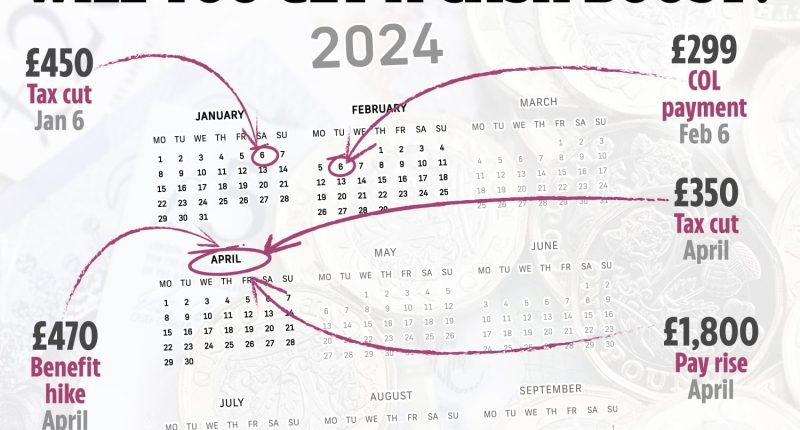

ANYONE feeling the pinch at Christmas will want to make a note of some key dates when they could be in for a cash boost.

From one-off payments to paying less tax, we’ve rounded up what you can expect and when in 2024 that means you’ll have more in your pocket.

You won’t have long to wait either, as the first boost comes in the first week of January.

In total, they are worth as much as £3,299, though exactly what you can get depends on your circumstances.

Here’s everything you need to know…

Tax cut for workers – £450 better off from January 6

Millions of workers will pay less National Insurance, and soon.

Read more on income boosts

From January 6, 2024, the main rate of National Insurance Contributions (NICs), also known as Class 1, will be slashed from 12% to 10%.

The tax cut was announced in the government’s Autumn Statement where it set out a raft of plans for spending for the year ahead.

In a surprise move the Chancellor announced that new NI rates will slash tax bills by £450 a year, on average.

But the exact amount you’ll save will depend on how much you earn as NICs are calculated as a percentage of earnings.

Most read in Money

Here are some examples of how much you could save, according to advisers at Quilter:

- £30,000 a year – save £348.60

- £34,963 a year (average salary) – save £447.86

- £40,000 a year – save £548.60

- £50,000 a year – save £728.60

- £100,000 a year – save £754

Around 27million people are set to benefit from the cut.

Read more on how National Insurance works and how much you pay now and after January’s cut.

Cost of living payment – £299 better off from February 6

Households on certain benefits, including Universal Credit, are set to get the last of three cost of living payments in 2024.

The cash, worth £299, is due to land in bank accounts between February 6 and February 22.

It’s tax-free and won’t affect your usual benefits.

Benefits that qualify include:

- Universal Credit

- Income-based jobseekers allowance

- Income-related employment and support allowance

- Income support

- Working tax credit

- Child tax credit

- Pension credit

You need to have been claiming one of these between November 13 and December 12 to be eligible.

Look out for the code DWP COL or HMRC COLS and you National Insurance number on your bank account or statement which signals that payment has been made.

Benefit hike – up to £470 better off from April

Millions of people on benefits will be up to £470 a year better off from April when payments rise.

Benefit rates are usually updated annually, to keep up with the rising cost of living.

It’s no different in 2024, and Chancellor Jeremy Hunt confirmed in the Autumn Statement rates will rise by the rate of inflation for September – 6.7%.

The benefits that will increase include Universal Credit, pension credit, and personal independence payment (PIP).

The exact amount more you’ll get will depend on how much you get though.

For example, the standard UC allowance for over 25s is going from £292.11 to £311.68 a month – an extra £234.84 a year.

We’ve rounded up all the benefits rising, and by how much.

But there are some who won’t get more.

For instance around 85,000 people who are subject to the benefit cap which limits the overall amount you can get won’t get more, because the level of the cap is not rising.

We’ve rounded up who else might miss out too.

Tax cut for the self-employed – £350 better off from April

In a separate move to January’s NIC rate reduction, millions more are also getting a tax cut.

Mr Hunt also announced in the Autumn Statement he would abolish Class 4 NICs.

This affects the self-employed and will mean they are £350 a year better off on average.

This change also comes in from April 2024 when the new tax year starts.

National Living wage rise – £1,800 better off from April

Next April, millions of workers on low incomes will earn more thanks to a rise in the National Living wage.

Also revealed in the Autumn Statement, Mr hunt said that for those over 21 the minimum wage will rise from £10.42 to £11.44.

Currently there are different pay rates for those aged 21 and 22, with over-23s paid more.

But for the first time the same rates will apply to anyone aged 21 and over.

Almost three million workers should expect to receive what is almost a 10% boost to their pay packets – or £1,800 a year for full-timers.

The minimum hourly wage for an apprentice is also set to increase from £5.28 to £6.40 an hour.

Rent help increase – from April

Renters on benefits are set to see a hike in how much help they can get for housing costs.

In April, the government will increase the Local Housing Allowance (LHA), the first time it has done so since April 2020 and amid record high rents.

LHA will be increased to cover the cheapest 30% of local market rents.

This means anyone renting a home that is among the cheapest 30% of private rental properties in their area should be able to cover their entire rent with housing benefit.

The allowance sets the maximum amount people renting from a private landlord can claim in Housing Benefit or Universal Credit.

The exact amount you can claim depends on the area you live in and the size of the property you rent.

Read more on The Sun

You can check your LHA rates on the government website at lha-direct.voa.gov.uk/

While it’s a welcome boost for renters, there’s other help you can get if you’re struggling, like discretionary payments.