As a vicar for the Church of England my housing is part of my stipend so our family home has been rented out for about 18 years.

As I’m drawing near retirement we are thinking about where we would like to live and are thinking about selling the family home and buying a new home to initially rent out until we actually retire.

When talking to a friend he has suggested we would be liable for capital gains tax as this would be classed as a business even though it’s our main home.

Clergy often have different tax benefits as we are not waged but I cannot find anything about family homes having to be rented out when we are given clergy housing. I would be most grateful for your advice.

SCROLL DOWN TO FIND OUT HOW TO ASK HEATHER YOUR TAX QUESTION

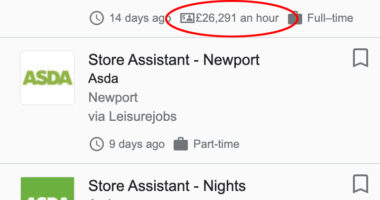

Capital gains tax: I’m a vicar so the church provides housing, but I have another home that is rented out (Stock image)

Heather Rogers replies: This is a good question concerning job related accommodation, which actually affects quite a few different working roles from military personnel to farm workers.

There is a whole section of the Taxation of Chargeable Gains Act 1992 on this very matter. By and large, the rules are helpful and understanding of the situation, but there are a couple of pitfalls.

I will run through the rules in general terms before moving onto your own personal circumstances below.

How does ‘Private Residence Relief’ on capital gains tax usually work?

Normally, subject to certain criteria, your own home qualifies for Private Residence Relief on sale, as it is your only or main residence.

This means you do not pay capital gains tax, as you would on the disposal of a property you didn’t live in.

However, if you live in another property, then you would need to determine which was your main residence.

This is normally done by ‘election’, meaning you get to decide, but HMRC would need some evidence that you were living in the property you want to be covered by PRR at least some of the time.

What happens if you live in job-related accommodation?

Living accommodation is job-related if it is provided for an individual’s employment, or for the employment of their spouse or civil partner, in any of the following cases.

– It is necessary for the proper performance of their duties.

– It is provided for the better performance of their duties and where the provision of living accommodation is customary for that type of employment

– The accommodation is provided as part of special security arrangements.

– An individual or their spouse or civil partner are contractually required to reside in premises provided by another person, from where they carry on a particular trade, vocation or profession.

What if you already own or buy your own home while living in job-related accommodation?

If an individual owns their own home which they are unable to occupy due to the fact that they need to reside in job-related accommodation, then the home can continue to be their main residence for capital gains tax purposes, providing they intend to return to occupy the home once the employment is finished.

That said, if you decide when the job ends that you don’t want to move to the home in question, you may never actually even have to occupy the property.

If, for example, you purchased the property during the time you were in job-related accommodation with the intention of moving into it at the end of the employment but then your circumstances change and you sell it, providing your intention was to live there, then PRR will be available, up to the date your intention changed.

Once the intention to occupy the home stops, then the home is no longer treated as a residence, so PRR will not be available from this point on, if for example you move to another property whilst still owning your original home.

PRR will however be available up to the point the intention changed, plus the last nine months of ownership.

HEATHER ROGERS ANSWERS YOUR TAX QUESTIONS

There is no specific definition of ‘intention’, I’m afraid. If the claim was challenged by HMRC, then a taxpayer’s particular circumstances would dictate the likelihood of PRR being allowed for the whole period of ownership.

If you had purchased another property then it would be up to you to show why and when you decided not to move back into your former residence.

What if you let your home while living in job-related accommodation?

You can still claim PRR, unless the period of let extends beyond the period of residing in job-related accommodation.

In that case, at that point the intention to live in the home would not be supported and there could then be a wrangle as to whether there was an intention to move into the home at all.

What about your circumstances?

In your specific case, you have a home which you rent out as you live on church property which would no doubt qualify as job-related accommodation. So far, so good.

However, if your intention to move back into the home you have rented out will cease, then it will stop qualifying from that moment for PRR.

PRR will however be available up to the point the intention changed, plus the last nine months of ownership.

The new property would also qualify providing you move in immediately after your employment ceases.

If your intention not to move back into your old home falls within the last nine months of ownership, then you will receive full PRR on the sale of your long owned property.