Last May 2023, Gold reached its highest level since August 2020 at $2,078.54, according to the financial data from ActivTrades on Gold.

Earlier this year, the ongoing banking crisis and uncertainties in the financial markets supported the price of Gold.

It is interesting to note that during the first quarter of the year, the demand for Gold from central banks has reached an all-time high since the data series began in the 2000s, according to the World Gold Council.

A weaker USD at the beginning of the year also helped support Gold demand, not forgetting that the recent rate hikes in the United States and over the world could potentially lead to a mortgage crisis, a recession, and more bank failures, all of which would push investors to buy Gold.

Since their peak, prices are down more than 7% and the overall technical configuration is rather bearish on the daily chart.

Prices are below the Tenkan and Kijun lines, as well as the Ichimoku cloud, and the Lagging Span line is also below the prices and the cloud moves downwards without major obstacles.

The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are bearish, while the Parabolic SAR is above the price, telling traders to better option short positions than long ones.

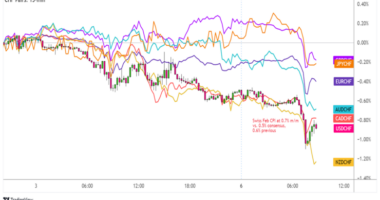

Gold and Dollar Index Daily Chart – Source: The Online Trading Platform from ActivTrades Powered by TradingView

What makes the price of Gold move up and down?

Understanding the factors that drive the price of Gold is essential for any investor.

By gaining insights into these factors, you can make more informed decisions regarding the future movement of Gold and whether it is better to open long or short trading positions.

One of the primary characteristics of Gold is its historical role as a safe haven asset during times of economic uncertainty and market volatility.

When faced with financial turmoil, investors often seek refuge in Gold as a “flight to quality” instead of opting for riskier assets such as stocks.

The perception of Gold as a stable and reliable store of value makes it an attractive choice for protecting wealth during turbulent times.

Furthermore, Gold is often viewed as a hedge against inflation. In periods of rising inflation, investors may turn to Gold as a means of preserving their purchasing power.

However, the decision to invest in Gold as an inflation hedge is influenced by the specific monetary context and the extent to which inflationary pressures are expected to persist.

Central bankers play a vital role in assessing the nature of inflationary pressures. They closely monitor economic indicators and data to determine whether inflation is transitory or likely to be sustained over the long term.

These assessments directly impact the monetary policy decisions made by central banks.

If inflation is deemed a significant concern, central banks may implement measures to combat it, such as tightening credit conditions through interest rate hikes and scaling back economic stimulus programs.

These actions, aimed at controlling inflation, can have implications for the attractiveness of Gold as an investment option. As benchmark interest rates increase, real interest rates are affected, which, in turn, influences the demand for Gold.

Another factor to consider is the relationship between Gold and the US dollar (USD). Gold is priced in USD, and as a result, the two assets often exhibit a negative correlation.

When US interest rates rise, the USD tends to strengthen against other currencies.

This strengthening of the USD can impact the price of Gold, as a stronger dollar makes Gold relatively more expensive for investors using other currencies.

Additionally, the supply and demand dynamics of Gold are influenced by other factors. The demand for Gold in the jewelry sector, investment demand from individuals and institutions, central bank activities involving buying or selling Gold, and the industrial utilization of Gold all play a role in shaping its market dynamics.

Monitoring economic indicators, staying informed about geopolitical developments, and being aware of market speculation is crucial to understanding the broader market conditions and potential price fluctuations of Gold.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument.

No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it.

Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.