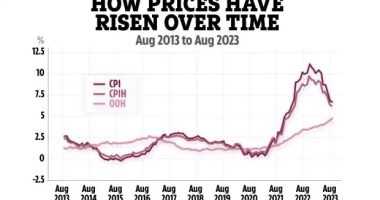

The nation’s savings are being savaged by inflation. Banks are paying a pittance in interest and our nest eggs are wasting away.

If your money isn’t growing at the same rate as the cost of living, its value is being diminished. And with inflation expected to peak at 6 per cent this year, now is the time to act.

Money experts say households should have about three to six months of outgoings put aside in a cash savings account.

Invest to save: If your money isn’t growing at the same rate as the cost of living, its value is being diminished

But anything more — that you do not need to hand — could be growing at a far better rate on the stock market.

Watchdog the Financial Conduct Authority is so concerned about the effect of inflation on the nation’s nest eggs that it has launched an £11 million campaign to make us a nation of smarter investors.

However, many long-term, loyal savers may be apprehensive about staking their money on the stock market.

So Money Mail has spoken to the experts to get their tips on taking the first step, including a pick for a first fund to try. We have also included the fund’s performance over the past five years.

For reference, £10,000 left in an average easy-access savings account would now be worth just £10,180 after five years.

The best financial advisor is yourself

Peter Hargreaves, who co-founded investment giant Hargreaves Lansdown, writes for on how to get started…

Start small: Hargreaves Lansdown co-founder Peter Hargreaves

There have always been plenty of reasons to put off investment and/or learning about investing.

They range from not having enough time to not trusting advisers, and the simple fear of losing money.

General malaise among would-be-investors has resulted in billions of pounds languishing in poor arrangements — notably deposit accounts with minimal interest.

Everyone with capital to invest knows they should do something, but many keep putting it off. Their two biggest questions are: ‘How do I get started?’ and ‘Where can I get the best advice?’

I am a firm believer in starting with a small investment. Only when you own an investment can you begin to understand and hopefully spark an interest. Optimistically, you will follow it and study any information about it.

With regards to advice, the conclusion of my 50 years’ involvement with the investment industry is that the best adviser is yourself.

I know for beginner investors this may sound silly, but the most important factor is to establish your attitude to risk.

Assessing another investor’s risk profile is basically impossible. The word ‘risk’ means different things to different people. Only you know what risk means to you. And advice can be expensive.

I always say that you should never invest in something you don’t understand. That doesn’t mean you need to know a company’s reports and accounts inside out, but it does mean you should have at least a rough idea why you are making that investment.

Something as simple as ‘I have bought something from them recently and the customer service was brilliant’ could be a good start in researching a company for future investment.

Or ‘I went on holiday there, and they seemed to be doing really well’ could lead to you looking into an investment in that region of the world.

Conversely, tips handed over at the pub or golf club are not a good start. You are never really told the reason they are ‘tipping’ it and why the price is likely to rise.

To get started, buying a share of a well-run collective investment (unit trust or investment trust) will initiate an interest and is a safer way into the world of investment.

Let’s start by explaining why you would buy a share in a business. The concept is simple. Most businesses today are valued on their profitability.

The Financial Conduct Authority is so concerned about the effect of inflation on the nation’s nest eggs that it has launched an £11m campaign to make us a nation of smarter investors

If a business’s profit increases, it is likely its value will increase (the share price will rise).

Good businesses are run with the aim of boosting their profitability. It follows that a share in those businesses should increase in value and help wealth to grow.

It is sensible to start with a collective managed investment. A well-run unit trust or investment trust has the advantage that the underlying investments have been expertly chosen and are constantly monitored and changed, if necessary, by the investment manager.

They also offer you instant diversification as they hold several different companies’ stock to spread the risk.

Still, your own research here is key. But, as with investing in a single firm, you may find you have an inkling of the sort of thing you are after.

Do you want to invest to grow your money, to gain an income, or do you think a certain type of business (for example technology or healthcare) or certain geographical area (such as emerging markets or the U.S.) might do well?

Simply searching for investments in these areas can be a good start to your research. But the most important thing is just to get started.

Make a relatively small investment to start, learn from that and invest more as you become more comfortable. Starting small has the added benefit of meaning you aren’t putting too much on the line.

But whether your investment is for £100 or £10,000, you will develop a keen interest and start learning from your wins and losses and get the bug for finding out more.

I know very few people who started investing in an orderly and sensible way who are not delighted and feel much happier about their futures.

If size provides comfort, the shares held in our Blue Whale Growth Fund are comforting. My earliest knowledge of investment was with ‘blue chips’. This was the name given to the largest, most secure firms.

Those in the Blue Whale Growth Fund dwarf the blue chips of yesteryear. Some of these companies on their own are larger than the entire UK stock market.

Firms such as Microsoft, Alphabet (Google) and Mastercard have unassailable positions in their marketplaces, growing profits and realising excellent shareholder value.

FIRST FUND TIP: Blue Whale Growth Fund. Return on £10,000 after launch in September 2017: £21,773.

Having a safety net is essential: Maike Currie, investment director at Fidelity International

Plan ahead: Fidelity International director Maike Currie

For first-timers it can feel daunting to take the plunge and invest.

Investment is for the long term, so always ensure the money you plan to use isn’t what you will need in the immediate future.

Also, make sure you are ‘investment ready’. This means starting from a firm financial foundation. Whether it’s paying off debt, having a financial safety net in place or making sure you set yourself up before even starting is essential.

When deciding on where you want to invest, it’s best to be clear on your financial goals, and how long you need to get there.

For first-time investors, a fund that makes sense is the Fidelity Index World Fund. This gives investors access to some of the world’s biggest companies — names such as Google, Microsoft, Burberry and Disney.

It aims to closely follow the MSCI World Index, which tracks these companies and spreads your money across them. This keeps costs low and ensures your investment is well diversified.

It’s a great way to own a slice of the most exciting and fast-growing businesses, and spread your risk across a wide range of shares, while keeping costs low.

Once invested, keep in mind that long-term mantra. It can be tempting to get distracted by real-time online stock tickers and 24-hour business news, but it’s important to ignore the daily updates.

If you chop and change your investments too often, you are more likely to miss out on long-term benefits such as compounding.

FIRST FUND TIP: Fidelity Index World Fund. Return on £10,000 after five years: £18,412.

Multi asset fund is a good start: Andy Bell, chief executive of investment platform AJ Bell

Spread your bets: AJ Bell chief exec Andy Bell

Choosing the right investment as a first-time investor involves thinking about different factors.

This includes the time horizon and the person’s attitude to risk as this will shape the type of funds that are appropriate.

If we assume the first-time investor is quite cautious, then using a multi-asset fund that has the investments spread across different assets such as equities, bonds, gold and cash may be a good starting point.

In essence, this will give a first-time investor an instant portfolio. I would look at the Personal Assets investment trust or its fund equivalent, Troy Trojan, as the fund version is more suited for smaller investments or monthly savings.

Manager Sebastian Lyon has a clear focus on capital protection that looks to grow capital over the long term but, importantly, taking limited risk in the short term to avoid losses.

This cautious approach spreads the portfolio across high-quality equities such as Microsoft, Visa and Nestle as well as investing in inflation-linked bonds and gold.

Roughly half of the portfolio is in equities, with 30 per cent in bonds and 10 per cent in gold.

This approach gives investors a diversified portfolio as a starting point and then, as the first-time investor builds knowledge and confidence, they can add different funds and approaches.

FIRST FUND TIP: Troy Asset Management’s Trojan Fund. Return on £10,000 after five years: £13,506.

Don’t be put off by the jargon: Moira O’Neill, head of personal finance at broker Interactive Investor.

Straight talk: Head of personal finance at Interactive Investor Moira O’Neill

It is easy to be overwhelmed by the sheer number of investments available, while the investment industry can be guilty of using too much jargon.

But one piece of jargon that I would advise beginner investors to understand is ‘multi-asset fund’, as this might be all you need to get started.

Often referred to as a one-stop-shop fund, a multi-asset fund makes the investment decisions on your behalf — splitting your money across different types of investments, but mainly shares and bonds.

Interactive Investor recommends six carefully selected multi-asset funds for beginners. Three are taken from the Vanguard LifeStrategy range and three from the BMO Sustainable Universal MAP range.

For investors who are comfortable with higher risk and who have at least five to ten years to invest, we like Vanguard LifeStrategy 80 per cent Equity fund, which offers a cheap way of gaining exposure to thousands of investments across the globe.

As the name of the fund suggests, 80 per cent of it is invested in shares, with the remaining 20 per cent invested in bonds and other fixed- income assets.

The sheer level of diversification offered by the fund means investments are protected in a way that funds investing in a handful of holdings aren’t, making it a good long-term option.

While past performance is not an indicator of future results, the fund’s stellar performance record over the decade, beating its sector average and nestling in the top quartile of funds in their sector, instils confidence in the strategy.

FIRST FUND TIP: Vanguard LifeStrategy 80. Return on £10,000 after five years: £15,354.