Parker has been investing, and he said he managed to earn about $15,000 over the past six months from an initial investment of $2,000 and by investing $500 from his paycheck every two weeks into his employer’s stock, as well as index funds.

Like many his age, Parker — who lives in Windsor Mill, a Baltimore suburb — is saving up for a house. He plans to first invest in real estate before he settles down into a place of his own again.

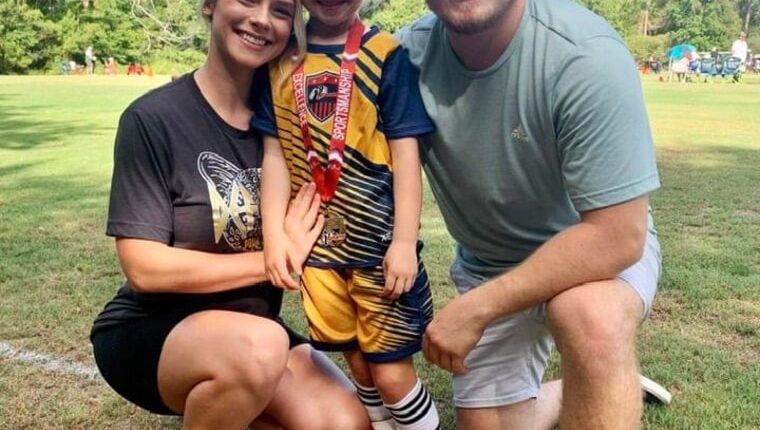

Homeownership is a common goal expressed by other high-income earners reached by NBC News, although it’s a goal they feel will be difficult to achieve. Josh Rodriguez, 27, lives with his wife and two children outside Houston. He makes as much as $14,000 a month earning commissions as a Realtor and as part-owner of a real estate brokerage firm.

Thanks to inflation, he said, Rodriguez’s weekly grocery expenses have climbed from about $180 to more than $300.

So now, he said, he and his wife make trips to two different grocery stores to try to save money on fresh food. The couple have also postponed vacations to Mexico and Colorado.

“With the kind of money we make, it really shouldn’t be like that,” Rodriguez said, adding that his priorities have changed as they aim to save money for a house.

“We’re not suffering in any way,” Rodriguez said, “but it’s as clear as night and day what the spending power of $10,000 a month has turned into.”

Rodriguez also noted a generational shift. His father, a mortgage loan officer, also made about $10,000 a month and was able to take his family on skiing and snowboarding vacations.

“I’m making more than that, but I have less spending power,” Rodriguez said.

Home prices have risen faster than wages

It’s not an illusion. It is indeed more difficult to buy a home today, even for some people who make a lot of money. Over the past four decades, home values have increased much faster than incomes.

The inflation-adjusted median household income in the U.S. has climbed by 27%, from about $56,000 in 1984 to about $71,000 in 2021. By comparison, the inflation-adjusted median U.S. home value has climbed by about 102%, from about $232,000 in 1984 to nearly $468,000 in the last quarter of 2022.

Marissa Cameron, 36, makes more than $9,000 a month before taxes as a communications contractor for the Veterans Affairs Department. She said she has been trying to save up to buy her own home for four years but increasingly feels that goal is falling out of reach.

“I can’t put away as much and build as much of a nest egg, because that process is expensive,” she said.

Cameron said she struggles with finding an optimistic outlook for her finances, especially when compared with her parents. Her father was a satellite engineer and earned a pension after having spent more than two decades in the Air Force.

“They’re boomers and are very solid in savings and having liquid cash available,” Cameron said.

Financial analysts have preached the importance of stabilizing personal finances before buying property. For many of those experts, that means building an emergency savings fund, paying down debt and saving up that down payment separately.

But even for some who earn more than the median household income, the first of those — building up emergency savings — is a hurdle.

For Kim Butler, 37, of Orlando, saving for an emergency fund means making lifestyle changes, like moving to a cheaper apartment, growing some of her own food and cultivating aloe plants for use in her hair.

Butler, who works in digital marketing, said that she has dramatically cut back on going out and that she even lights her apartment with homemade candles to save on electricity. She said her electric bill has gone down by about $30 per month since she started using candles more. She also sells the candles she makes online.

“I use a lot of candles. Instead of buying, I just make them,” she said. “Instead of having different lamps in my apartment, candles is it for me.”

While Butler makes less than six figures, earning about $86,000 a year, she is single and doesn’t have kids to support. She wants to save to buy a place but has resigned herself to the reality that such a goal may never materialize.

“It doesn’t seem like that’s going to happen if I go for a traditional loan,” she said.

“It’s difficult. If you’re single with no children … I haven’t found too many resources for folks in my particular situation.”

Source: | This article originally belongs to Nbcnews.com