Ordinary investors could be given a chance to buy a slice of the Government’s stake in NatWest as the Chancellor seeks to reignite interest in share ownership.

Ministers plan to sell the remaining stake in the bank by 2026 and will explore options for allowing retail investors to buy shares.

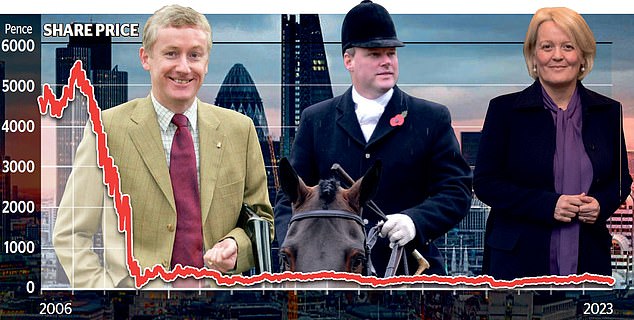

The state became the majority shareholder of NatWest – then known as Royal Bank of Scotland – in 2008 when it had to bail out the lender to the tune of £45.5billion after it was taken to the brink of collapse by boss Fred Goodwin.

It has gradually been selling its stake – 84 per cent at its peak – but still owns as much as 39 per cent.

Until now, only institutional investors such as pension funds, have been able to take part in share sales.

Taken to the brink of collapse: Former Natwest bosses Fred Goodwin, Stephen Hester and Alison Rose

But Chancellor Jeremy Hunt will ‘explore options to launch a share sale to retail investors in the next 12 months’.

Other options include direct buybacks with NatWest and continuing sales through the ongoing trading plan.

Shares in NatWest, which have languished under a string of bosses including Stephen Hester and Alison Rose, fell 1.4 per cent, or 2.8p, to 204.2p. Announcing the plan to allow retail investors to take part in the reprivatisation, Hunt said: ‘It’s time to get Sid investing again.’

The remark harks back to the ‘Tell Sid’ advertising campaign in the 1980s, which encouraged households to buy shares in state-owned companies during Margaret Thatcher’s privatisation drive.

Jason Hollands, at investment platform Bestinvest, said the reference to the 1986 privatisation of British Gas ‘was perhaps a bit of a dog whistle to older Tories who look back fondly in the heyday of Thatcherism’.

The privatisation drive heralded a boom in the number of individuals buying shares in UK companies.

But in the past two decades, the number of households directly owning shares has since plunged from 23 per cent to 11 per cent.

Alasdair Haynes, at stock market exchange Aquis Exchange, said the NatWest offer marks a ‘positive first step to attract new retail investors to UK markets’, adding: ‘Investing in equities not only benefits individual investors but also fuels the much-needed scale-up capital for the British economy and businesses.’

However, Richard Berry, founder of comparison site Good Money Guide, said it was a long time since the Tell Sid campaign and the NatWest sale is unlikely to capture the public imagination in the same way. ‘Times have changed and Sid’s unlikely to be listening,’ he said.

‘The privatisation of British Gas in the 1980s captured the public imagination because, back then, buying shares in an individual company was prohibitively expensive for smaller investors.

‘Nowadays millions of people routinely invest in the stock market, and the average investor is far more sophisticated.’

Laith Khalaf at investment platform AJ Bell predicted shares would be offered at a discount.

‘If there’s no discount, investors might as well buy shares on the open market,’ he said.

NatWest chief executive Paul Thwaite said he encouraged any policy that supports the bank getting back to private hands.

He added: ‘I’ve always said the mechanics for doing that is ultimately up to the Government.’

This post first appeared on Dailymail.co.uk