WAGES are still rising and it’s good news for millions of workers.

Official figures released today by the Office for National Statistics (ONS) have revealed that basic pay is still growing.

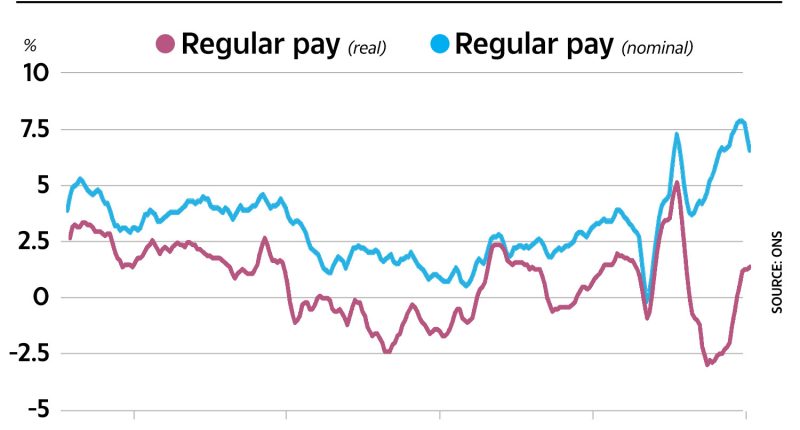

Growth in regular pay, excluding bonuses, stood at 6.6% in the three months to November last year.

This was down from the previous quarter when wage growth stood at 7.2% from August to October 2023.

It is the lowest rate since the three months to January last year.

But taking into account inflation, which measures how much prices are rising, total pay increased by 1.3%.

READ MORE IN MONEY

The rate of UK unemployment remained unchanged at 4.2% in the three months to November.

A growth in wages is good news for millions of workers who have been battling against high inflation over the past year.

The most recent figures show the annual rate at which prices rise was 3.9% in the year to November, down from 4.6% in October.

These figures showed Prime Minister Rishi Sunak had further met his promise to half inflation by the end of 2023, a promise he made at the beginning of the year amid the cost of living crisis when the rate had hit 10.7%.

Most read in Money

The December inflation figure is set to be released tomorrow.

Commenting on today’s figures, Liz McKeown, director of economic statistics said: “While annual pay growth remains high in cash terms, we continue to see signs that wage pressures might be easing overall.

“However, with inflation still falling more quickly, earnings continued to grow in real terms.”

If pay rises by less than inflation it squeezes income, leaving people worse off.

Inflation is a measure of how much goods and services are worth in a given period.

But wages are now rising faster than prices for the third time since September 2021, easing pressure on hard-up households.

Meanwhile, today’s figures also show growth in average total pay, which includes bonuses, was 6.5% from September to November.

In recent months rising wages have been blamed for keeping inflation stubbornly high over the last year, resulting in base rate hikes by the Bank of England (BoE) which have pushed up borrowing costs for millions of households.

The latest wage figures show some of this pressure on household budgets could ease.

But rising wages could force the BoE to hike rates or keep them the same, as it has opted to do at the past two occasions, as it tries to bring inflation back down to its 2% target.

Chancellor of the Exchequer Jeremy Hunt said: “With inflation falling, it’s heartening to see real wages growing for the fifth month in a row.

“This is on top of the record cut to National Insurance worth nearly £1,000 in a typical household with two working people, putting more money in their pockets.”

The average employee received a £450 pay rise thanks to a two percentage point cut to the main rate of National Insurance Contributions (NICs).

This income boost will kick in from your first pay packet after January 6.

What it means for your money

Growth in wages is good news for millions of workers who have been battling against high inflation in recent months.

Alice Haine, personal finance analyst at Bestinvest, said: “The hope is that real pay growth will remain positive in 2024 because inflation is expected to ease further over the course of the year.

“While some forecasters expect inflation to drop rapidly in the first quarter amid lower energy prices, such optimism may be tempered by the growing tensions in the Red Sea and wider Middle East – a reminder that global price pressures are still very much with us and the risk of change is always a factor.”

She added that it means households should not expect their cost of living challenges to disappear completely.

“In addition, pay rises may be more muted this year as employers strive to keep costs down amid economic uncertainty,” Ms Haine said.

While high wage growth can ease the pressure off households it does run the risk of fuelling inflation if businesses pass on that cost to customers by increasing the price of goods and services.

This would add extra pressure to household budgets at a time when energy prices are under threat from geopolitical tensions and rising demand as the colder weather sets in.

Ms Haine said: “With wage growth and the jobs market potentially softening further in the coming months, lingering economic uncertainty means employers may mull head count cuts carefully as they strive to keep costs down to protect profits.

“Households should prepare their finances for every eventuality, keeping emergency funds topped up and paying down expensive debts to ensure they can cope with any further surprises in 2024, including the risk of job loss.”

Rising wages have previously been blamed for keeping inflation high by Bank of England bosses.

The Bank’s Monetary Policy Committee (MPC) held the base rate at 0.25 percentage points to 5.25% in December.

This was the second time in a row that the bank decided to hold the base rate, easing pressure on homeowners facing rising mortgage rates.

Ben Harrison, Director of the Work Foundation at Lancaster University, said: “While policy-makers at the Bank of England may be reassured by these figures as they assess whether to adjust interest rate levels, workers in insecure and low-paid work are at the sharp end of the most significant reduction in real living standards since ONS records began as they try to make ends meet.”

Interest rates could be cut by the Bank of England as early as the spring, experts are now predicting.

High-street banks use the BoE base rate to work out the interest rates it offers to customers.

A hike means the cost of borrowing, including loans, credit cards and mortgage repayments become more expensive.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories.