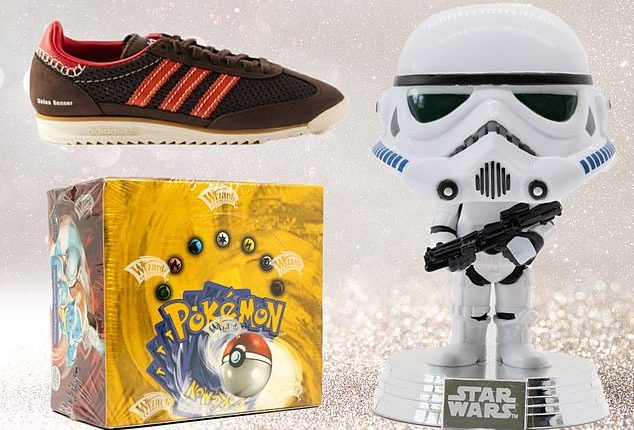

If you’re still looking for some last-minute gift ideas, you might want to consider looking at collectables.

There are plenty of items that you could buy as an investment, like a first-edition book or vintage bottle of wine, but these can often be expensive.

Instead, looking for smaller-ticket items and buying ‘one to play and one to put away’ could net you some extra cash in the coming years.

We speak to some collectable experts about what gifts might rise in value over time, and which could make you a pretty penny as soon as the new year.

Collectables: Trainers, trading cards and collectables have all soared in popularity recently

Funko Pops

With such a vast number of brands and collections, as well as increasing number of franchises – think of the ever-expanding Marvel universe – investing in toys can be a daunting prospect.

Toy expert Dougie Anscombe-Stephen, founder of Not Another Toy Store says: ‘In the 80s you could fixate on Star Wars: A New Hope and the toys released in 1977.

‘There was a very narrow range of toys and collectables as it was based on one film and there was always going to be a limited amount.

‘Today, the loyalty isn’t towards franchises I don’t think. For millennials it’s more about the toy brand itself and that’s where you’ll start to see a shift.

Anscombe-Stephen focuses on the lower end of the market and thinks there is value to be found in limited releases.

Among these are Funko Pops, the cute, big-headed vinyl figures which have become popular with collectors since they arrived on the scene in 2010.

‘A lot of people buy Funkos at the moment because of the low price point – they can afford to buy two or more,’ he says. ‘You can pick them up for anything from £5 to £12, but the market is getting a lot more savvy as to which are the rarer ones.’

There are a few ways to find out which Funko Pops are the most valuable. The first is the Funko app, which aggregates data on trending toys and their value.

The other, which is growing in popularity, is by doing your own research, using online forums and speaking to other collectors.

Cheap and cheerful: Funko Pops can be bought for as little as £5, but could rise in value

‘What my kids and I do is look at crowdsourcing the information,’ says Anscombe-Stephen. ‘Ask who’s seen a model, and you start to build up a picture of how many of that design Funko has released.’

If you’re new to Funko Pops, he suggests starting with five or six models because ‘there are a ridiculous amount of collections out there… from there you can double down on researching.’

He recommends that people looking for a toy investment over five to 10 years should consider rare Funko Pops as they are likely to rise in value.

‘The important thing to remember is that, of the thousands of people I’ve met who deal with Funkos, I’ve only ever met one person who was really serious about it. For the rest it’s still rooted in fun and not about pure profit,’ he adds.

Lego

When it comes to classic toys that could rise in value, Anscombe-Stephen’s top pick is Lego.

‘Lego has been a feature of the collector market for some time,’ he says. ‘I’ve been after a Lego castle set from the mid-80s and you’d be lucky to find one now.

‘If you look at Lego both as an investment and for the sense of enjoyment, the two are by far the most equal in measure [of any toy].’

His top tip is to snap up new Lego sets when they are released, and then sell when the firm retires them.

‘If you know it’s coming into retirement soon, you could see it on the secondary market for twice the price,’ Anscombe-Stephen says.

‘A £150 set the day after it retires could sell for £450 at trade shows. We sold a set for £300 and a few weeks later it sold again for £800.

Of course, you can make even more if you take care of it for a longer time.

‘You can sit on it knowing you could make money, but you could also enjoy it,’ he adds. ‘The sheer amount of enjoyment on the build and admiring it is huge.’

Tamagotchis

Millennials will remember Tamagotchis as one of the biggest toy fads of the late 1990s and early 2000s. Now, the pocket-sized digital pets from Japan are making a comeback.

If you got your hands on an original Tamagotchi or it’s been in your attic for the past 20 years, you could be sitting on a few hundred pounds, according to Anscombe-Stephen.

‘I wouldn’t have believed that original ones from the 1990s would be worth £200 now,’ he says.

A number of Tamagotchis have been reissued recently and remain at the lower price point of around £20.

‘Retro is coming back and kids are wanting to go back to that lo-fi tech,’ says Anscombe-Stephen. ‘I think they will speculate but it will take time, maybe 20 to 30 years if you keep hold of them.

‘Nostalgia is a huge seller and a huge weapon of speculation. As long as there’s nostalgia there and people are willing to be a part of it, there’ll be a price tag attached.’

Crucially though, you’ll need to keep it in mint condition. Factors like sun damage and bleaching can significantly decrease the resale price.

Virtual pet: Tamagotchis were a popular game in the late 1990s and early 2000s but are making a comeback

Video consoles and games

Like Tamagotchis, interest in retro video games has rocketed in recent years.

Andrew Ewbank, partner and auctioneer at Ewbank’s Auctions says that, as most video games now come in the form of digital downloads, having a cartridge to hold in your hands has taken on a nostalgic appeal.

‘People tend to have digital-only versions for their consoles, and so the appeal of older games is around the physical issue of them,’ he says.

‘Some of them are more rare and valuable because of quirks. It might be a banned video game or artwork and access was restricted, which increases the value.’

The most desirable items at the moment are sealed Nintendo Game Boy games. ‘Where people have bought a couple of copies and put one in the attic, they’re selling for £2,000 to 3,000.’

As with toys, condition of the product and whether it is sealed is important.

With newer games, Ewbank says the value is harder to predict.

‘The impact of streaming has yet to be fully seen. Physical copies of games are becoming rarer, and the most valuable things tend to be iconic games that are sealed,’ he says.

If you’re looking to buy something to put away, he recommends opting for limited and collector’s editions and to keep them in their shrink wrap.

Anscombe-Stephen says there is also money to be made in the ‘flipping’ market – when something is bought to be sold in the short term to make a profit.

However, this is less of a seasonal phenomenon and one focused on limited product releases.

Pokemon cards

Pokemon is synonymous with the trading card market, and their popularity has continued to soar.

The nostalgia around the ‘151’ collection – the original cast of characters – is a good place to start if you’re considering buying trading cards as an investment, says Ewbank.

‘It’s old characters like Pikachu with new artworks that appeals to the original players,’ he says. ‘You could buy a set from retail and if you can get hold of two, leave it sealed and hope it exponentially rises in value.’

As with other products, sealed trading cards are going to increase in value more.

Catch them all: Pokemon card collectors could see their investments grow in value

‘A played card which has elastic bands around it, or the edges worn, is going to have a much lower value,’ Ewbank adds.

Trading cards can be graded depending on their condition, but you’ll want a 7.5/10 or more grade to increase the value, says Ewbank.

Grading card companies will charge you for the service, and you can also do this through a broker for a fee. A ‘gem mint 10’ is the best grade you can achieve.

Trading cards are a good example of the fact that the value of collectables can go down, as well as up, however,

If a company decides to reprint a set of trading cards, however, the value of your cards is likely to drop.

Last year, Hasbro was accused of overprinting Magic the Gathering trading cards and diminishing their value, to the dismay of collectors.

Ewbank says: ‘It is still a young market and prices move up and down quite quickly. ‘What tends to move the needle on this is that 2021 saw the high point of prices in lockdown, which had a knock-on effect. People were at home more, so there were more players and more buyers.

‘Now, people have less disposable income and people are playing less. It means prices have dropped back and there’s been a big rebalancing on prices.’

Trainers

The rise of platforms like StockX, a platform dedicated to reselling trainers and clothes, shows trainers have become one of the most sought after items for collectors.

Drew Haines, merchandising director of trainers at StockX, said: ‘A new generation of consumers are seeking out investment opportunities that are meaningful on a personal and cultural level while also delivering future returns. Sneakers are one of the leading categories of this paradigm shift.’

Could a pair of trainers you get for Christmas actually be a good investment, though?

The Jordan brand has been protective of Jordan 4 releases, driving up their value

The collaboration between Adidas and clothing brand Wales Bonner shows how the price can rise very quickly on the back of collector hype.

Their latest Adidas Samba Pony trainer is very popular at the moment but Haines says it is trainers from their earlier collections that are seeing the most significant appreciation.

The Adidas Samba Wales Bonner Cream Green was released in June 2022 for $160 (£125). Its average resale price on StockX is now $514.

Haines said: ‘The more limited a release is, the better the chance is that it will trade for a premium. The Jordan brand has been super protective of Jordan 4 releases – you will only see a few Jordan 4s every year, including collaborations. As a result, the supply is more limited, driving up the value of every release.’

So how do you know which trainers are going to rise in value? As with any investment, it’s hard to know whether they will, or by how much.

However, as supply of older trainers tends to decrease over time, resale values tend to increase. This is especially true of trainers that are unworn and in their original packaging.

Haines said: ‘A large number of people purchase sneakers to wear rather than to sell, meaning there is an ever decreasing amount of “deadstock” products available for people to trade.’

He recommends looking at early collections from a first-ever collaboration like Wales Bonner x adidas or JJJJound x Asics, can increase in value over time.

He adds: ‘Also, don’t underestimate the power of a major movie or TV franchise. We’ve seen collaborations that involve Star Wars and Batman see really strong price appreciation – and that’s happening cross-category, from collectables like Lego sets to special sneakers.’

Vinyl

With vinyl back in vogue and a growing number of collectors, records could be a great investment this Christmas.

Steve Taylor, dealer at sellvinylrecords.co.uk, says potential investors should look for big artists with an already proven worldwide collectors market.

‘I’m thinking here artists such as Pink Floyd, Led Zeppelin, David Bowie – but perhaps look no further than the Beatles and the Stones, who have both had new releases this year. Even big collectable bands in more niche genres Like Iron Maiden or Metallica,’ he says.

Hitmaker: Limited edition Taylor Swift vinyl records could rise in value in the coming years, says one expert

Limited editions are also worth a look, as scarcity can increase the value of records, especially if you can get your hands on a small run of 500 or 1000.

Oasis’ live album Familiar to Millions cost approximately £29.99 in 2000 and is now worth £750. Similarly, Taylor Swift’s pink vinyl limited edition record of 1989 cost £29.99 in 2018 and is now valued at £1500.

Taylor’s top recommendations for this Christmas are Taylor Swift’s lilac vinyl limited edition release of ‘Speak Now’, currently retailing at £49.99.

He also recommends The Beatles’ 1962-1966 red vinyl limited edition, retailing at £79.99, and Metallica’s Master of Puppets, coloured vinyl limited edition, which is on pre-release for £39.99.

Taylor also recommends looking for upcoming artists that might make it big one day.

‘The sheer fact that they are relatively unknown now will mean limited numbers on the market. ‘If or when they make it to the big time, these very early recordings will be sought after and therefore rise significantly in value.

‘It’s a bit more risky opting towards lesser-known or unknown artists, but there are also new artists that are already making their mark in the collectable market.

‘Taylor Swift is a great example of this.’