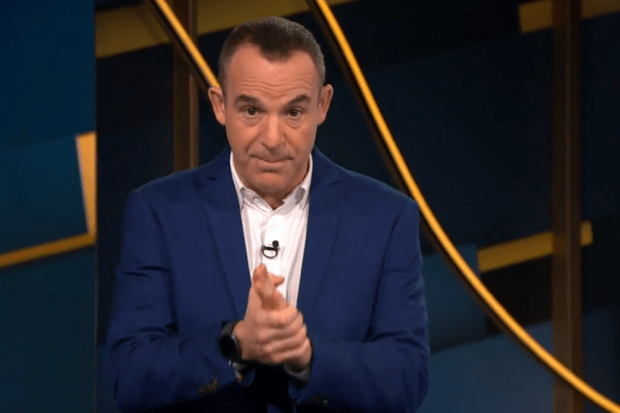

A MARTIN Lewis fan has revealed how they are now £3.5k a year better off thanks to a little-known benefit.

The consumer champion highlighted last year that thousands of pensioners were missing out by not claiming Attendance allowance.

Attendance allowance is available to pensioners to help them cover the cost of someone “attending” to them.

In December a report by Policy in Practice identified that up to 1.1m pensioners were missing out on £3,500 a year by not claiming.

Since then a follower of Martin has emailed him and his team to say that following a successful claim he is now getting an extra £68 a week.

The email from Philip read: “Dear Martin & all at MSE, I’m not sure if being ill enough to qualify for Attendance Allowance can be classed as success, but £68 each week certainly does not come amiss!

Read more on Money

“Despite struggling on for eight months, it never occurred to my wife and I that she might qualify for help until reading about it on MSE.

“We applied mid-Dec and received positive notification today. Thank you – you have made our lives just a little bit easier in difficult times.”

We explain everything you need to know about this little-known benefit so you can ensure that you are not missing out.

What is attendance allowance?

Attendance allowance is for pensioners who need some help with day-to-day living.

Most read in Money

It is not a means-tested benefit meaning eligibility is not based on your income.

It is paid at two different rates and how much you get depends on the level of care that you need because of your disability.

You can get attendance allowance if you’ve reached state pension age (currently 66) and the following applies to you.

- You have a physical or mental disability, or both

- Your disability is severe enough for you to need help caring for yourself

- You have needed that help for at least six months (unless you’re terminally ill)

Even if you don’t think of yourself as disabled, if you need someone to help you daily you could still be eligible.

To get the benefit, you must have been in Britain for at least two of the last three years unless you’re a refugee or have humanitarian protection status.

If you live in a care home and pay for all the costs yourself, you’ll be able to claim an attendance allowance.

How much is attendance allowance?

Basic attendance allowance is worth £68 a week which means you will get £3,540 a year.

There is a higher and lower rate of allowance depending on the level of care you need, they are as follows:

- £68 a week or £3,540 a year for people who need help during the day or night.

- £102 a week or £5,300 a year for people who need help both during the day and night or have less than 12 months to live.

There are 57 categories of medical conditions you can claim with, but the most common ones are arthritis and dementia.

You can also claim for mental health conditions and learning difficulties.

It is important to know that while some benefits can be backdated, attendance allowance cannot.

The date of your claim will be the date you call and ask for a claim form – as long as you complete and return it within the time given.

If you download a claim form, it will be the date your completed claim form is received.

How to claim for attendance allowance

If you want to claim attendance allowance you will need to download the form from the GOV.UK website and then send it by post.

It should be sent to the address: Attendance Allowance Unit, Mail Handling Site A, Wolverhampton WV98 2AD.

If you do not have access to a printer, you can call the attendance allowance helpline on 0800 731 0122 and ask for a copy to be sent to you.

If you receive attendance allowance this could also open the door to other benefits such as housing benefit or a council tax reduction, so it is worth applying.

Do bear in mind that the application is very long and does ask for a lot of personal information.

If you think you’ll need help filling in the form, you should get a friend, relative or adviser to help you complete it if possible.

What other benefits can I get if I claim attendance allowance?

As previously mentioned you could be entitled to extra help once you start receiving attendance allowance.

You might be able to get help with your council tax, even if you’re already getting a reduction.

It is possible to get help towards your council tax in the way of the severe mental impairment (SMI) discount.

This can mean that you could get either 25% or in some cases up to 100% discount meaning your council tax bill would be wiped out completely.

READ MORE SUN STORIES

The 100% discount is usually available for those who live alone or with someone who is classed as having severe mental impairment.

It might also be possible for you to apply for Pension Credit or Universal Credit if you live with a partner under State Pension age as well.

This post first appeared on thesun.co.uk