Geopolitical and economic news flow stayed elevated this week, with both good and bad developments keeping price action mostly in a range.

The War premium faded a bit early on as major escalation from Israel was pushed back through Thursday, and traders still had plenty to worry about with global growth, inflation and interest rate drivers steadily hitting the wires.

Ready to do a quick review? If so, let’s check out the major headlines first!

Notable News & Economic Updates:

🟢 Broad Market Risk-on Arguments

S&P Global Flash US Manufacturing PMI for October: 50 vs. 49.8 in September: “”The rise in workforce numbers was led by service providers, as manufacturing firms registered a fractional drop in staffing numbers on the month.”

President Xi Jinping boosted support for China’s economy by increasing sovereign debt, raising the budget deficit ratio, and making a historic visit to the central bank.

On Wednesday, Israel agreed to delay the ground invasion of Gaza to allow time for U.S. to bring missile defenses to the region to protect its troops

Grayscale court ruling sends Bitcoin ETF approval back to SEC

EIA weekly Crude Oil Inventory read for week ending Oct. 20: 1.372M (forecast -0.45M; -4.491M previous)

Blackrock’s spot BTC ETF ticker disappeared then reappeared on the DTCC list

The European Central Bank held its main interest rate at 4.50% as expected on Thursday

U.S. Advance GDP for Q3 2023: 4.9% q/q (4.0% q/q forecast; 2.1% q/q previous); core PCE Prices was 2.4% q/q (3.1% q/q forecast; 3.7% q/q previous)

China industrial profits year-to-date in September: -9.0% y/y as expected vs. -11.7% y/y

🔴 Broad Market Risk-off Arguments

Japan’s au Jibun flash manufacturing PMI steadied at 48.5 in October (vs. 48.9 expected); “A sustained reduction in new orders led to production shrinking at the fastest rate in eight months.”

Germany’s GfK consumer climate deteriorated from -26.7 to -28.1 in October

Eurozone’s manufacturing PMI worsened from 43.4 to 43.0; Services PMI also deeper into contraction from 48.7 to 47.8 in October

U.K.’s manufacturing PMI improved from 44.3 to 45.2 in October; Services PMI dipped from 49.3 to 49.2

On Tuesday, ECB President Lagarde commented that she sees potential stagnation conditions over the next few quarters, prices risk becoming more balanced, and signs of economic weakening

Australia’s inflation sped up from 5.2% y/y to 5.4% y/y in September; quarterly CPI also went up from 0.8% to 1.2% in Q3

U.K.’s adjusted experimental unemployment rate remained at 4.2% in the three months to August; Jobless claimants swell from -9.0K to 20.4K in September

Global Market Weekly Recap

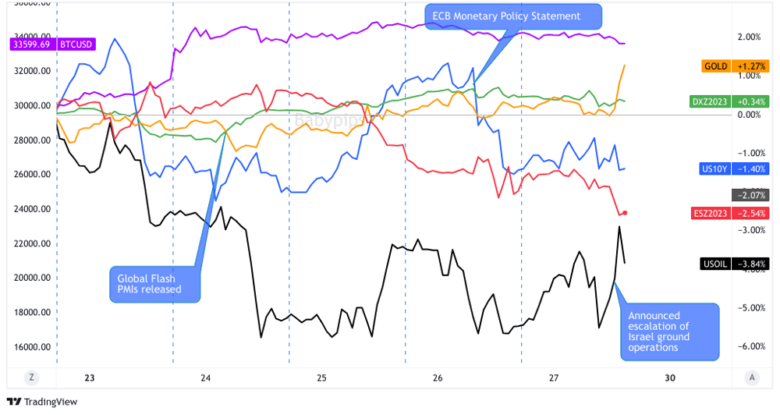

Dollar, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

It was definitely another heavy week of news flow for traders to work with, but much calmer with some signs of positive developments from the geopolitical front. On Monday, there were reports of Hezbollah launching attacks on Israel from Lebanon, but then we saw news reports of more hostages being freed by Hamas, as well as humanitarian aid moving into Gaza.

On Wednesday there were signs that the conflict was starting to spill further in the region and to other players as the U.S. military was attacked in Iraq and Syria, which led to the U.S. asking Israel to delay the ground invasion against Hamas so that the U.S. can bring their own assets in to protect their people in the region.

The next session, we saw fresh reports that Hamas leaders are ready to release civilian prisoners to Tehran, according to Iran’s Foreign Minister Hossein Amirabdollahian. But in the same speech, he also warned the U.S. that they will not be spared if the attacks in Palestine continue.

And rounding out the big headlines from the geopolitical front, on Friday Israeli Defense Forces spokesman Daniel Hagari stated that the military increase aerial attacks and will expand ground activity in the evening. He also shot down optimism that a deal for the release of hostages was imminent. This prompted a spike higher in the “war premium” with gold jumping from around $1980 to break above $2000 before the week close. Oil and the Swiss franc (big beneficiaries from the conflict) also rallied with the news.

The forex calendar was very busy this week to cloudy up the picture, lined with flash business sentiment survey updates, inflation updates and two central bank policy statements. On the central bank front, both the Bank of Canada and European central bank held off from hiking interest rates once again this week. Both also noted that the current interest rate environment is clearly working to slow inflation rates, but that those rates still remain high and that economic growth has been slowing.

Following the central bank events, the flash business sentiment survey updates were of note, once again showing businesses around the globe were mostly negative on the current environment and arguably getting worse. This was most apparent in the Euro area, which did have an immediate influence on the euro as it fell against the FX majors on Tuesday through the London and U.S. trading sessions.

Finally, the Aussie was a notable mover this week after a stronger-than-expected Australia CPI update, first pumping higher in reaction to the data point, but falling quickly soon after, possibly getting caught up in negative geopolitical headlines and a mixed (arguably net negative) round of U.S. tech earning updates from Microsoft and Google likely pulled equities and risk sentiment lower.

Reserve Bank of Australia Governor Bullock spoke on Thursday, noting the higher inflation read and saying that it was expected, but didn’t see it as material to whether or not it would change the interest rate outlook. His comments were later followed by stronger-than-expected updates to import prices and producer prices indexes, which was likely drawing in fundie bulls into the Aussie as the week closed out and putting it at the top relative to the majors on Friday.

Probably the big mover of note this week is bitcoin, rocketing higher on Monday. Bitcoin ETF optimism grew dramatically in reaction to a pair of news reports this week, starting with the D.C. Circuit Court of Appeals ordering the U.S. Securities and Exchange Commission (SEC) to take back its rejection of Grayscale’s spot bitcoin ETF application. Bitcoin quickly jumped from $30K to $34.5K on Monday, and was able to hold there despite a broad risk averse environment this week.

The bullish hold was also likely due to reports of BlackRock’s spot bitcoin ETF ticker (IBTC) first disappearing then reappearing on the Depository Trust and Clearing Corporation’s (DTCC) website. Traders took this as further evidence of a bitcoin ETF coming to the U.S., despite knowing that appearing on this list does not guarantee approval and listing.

All put together, this was a great week for crypto holders as not only did bitcoin pop over 10% this week, but other big crypto like etherum (+5.45%) and solana (+8.61%) gained big on this week’s shift in sentiment.