh on the low-yielding yen

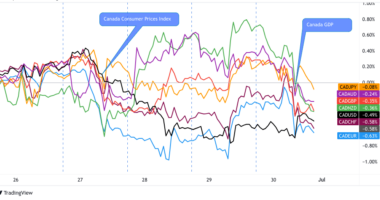

- Major data releases like the U.S. and Chinese CPI, U.K. GDP, and remarks from major central bankers can cause intraday volatility for the major yen crosses

Technical snapshot

- Bollinger Bands reflect the yen’s “overbought” conditions against the dollar

- JPY may soon hit “oversold” status against the Kiwi

- JPY remains in neutral conditions against GBP, CAD, EUR, and CHF

- EMAs show the yen’s short and long-term bearish trends against the Aussie and Kiwi

- GBP/JPY and CAD/JPY may provide retracement or reversal opportunities

- The yen is enjoying short and long-term demand against the dollar on the daily time frame

- The yen was most volatile against the comdolls and the pound in the last seven days

Missed last week’s price action? Read JPY’s price recap for Nov. 2 – 6!