Risk-takers took a chill pill this week, as persistently high inflation got central banks planning more interest rates, which got traders worrying about lower growth.

It didn’t stop bitcoin bulls from pushing BTC/USD to a key technical level though! What had traders FOMO-ing hard into the digital asset?

Missed all the market movers this week? Lemme show you the biggest headlines first:

Notable News & Economic Updates:

? Broad Market Risk-on Arguments

NZ BusinessNZ Services Index up by 3.2 points from upwardly revised 50.1 in April to 53.3 in May. All five measures showing expansion.

Canada Retail Sales for April 2023: +1.1% m/m (+0.2% m/m forecast; -1.5% m/m previous); core retail sales was +1.3% m/m (+0.2% m/m forecast; -0.4% m/m previous)

Australia’s manufacturing PMI rose from 48.4 to three-month high of 48.6 in June as production shrank at its slowest pace since February

RBA meeting minutes showed rate hike arguments were “finely balanced,” as members weighed inflation risks, tight labor market, and rising home prices

U.K.’s GfK consumer confidence rose for a fifth month in a row, up from -27 to -24 in June despite stubbornly high inflation and interest rates

Powell: FOMC members “do think that there’s more rate hikes coming but we want to make them at a pace that allows us to see incoming information.”

U.S. Treasury Secretary Yellen sees lower U.S. recession risk, says a consumer slowdown is needed

Euro area Flash consumer confidence for June: +1.3 points to -16.1; EU was +1.1 points to -17.2

? Broad Market Risk-off Arguments

S&P Global U.K. Manufacturing PMI dropped from 47.1 to a six-month low of 46.2, while the Services PMI also weakened from 52.8 to a three-month low of 52.8

SNB raised its interest rates by 25bps to 1.75%, its highest since April 2002. Chairman Jordan doesn’t rule out further rate hikes.

Bank of England surprised with a 50 bps interest rate hike to 5.00% on Thursday with a 7-2 vote

U.K.’s inflation remains at 8.7% y/y in May, marking the fourth month in a row that CPI exceeded market estimates

During his testimony before the House Financial Services Committee, Fed Chair Powell warned that below-trend growth is likely needed; likely more rate hikes ahead but likely at more moderate pace and based on data.

U.S. initial weekly jobless claims for week ending June 17: 264K vs. 271K previous week

Deteriorating demand conditions dragged HCOB Germany Manufacturing PMI from 43.2 to 41.0 (37-month low) in June while the Services PMI dropped from 57.2 to a 3-month low of 54.1

HCOB Eurozone Manufacturing PMI slipped from 44.8 to a 37-month low of 43.6 in June, Services PMI also hit a five-month low from 55.1 to 52.4.

Flash U.S. Manufacturing PMI for June: 46.3 vs. 48.4 in May; “Despite a sharper rise in cost burdens, US firms raised their selling prices at the slowest pace since October 2020”

Global Market Weekly Recap

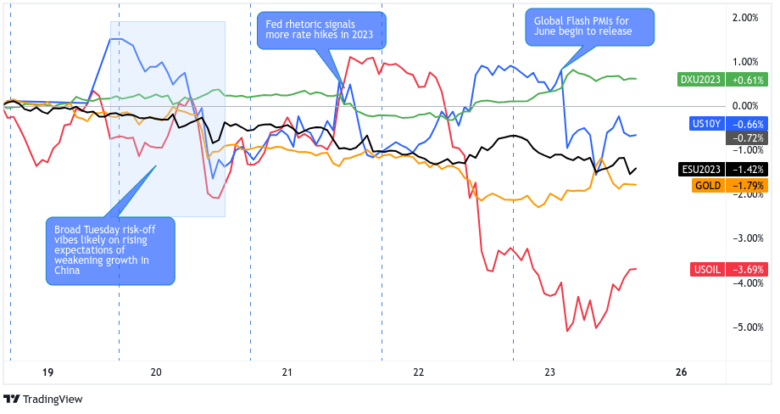

Traders greeted the week with Goldman Sachs cutting its growth forecasts for China’s 2023 GDP from 6.0% to 5.4%. This followed a less-detailed-than-expected economic support measures from the China State Council on Friday and similar downgrades from other major U.S. banks.

Concern for the world’s second-largest economy and the U.S. markets being closed for a holiday gave traders more reason to take profits from the previous week’s gains.

Equities, crude oil, AUD, and NZD turned lower while the rest of the major assets traded in relatively tight ranges.

Tuesday wasn’t much better for risk-takers especially after the PBOC “only” cut its one-year and five-year loan prime rates by 10 basis points to 3.55% and 4.20% respectively.

The RBA latest meeting minutes also showed that the June decision was “finely balanced,” something that disappointed AUD buyers who thought that the 25bps hike to 4.10% was decisively hawkish.

The “disappointing” PBOC changes, lack of fresh catalysts, and cautiousness ahead of awaited events like Powell’s speech and BOE decision kept the pressure on high-yielding bets.

Crude oil suffered from Chinese demand concerns AND higher output from Iran and Russia, the Australian dollar dropped like a rock with minimal pullback, and U.S. equities turned even lower from their highs from the previous week.

Bitcoin was the only clear winner, as BTC/USD broke its weekend resistance and busted above the $28,000 mark days after fund management giant BlackRock filed for a spot bitcoin ETF. Speculation is running hot that a firm like BlackRock wouldn’t file for a spot ETF if they didn’t have a reasonable doubt that it will get approved. We’ll have to wait-and-see but for now, but that narrative is enough to put the crypto asset securely back in the bulls control as it tested $31,000 ahead of the weekend.

Central bank speculations made the week more interesting on Wednesday. The BOJ, for example, hinted in its June meeting minutes that members are still mostly supportive of their plan to not tighten policies like what their peers are doing.

And then the U.K. dropped its CPI data. U.K.’s inflation came in at 8.7% y/y in May, higher than the 8.4% rate expected and the fourth consecutive month that CPI exceeded estimates.

This got the markets thinking that the BOE might have to raise its interest rates above 6.0%. That’s about the level that investors think would trigger a recession!

Fed Chairman Powell capped the day by saying in a testimony that two more 25-bps rate hike would be “a pretty good guess.” Unfortunately for USD bulls, JPow was less clear about the conditions and the timing of the rate hikes.

Both the dollar and 10-year U.S. yields turned lower while the non-yielding gold also dipped. Meanwhile, U.S. equities were weighed by profit-taking from AI-buying, crude oil spiked higher after a surprise U.S. crude oil build and bitcoin extended its gains all the way to the big $30,000 handle.

The rate hike parade was in full swing on Thursday when the BOE pulled a 50bps rate hike to 5.00% and both the SNB and Norway’s central banks raising their interest rates by another 25bps.

The prospect of central banks still maintaining their aggressiveness and hawkishness did not sit well with investors who are cringing at the already high interest rates and low global growth estimates.

Asian, European, and U.S. equities turned lower, crude oil extended its intraweek lows going into the Friday session. And the rising recession odds narrative gained steam on Friday after traders began seeing disappointing June Flash PMI reads from around the world.

The most notable reads came from Europe, with many countries falling deeper into contractionary conditions, which suggests another quarter of weakness ahead. This is all in the face of likely rate hikes ahead, creating a fearful environment for risk assets ahead.