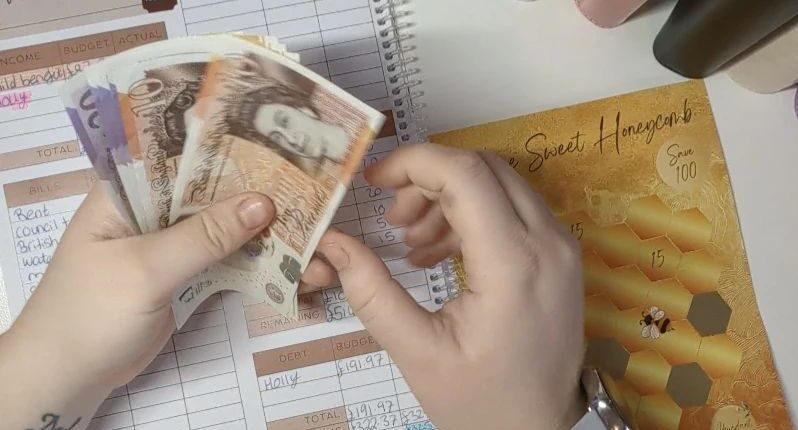

A MUM has shared her five point action plan on how she’s clearing over £30k of debt – as she makes plans to go to Disneyland.

Holly Smyth, 28, from East Sussex found herself in £34,753 worth of debt after being “young and stupid” with her finances using credit cards and loans.

Now she is sharing her tips for people struggling with their finances.

She said writing down your income and outgoings is key.

Eliminating subscriptions, planning meals for the week and writing out your budget – including income, bills, expenses etc – are some of the ways she has cleared her debt.

She said writing down what you spend can help manage your money as you can clearly see unnecessary expenses.

Holly said: “I print out meal planning, weekly planner sheets and itemized shopping list sheets to replenish or order what we need that week.

“I also have a large A4 file which holds all my recipes, credit score tracker, bill trackers so I’m never late on a payment.”

Holly found herself in debt partly due to a disability that occurred during the Covid-19 pandemic that left her having to pay for mobility aids.

At the time, she was 16 weeks pregnant with her daughter, now 3, when she fractured her spine falling down the stairs.

Most read in Money

Eight weeks after giving birth, she fell down another flight of stairs which worsened her injury.

In hospital she was told the cause was a form of heart disease which left her falling unconscious.

Unable to work, she accrued huge debts, but says her budgeting has left her in control of her finances.

She has cleared almost £24,252 so far.

She said: “Being in a massive amount of debt and when I became disabled – life massively changed.

“Living on one income was very hard, at one point we couldn’t even afford nappies, we had to make a plan to improve our lives as a family.”

“I was completely ashamed, especially when I became disabled because I went from working full time to nothing and trying to manage my debt was so hard on us.”

“I actually ignored it for a while, but ultimately I didn’t have a choice but to sort it.

She said she now just wants her daughter to have the best memories possible – and they are currently saving for Disney world.

Her daughter Everleigh is helping her budget.

She said: “She loves to learn about the value of money and about all coins and notes. She chooses to save all her pocket money for Disney shops when we go on holiday,”

Holly tries not to miss out on things, but saves money where she can – using charity shops in particular.

She said: “I had mostly good experiences, I hope my journey will help everyone else in there budgeting and planning.

For people struggling, she said: “Be patient and stick with your plan, give yourself grace the first few months you’re going to get things wrong I did, and I still do. No one is perfect”.

“I think the first year is the hardest, but it is so worth it. Having savings in the bank for any sort of emergency is a great feeling.”

Holly has a Youtube channel, Disabled Mumma Budgets, that offers help to get started with budgeting.